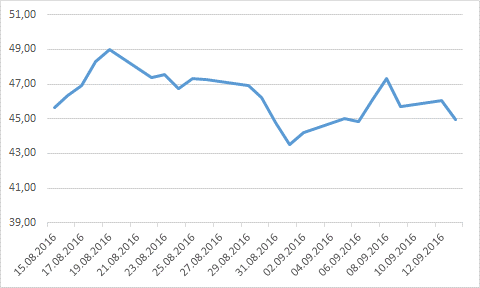

Last week the price of WTI lost 2.5% and went down to $44.96/bbl. On September 13 the price reached its weekly bottom of $44.96/bbl. The resistance level rose to the price of $47.7/bbl, while the price of $44.9/bbl could be considered as a relatively strong support level.

WTI futures price, August, 15 – September, 13, 2016

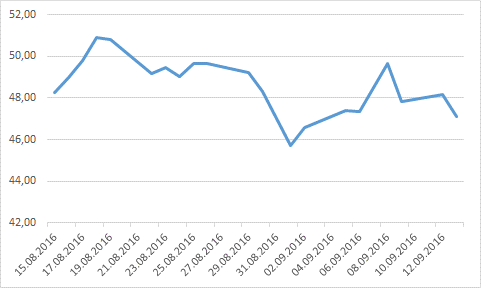

The price of Brent crude fell by 3% to $47.12/bbl last week. The spread between the prices of Brent and WTI reduced to $2.16, but volatility on the crude oil market is still high.

The level of resistance for Brent is at $48.7/bbl; failing to remain at the previous resistance level of $50/bbl. The crude oil market is not ready for growth.

Brent futures price, August, 15 – September, 13, 2016

Baker Hughes reported that the number of active drilling rigs rose by 7 units to 414 rigs last week. However, commercial stocks of oil in the US last week fell by 14.5m bbl, while the market expected an increase in the stocks by 225,000 bbl. The signals coming out of the petroleum market are ambiguous.

The International Energy Agency in its new energy outlook stated that it has downgraded the forecast of demand for crude in 2016 by 0.1m b/d. The agency reported that Kuwait and the Emirates hit their highest output, while Iraq lifted its production. Output from Saudi Arabia has been held at near a record, while Iran reached a post-sanctions’ high. It concludes that the demand for crude oil will not be boosted in 2016.

We expect the price of Brent and WTI next week to be in a range of $47-48 bbl.