The investors are getting more and more vigilant as the Q2 earnings season gains momentum. Notably, most of the companies that have reported so far have delivered better-than-expected results revealing a positive earnings growth trend. Per the Earnings Trends, out of the 128 S&P 500 members that have come up with quarterly numbers, approximately 77.3% have posted positive earnings surprises, while 70.3% beat top-line expectations.

According to the report, earnings for the 128 S&P 500 companies that have reported so far have advanced 7% from the same period last year, while revenues have increased 4.2%.

Additionally, per the Earnings Preview dated Jul 21 earnings for the total S&P 500 companies are expected to grow 8.6% from the year-ago period, while revenue will rise 4.7%. In the first quarter, earnings of S&P 500 companies increased 13.3%, while revenues rose 7%, which is the highest growth rate in nearly two years.

The performance of the Index is not restricted to a single sector, and of the 16 Zacks sectors, five are anticipated to witness an earnings decline in Q2, with Autos, Conglomerates and Utilities acting as a drag. As far as Consumer Staples sector is concerned, the total earnings of the sector are anticipated to increase 3.6%, while revenues are estimated to advance 11.3%. Publishing stocks form part of the consumer staples sector.

Let’s Take a Glance at Publishing Industry

The U.S. publishing industry has been grappling with sinking advertising revenues for quite some time now, and the global economic slowdown has only worsened the situation. The downturn in the publishing industry witnessed in the last few years is largely due to a decline in print readership. More and more readers started opting for online news, consequently making the print-advertising model increasingly irrelevant.

To counter the downtrend in the print revenues, publishing companies are adapting to the changing face of the multi-platform media universe, which currently includes Internet, mobile, tablet, social media networks and outdoor video advertising in its portfolio.

Let’s take a sneak peek at two Publishing stocks which are lined up to report quarterly numbers on Jul 27.

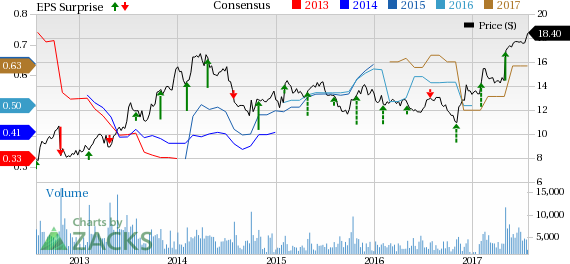

The New York Times Company (NYSE:NYT) , a diversified media conglomerate, is slated to report second-quarter 2017 results. In the trailing four quarters, it has outperformed the Zacks Consensus Estimate by an average of 31.4%. In the preceding quarter, the company witnessed a positive earnings surprise of 83.3%.

The New York Times Company is diversifying business, adding new revenue streams, strengthening balance sheet along with restructuring portfolio. It has offloaded assets in order to re-focus on core newspapers and pay more attention to online activities. We believe these moves will have a favorable impact on the quarter to be reported. Further, it is not only gearing up to become an optimum destination for news and information but is also now focusing on service journalism, with verticals like Cooking, Watching and Well. The company has launched digital subscriptions for NYT Cooking, its popular recipe site and app.

However, advertising revenue remains an area of concern for the company. We observed that the company has been struggling with dwindling advertising revenue for quite some time now. (Read more: Things You Need to Know Before NY Times' Q2 Earnings)

The New York Times Company carries a Zacks Rank #3 (Hold) and has an Earnings ESP of 0.00%. The Zacks Consensus Estimate for the quarter is pegged at 13 cents. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

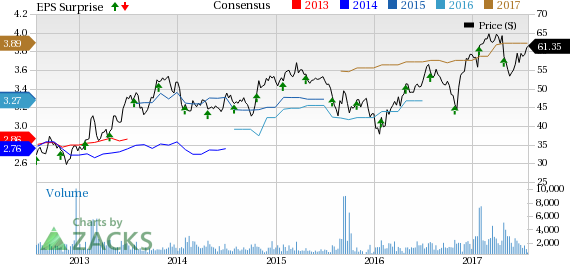

Meredith Corporation (NYSE:MDP) , one of leading media and marketing companies in the U.S. is slated to release fourth-quarter fiscal 2017 results. In the previous quarter, the company’s earnings came in line with the Zacks Consensus Estimate. However, it has posted an average earnings beat of 3.9% in the trailing four quarters.

Strategic endeavors such as increase in digital offerings, the launch of new magazine, The Magnolia Journal, and addition of newscasts across television stations, along with its focus on non-advertising revenue generating avenues such as retransmission fees, brand licensing and e-commerce are likely to drive the top line higher.

To strengthen position, Meredith has launched additional newscasts in the Atlanta, Phoenix, Portland, Nashville, Greenville and Flint/Saginaw markets. The company also renewed licensing program with Wal-Mart Stores, Inc. (NYSE:WMT) , which allows it to showcase 3,000 SKUs of Better Homes & Gardens branded products at 5,000 outlets and on Walmart.com. Notably, fourth-quarter earnings are anticipated to be in the range of 93–98 cents per share. Local Media Group’s revenue is expected to be up mid-single digits, while that of National Media Group is likely to be down marginally in the final quarter. However, with advancing technology, the print media is on a decline. (Read more: Meredith to Post Q4 Earnings: What's in the Cards?)

Meredith carries a Zacks Rank #3 and has an Earnings ESP of 0.00%. The Zacks Consensus Estimate for the quarter is pegged at 96 cents. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaries,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

New York Times Company (The) (NYT): Free Stock Analysis Report

Meredith Corporation (MDP): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Original post

Zacks Investment Research