Silver is moving up quite quickly today, which sounds bullish, until one realizes that silver tends to be particularly strong right before the precious metals market tops. And you know what’s the other thing that quite often happens at the tops, in addition to silver’s temporary strength? Miners tend to underperform. What did gold miners do on the last trading day of the previous week?

Miners reversed and ended the day over 1% lower, even though the SPDR® Gold ETF (NYSE:GLD) ended the day slightly higher. Consequently, this piece of the puzzle seems to be in place.

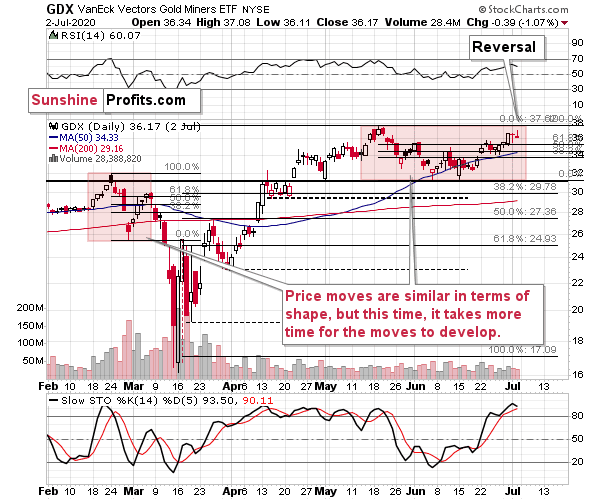

Remember when we wrote that the situation right now is similar to what happened in March, but this time it takes longer for everything to develop due to the change in market’s perception of risk? To make a long story short, the March coronavirus panic was because the entire world was dealing with the unknown, which exacerbated the fear. Right now, the situation is worse, and it goes worse almost on a daily basis, but people are not as afraid. The economic implications don’t appear so dire either. And it’s definitely nothing unknown – we more or less know what to expect.

This means that we’re likely to see a repeat of what we saw in March, we’re likely to see it in “slow motion”, at least for some time. Please note that even slow-motion mode of the mid-March plunge would still be very volatile.

The areas that we marked with red rectangles are similar in terms of shape, but the current one is about four times longer. The previous pattern was characterized by a decline and a correction that took more or less the same time to complete. If we’re about to see something similar also this time, then we can expect the top to be formed this week.

If the March decline took 5 trading days and the price moves are taking four times as long this time, then perhaps we would see a monthly decline to the final lows instead of a weekly one. This would serve as a perfect “handle” for the massive, long-term “cup and handle” pattern in gold.

Today’s relatively weak performance of the mining stocks seems to confirm the above. The implications for the next 1-6 weeks are bearish.