We expect Pure Storage Inc. (NYSE:PSTG) to beat expectations when it reports second-quarter fiscal 2018 results on Aug 24.

Why a Likely Positive Surprise?

Our proven model shows that Pure Storage is likely to beat earnings because it has the right combination of two key ingredients.

Zacks ESP: Pure Storage’s Earnings ESP is +4.26%. A favorable ESP serves as a meaningful and leading indicator of a likely positive surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Pure Storage currently carries a Zacks Rank #3 (Hold). Note that stocks with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating earnings estimates. Conversely, Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

The combination of Pure Storage’s Zacks Rank #3 and +4.26% ESP makes us reasonably optimistic of an earnings beat.

Key Factors

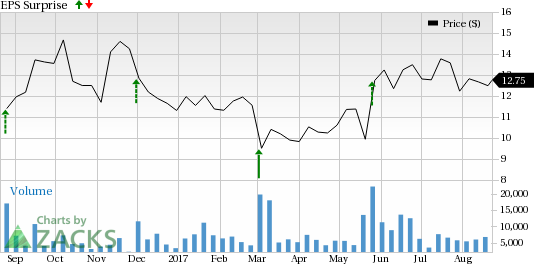

We note that Pure Storage has a record of positive earnings surprises in the trailing four quarters, with an average of 43.58%. The stock has gained 10.4% year to date, outperforming the 9% rally of the industry it belongs to.

The company’s portfolio saw substantial expansion in the quarter. Management had stated earlier that it is pleased with the pipeline, which is likely to lead to 34% year-on-year revenue growth in the quarter.

The company made some progress in the all-flash data platform for cloud in the second quarter and optimized the process of Tier 1 storage.

The company updated its FlashBlade product line, enhancing its capacity and performance almost five times. Moreover, the company also unveiled its self-driving storage platform Pure1 META.

However, an intensifying competitive landscape with the presence of major players such as Amazon’s AWS, Microsoft’s (NASDAQ:MSFT) Azure in cloud storage and NetApp (NASDAQ:NTAP) is a headwind for the company.

Other Stocks to Consider

Here are some companies that, as per our model, also have the right combination of elements to post an earnings beat in their upcoming release.

The Toronto-Dominion Bank (TO:TD) with an Earnings ESP of +1.18% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Big Lots, Inc. (NYSE:BIG) with an ESP of +0.72% and a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Pure Storage, Inc. (PSTG): Free Stock Analysis Report

Toronto Dominion Bank (The) (TD): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Original post

Zacks Investment Research