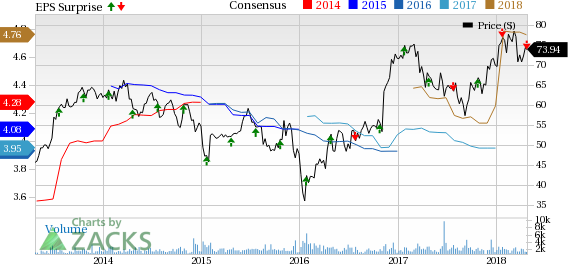

Shares of Prosperity Bancshares Inc. (NYSE:PB) lost nearly 2.4% following the release of its first-quarter 2018 results. Earnings of $1.07 per share lagged the Zacks Consensus Estimate of $1.14. However, the figure improved 8.1% on a year-over-year basis.

Results were hurt by an increase in expenses and lower non-interest income along with continued margin pressure. Also, a significant increase in provision for credit losses was a negative factor. However, higher net interest income and stable loan balances were on the positive side.

Net income available to common shareholders for the reported quarter was $74.4 million, up from $68.6 million registered in the prior-year quarter.

Net Interest Income Improves, Expenses Rise

Net revenues of $181.2 million in the reported quarter lagged the Zacks Consensus Estimate of $184.8 million. Also, the figure decreased 1.1% from the prior-year quarter.

Net interest income was $153.2 million, increasing nearly 1% year over year. The rise was primarily due to an increase in income on loans, partially offset by an increase in the average rate on interest bearing deposits and a decrease in loan discount accretion.

However, net interest margin, on a tax-equivalent basis, decreased 4 basis points (bps) to 3.16%.

Non-interest income declined 9.4% year over year to $27.9 million. This fall was primarily due to lower mortgage income, nonsufficient fund fees, service charges on deposit accounts and other noninterest income.

Non-interest expenses increased 2.6% year over year to $80.1 million. The rise was due to an increase in salaries and benefits costs, net occupancy and equipment costs along with credit and debit card, data processing and software amortization costs. Also, the company witnessed net loss on sale or write-down of other real assets in the reported quarter.

Solid Balance Sheet

As of Mar 31, 2018, total loans were $10 billion, almost in line with the prior-quarter end. Total deposits decreased 2.7% from the previous quarter to $17.3 billion.

Credit Quality: A Mixed Bag

As of Mar 31, 2018, total nonperforming assets were $33.2 million, decreasing 19.4% year over year. Also, the ratio of allowance for credit losses to total loans was down 2 bps year over year to 0.84%.

However, net charge-offs totaled $9.4 million, significantly up from the year-ago quarter figure of $3.9 million. Also, provision for credit losses increased significantly from the prior-year quarter to $9 million.

Capital & Profitability Ratios Improve

As of Mar 31, 2018, Tier-1 risk-based capital ratio was 15.31%, up from 14.45% as of Mar 31, 2017. Moreover, total risk-based capital ratio was 15.97%, up from 15.14% at the end of the year-ago quarter.

Also, common equity tier 1 capital ratio was 15.31%, up from 14.45% in the prior-year quarter.

The annualized return on average assets was 1.32% at the end of the reported quarter, up from 1.23% in the prior-year quarter. Similarly, annualized return on common equity was 7.69% compared with 7.45% in the prior-year quarter.

Our Viewpoint

Prosperity Bancshares remains well positioned for organic growth, supported by a strong balance sheet position. Also, steady improvement in asset quality should support its profitability. However, continued margin pressure (despite interest rate hikes) remains a major concern. Furthermore, the bank’s strategy to grow inorganically may lead to higher merger-related charges, resulting in rise in operating expenses.

Prosperity Bancshares currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other banks, Commerce Bancshares, Inc’s (NASDAQ:CBSH) first-quarter 2018 earnings per share of 92 cents surpassed the Zacks Consensus Estimate of 80 cents. Results primarily benefited from an improvement in both net interest income and non-interest income. However, higher expenses acted as a headwind.

First Republic Bank (NYSE:FRC) registered a positive earnings surprise of 1.29% in first-quarter 2018, reflecting higher revenues. Earnings per share were $1.13, outpacing the Zacks Consensus Estimate of $1.06. Revenues improved from the prior-year quarter. In addition, considerable rise in loans and deposit balances was recorded. However, despite rising rates, net interest margin disappointed on high deposit costs. In addition, higher provisions and expenses were undermining factors.

Zions Bancorporation’s (NASDAQ:ZION) earnings for the first quarter were $1.09 per share, comfortably surpassing the Zacks Consensus Estimate of 83 cents. Results, to a great extent, benefited from improvement in both net interest income and non-interest income. Also, the quarter witnessed overall improvement in credit quality. However, higher adjusted non-interest expenses remained a major headwind.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Commerce Bancshares, Inc. (CBSH): Free Stock Analysis Report

Prosperity Bancshares, Inc. (PB): Free Stock Analysis Report

Zions Bancorporation (ZION): Free Stock Analysis Report

First Republic Bank (FRC): Free Stock Analysis Report

Original post

Zacks Investment Research