I have been talking about S&P 500's major break out since July when it made new all-time highs. Four months later and it seems that many analysts and traders are joining me in looking for a major move. The S&P 500 has not done much since then, so why watch it closely now?

Tuesday was a key event for the index.

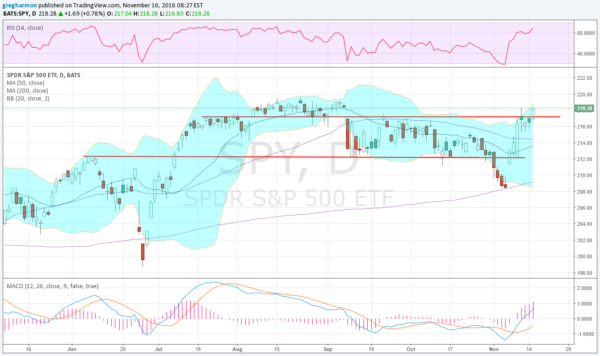

The chart below explains why. It started after the Brexit move lower. From that low, the SPY ran quickly higher. It stalled as August approached for about two weeks and then managed to make a new all-time high in August. But just barely. From there, it pulled back and retested the prior high. And then SPY traded in a channel between that prior high and the support level after achieving the new all-time high.

Then came the pullback into the election. That was when the FBI re-opened the case against Hillary Clinton. Draw your own conclusions, but what I care about is that it re-touched the 200-day SMA and bounced. This set a higher low. Then the move higher started, which set up a Positive RSI Reversal, a technical pattern that gives a target over 229 -- about 2290 in the index. And this is where Tuesday became significant. That's when the S&P 500 ETF moved over that prior channel, confirming a short-term break out. The next step is a new all-time-high close. But the S&P 500 seems on its way.