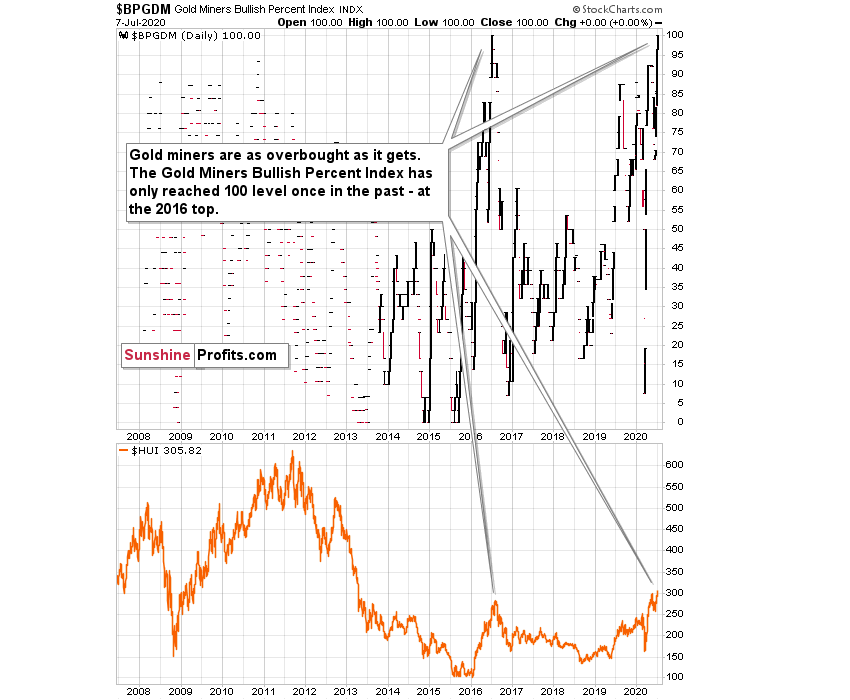

In yesterday's analysis, we featured a gargantuan sign pointing to a very likely turnaround in the precious metals complex. It's the extremely overbought Gold Miners Bullish Percent Index. What is truly remarkable is that it is at record highs, while the HUI Index is still close to 300.

It shows that the time for the rally is practically up. Yesterday, miners moved even higher, which might appear to invalidate this point, but it absolutely isn't the case. The situation in the mining stocks continues to be extremely overbought from the short-term point of view, and a day of higher prices doesn't change anything. In fact, the extremely overbought indication doesn't tell us that the market has to decline right now - it tells us that it's very likely to decline now, or shortly.

Here's what we said on Monday:

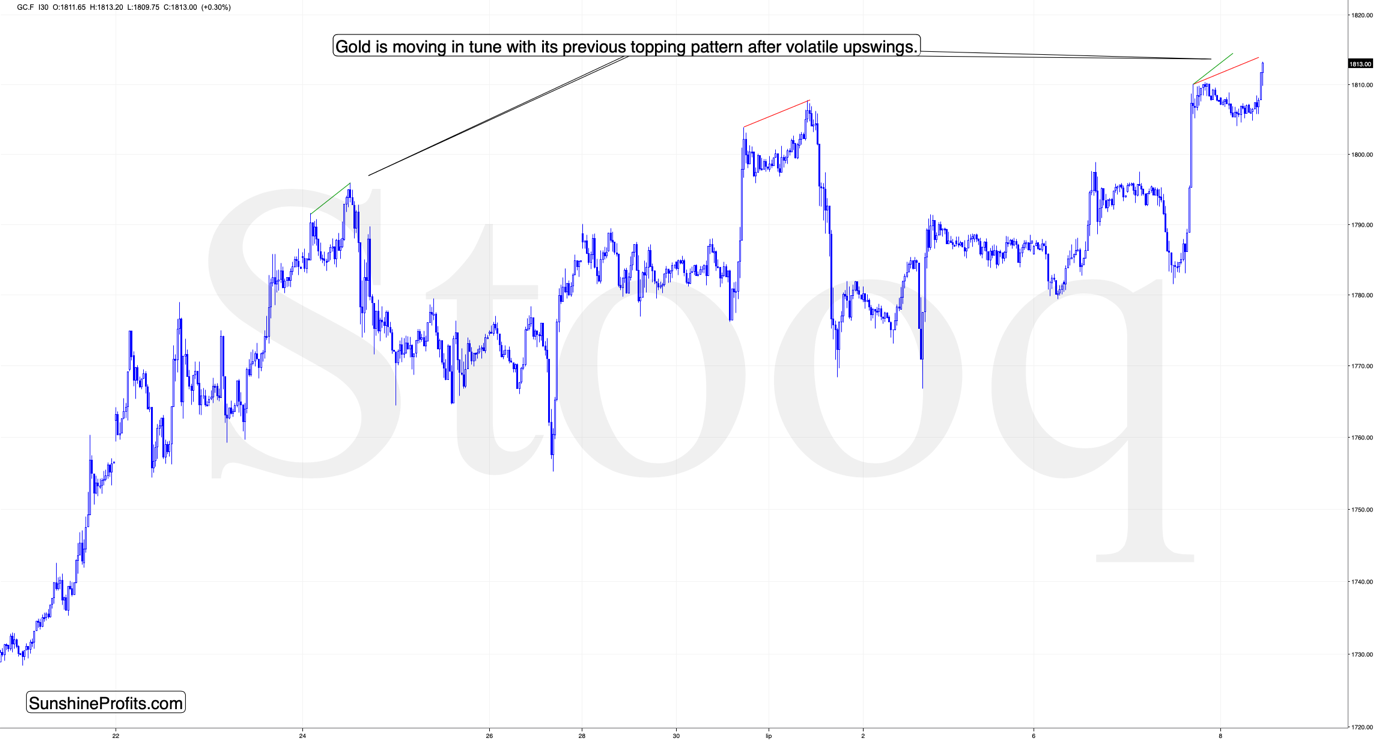

"This could mean that the top is already in, however, if the USD Index is to decline here, gold might be forced to move higher, nonetheless. We wouldn't rule out an attempt to move to or above the most recent high, but we doubt that gold futures would move above $1,820 even on a very temporary basis."

Gold is indeed making an attempt to move higher, and—as we wrote previously—we think that this attempt will not be successful. This is especially the case, given gold's specific intraday price pattern in which it tops. After a sharp intraday rally (the above chart features 30-minute candlesticks), gold tops, corrects, and then makes an attempt to move slightly higher in the following hours. We marked the recent cases with green and red, and we copied them to the current situation. If gold repeats its recent patterns, its likely to top at about $1,815 or so. At the moment of writing these words, gold futures are trading at $1,813.75, which means that this level was practically reached.

This means that gold is likely to reverse any hour now. This means that miners are likely to invalidate their tiny breakout, thus flashing a major sell signal.

This fits with the long-term reversal signs from gold and the US Dollar Index, and the bearish narrative for the next 1-6 weeks for the precious metals sector.