There are all the reasons to expect bitcoin to update its historical maximum and reach $65,000 in Q4 2021.

What are such optimistic predictions based on? In addition to the fact that Bitcoin keeps being in demand as a reserve asset, which allows investors to protect their capital from the sharp rise in inflation observed throughout the world, BTC buyers have another reason to rejoice - the long-awaited approval of bitcoin futures ETFs by the US Securities and Exchange Commission (SEC).

ETFs (exchange-traded funds) are investment funds that form asset portfolios and issue their own shares, where each security is linked to a certain part of the underlying asset. ETFs allow you to purchase an asset without actually owning it. In the case of the ProShares Bitcoin Strategy ETF (NYSE:BITO), the fund is linked to bitcoin futures that have been trading on the Chicago Mercantile Exchange since 2017. Here, we are talking about the creation of a new safe instrument for entering the cryptocurrency market for institutional investors. The only thing we don't know yet is how much money will be invested in bitcoin in the near future.

So, the first bitcoin-linked exchange-traded fund listed in the United States, the ProShares Bitcoin Strategy ETF, trading under the ticker BITO, became available on the New York Stock Exchange on Oct. 19. This date will definitely go down in history, especially considering that Bitcoin ETF applications have been filed since 2013, but each time they were rejected. Now everyone has the opportunity to invest in bitcoin and earn on its continuing growth, bypassing largely unregulated and susceptible to fraud cryptocurrency exchanges.

Immediately after the listing, BITO rose 5%, recovering from $40 to $42. In the first 20 minutes, BITO's trading volume exceeded $280 million. For reference, the SPDR® S&P 500 (NYSE:SPY) (one of the world's most popular funds that aims to track the S&P 500 index debuted in 1993 and traded about $40 million on the first day.

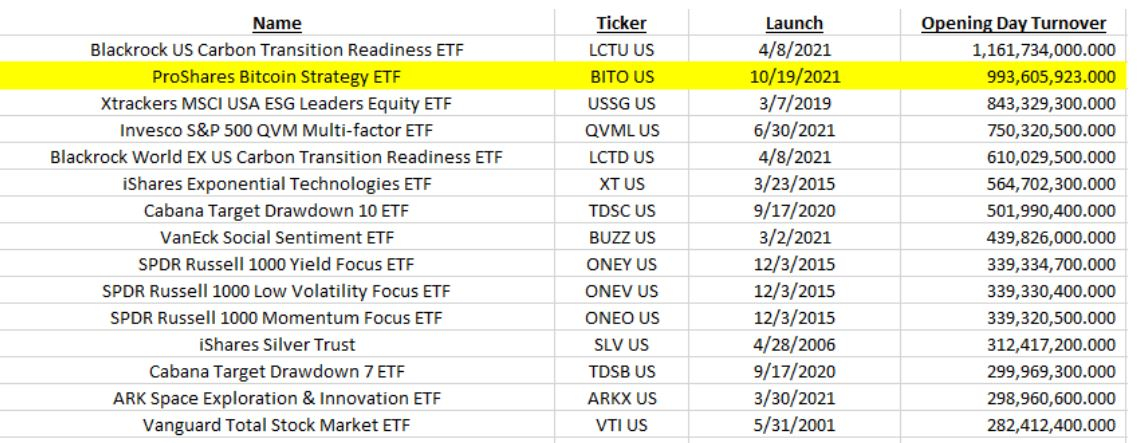

By the end of the trading session, BITO's trading volume reached $984 million, which made it the second-most heavily traded new ETF on record after the BlackRock (NYSE:BLK) giant.

The hype around Bitcoin ETFs clearly demonstrates the desire of an entirely new class of investors to experience the benefits of investing in cryptocurrency as a legitimate asset. Many experts note that the launch of a fully legitimate Bitcoin derivative demonstrates not only a special attitude of regulators to the cryptocurrency environment but also their readiness to move on towards creating a regulated spot market.

In other words, Bitcoin is going to stay with us for a long time. That being said, we have all the grounds to expect the BTC growth to $75,000. And given that it's already trading at $64,000, this scenario does not seem that unrealistic anymore.