We are nearing the end of Q3 earnings, with over 84% of the total S&P 500 index members having released their quarterly results through Nov 4. Results have improved considerably from the previous quarters and are expected to end up in the positive territory after five consecutive quarters of earnings decline for the S&P 500 index.

Per our latest Earnings Preview report, combining the actual results from the 423 S&P 500 members with estimates from the soon-to-be-report 77 index members, overall Q3 earnings are expected to be up 3% on a 1.5% growth in revenues. The relative improvement in estimate revisions for the quarter is largely due to an improvement in the economy and rising oil prices.

Four of the 16 Zacks sectors are expected to witness an earnings decline in the quarter, with Oil/Energy, Transportation and Autos being the biggest drag. Over 645 companies are scheduled to report this week, including 31 S&P 500 members, bringing the tally for the results of the index’s total membership to 90.8%.

The performance of the Business Services sector is looking reasonably healthy this quarter. For the sector, earnings are expected to grow 16.7%, while sales are touted to rise 8.7% over the last year. The projected improvement is majorly driven by the growing momentum in the economy as a whole and the job market during the quarter.

Let’s see how things are shaping up for the two Business Services companies scheduled to report their earnings results tomorrow.

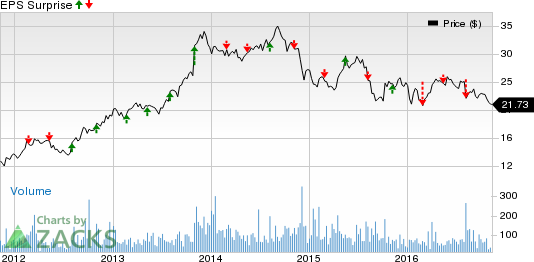

MAXIMUS, Inc. (NYSE:MMS) is slated to report its fiscal fourth-quarter results before the market opens. The company offers business process services to government health and human services across the U.S., the U.K., Australia, Canada, Saudi Arabia, and New Zealand. Over the trailing four quarters the company beat estimates thrice, with an average positive surprise of 0.20%.

For the quarter to be reported, we are uncertain of an earnings beat as the company has an Earnings ESP of 0.00% and a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stantec Inc. (TO:STN) is scheduled to report third-quarter 2016 results after market close. The company offers professional consulting services. It also provides professional consulting services across environmental sciences, project management, and project economics for infrastructure and facilities projects.

For the quarter to be reported, we are uncertain of an earnings beat as the company has an Earnings ESP of 0.00% and a Zacks Rank #3. Over the trailing four quarters the company missed estimates thrice, with an average negative surprise of 16.65%.

Now See Our Private Investment Ideas

While the above ideas are being shared with the public, other trades are hidden from everyone but selected members. Would you like to peek behind the curtain and view them? Starting today, for the next month, you can follow all Zacks' private buys and sells in real time from value to momentum . . . from stocks under $10 to ETF and option moves . . . from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for Zacks' secret trades >>

STANTEC INC (STN): Free Stock Analysis Report

MAXIMUS INC (MMS): Free Stock Analysis Report

Original post

Zacks Investment Research