In 2009 I shared my big picture analysis, investment forecast and strategy in a book called “New World Order Economics – What you can do to protect yourself”. In January 2009 I forecasted that the Dow Jones Industrial Average was going to make a bottom within a couple months which it did. I also predicted the price of gold to start another major rally, and for crude oil to bottom and rally for years, which were also correct.

You can call it luck, skill or a mix of both, but the truth is that the markets cannot be predicted with 100% certainty. That said, the US stock market, gold and oil look to be setting up for their NEXT BIG multiyear moves.

US Equities Bull Market Is About To End

2014 was a tough year for small cap stocks. The Russell 2000 index is a great barometer of what speculative money is doing as a whole. History has shown that small capitalization stocks are the first group to show weakness after a multi-year bull market.

For all of 2014 this group of stocks has been struggling to hold up. Each time the index nears a previous high, sellers come out of the woodwork and unload shares in large volume. This was the first tell-tale sign that institutions are starting to rotate their positions out of these high beta stocks.

Late in October 2014, the S&P 500 fell 10% in just a few weeks. The speed of the sell-off and the heavy volume that accompanied it are other warning signs that the underlying strength of the stock market is weakening. This broad market sell-off included the large capitalization stocks which means the end is near.

If we turn our focus to the Dow Jones Industrial Average and look at the chart below you will see my prediction for 2015/2016. I should be clear on what to expect during market tops because they differ from market bottoms. Most bottoms are powered by fear. And fear has a price pattern on the chart that is much different than what we see during market tops when optimism is high.

Bottoms tend to be more violent with larger range bars. The process happens in half the time that a bull market top requires. Bull market tops take longer to form and for price to actually break down and confirm it’s headed lower. My thinking is that a market top may have already started. The underlying metrics are eroding and the heavy volume sell-off in October 2014 was the first major signal that big money is selling.

I do feel the market as a whole can and will make some minor new highs, but there will be strong bouts of selling shortly after. Late 2015 and going into 2016 is when the US stock market will likely start to get volatile and we will see the first MAJOR drop in value. It will be similar to the first breakdown bar that took place January 2008. A 15-20% drop that breaks the October 2014 low is going to be the straw that breaks the camel’s back.

Once we get the initial break in price the market should pause or bounce for a few months as investors are still overly bullish at what they think are these BARGAIN prices and buy more shares. In reality it’s the worst thing an investor can do at this stage of the stock market life-cycle.

Once the bear market starts, investors should expect 12-24 months of lower and sideways price action.

So How Do We Take Advantage Of This?

There are two ways to play the next bear market. First is to simply move your money out of stocks. This means sell long positions, pull money out of mutual funds etc., and just hold your money in cash. Cash is king and by doing this you will retain your current level of wealth and be ready to invest when the time comes later in 2016/2017.

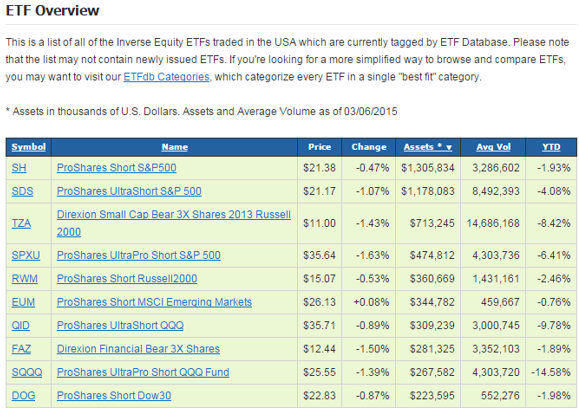

The second option is to do the same as above but to put a portion of your money to work in a way that will allow you to profit from a falling stock market. That is, invest in specifically inverse ETF funds.

Inverse funds rise in value as the stock market price falls. For example if the Dow Jones Industrial Average drops 35% over the next 24 months, your investment would rise 35%, 70% or even 105% depending on the type of fund purchased.

Below are some fundamentals about ETFs that can be used to take advantage of the next bear market: ProShares Short S&P500 (NYSE:SH), ProShares UltraShort S&P500 (ARCA:SDS), Direxion Daily Small Cap Bear 3X Shares (ARCA:TZA), ProShares UltraPro Short S&P500 (ARCA:SPXU), ProShares Short Russell 2000 (NYSE:RWM), ProShares Short MSCI Emerging Markets (NYSE:EUM), ProShares UltraShort QQQ (ARCA:QID), Direxion Daily Financial Bear 3X Shares (ARCA:FAZ), UltraPro Short QQQ (NASDAQ:SQQQ), ProShares Short Dow 30 (NYSE:DOG)

CONCLUSION:

In this article we talked about how the US stock market is showing signs of a major top being put in place later this year. In PART 2 I will show you what to expect long term for crude oil and how to play this multi-year cycle.