- ProPicks AI turned one year old this month with market-beating results.

- This article is part of a series on the top 10 best-performing stocks picked by our AI this year.

- Today, we focus on stocks ranked 4 and 3 - stocks that escaped long-term consolidation and exploded higher.

We've all been there; stuck on a stagnant stock for months in a row - sometimes even years - waiting for it to realize its full potential. Meanwhile, several other stocks rally past it, making you question your choice in the first place.

These moments challenge one's patience, demanding endurance through extended periods of inactivity with little guarantee of immediate reward. Unfortunately, many will surrender prematurely, selling their holdings after years of perseverance, only to witness the stock surge shortly afterward.

However, if you do spot these names at the right moment, the reward will often be huge, as the breakout unleashes years of untapped growth potential.

But how do you spot these hidden gems before they make their move?

That is precisely where AI-driven insights can simplify and improve this process, drawing on decades of data to surface the best-positioned stocks in the market from a fundamental perspective - And the best part? It costs less than $9 a month using this link.

By the way, if you are already a Pro user, you can see all our picks for November here.

In the following article, featuring the number 3 and 4 picks from the top ten ProPicks AI stocks of the year, we will discuss how our AI tool flagged two stocks breaking out from years of consolidation, yielding returns of 82% and 94.5% to our premium users who bought them at the right moment.

First up, stock #4 in our Top 10 performers: Vistra Energy (NYSE:VST).

#4 Pick: Vistra Stock Quadruples After 8 Years of Nearly No Returns

For years, Vistra's stock barely moved, frustrating long-term investors who patiently held on. Many considered selling, tired of waiting and looking for better opportunities elsewhere.

For nearly eight years, the stock barely budged.

Then, after years of stagnation, Vistra finally broke out, delivering stunning returns—at one point even outpacing industry giants like Nvidia (NASDAQ:NVDA) to claim the title of best-performing stock in the S&P 500. So far, it has surged an impressive 210% this year.

The stock’s parabolic rise is clear in the chart above. But how could anyone have known it was about to skyrocket?

Manually spotting this shift would have required combing through mountains of data with no promise of success. Or, you could have simply tracked ProPicks’ monthly rebalancing updates.

Vistra joined ProPicks’ ‘Top Value’ strategy on March 1, 2024, and was removed on June 1, 2024, netting an impressive 82.4% gain during that period.

However, while stocks like Vistra can stay stuck in a sideways pattern for a while, some stocks can remain in consolidation for even longer, like the #3 pick, which is the next stock we will discuss.

#3 Pick: MicroStrategy – ProPicks Bagged Staggering Gains in Just 6 Months After Two Decades of Lull

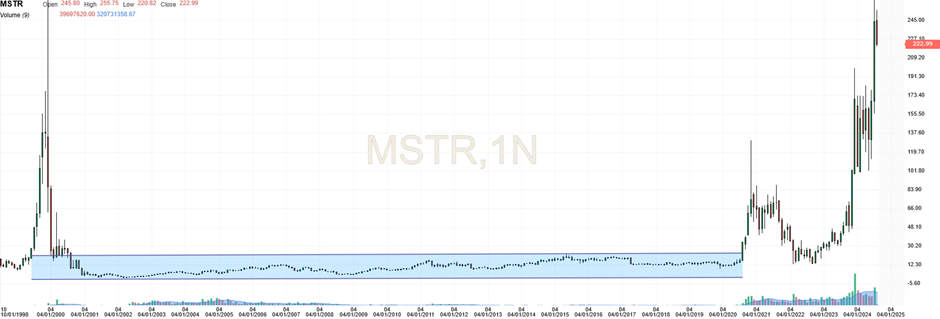

MicroStrategy (NASDAQ:MSTR), the American Bitcoin-focused company, shares a similar story to Vistra - only more extreme.

After a dramatic 62% drop on March 20, 2000, as the dot-com bubble burst, the stock drifted through nearly two decades without a clear catalyst to push it higher.

In 2020, the company made waves by investing heavily in Bitcoin, creating some initial excitement.

But despite this move, both long-term holders and newer investors saw the gains quickly fade as the stock couldn’t sustain its momentum amid news of a possibility of a margin call, as Bitcoin price plummeted in June 2022.

The real rally, however, came soon after a substantial investment in Bitcoin in late 2023. In September, MicroStrategy acquired approximately 5,445 bitcoins for $147.3 million, a bold bet that caught ProPicks' AI attention.

Recognizing that a turning point is in the offing for the stock, ProPicks added MicroStrategy to its ‘Tech Titans’ strategy on December 1, 2023.

By the time ProPicks exited the stock on May 1, 2024, it had netted a remarkable 94.5% gain in just six months. For investors who had waited for years with little to show, this parabolic surge underscored the power of timing and AI-driven insights.

Bottom Line

Spotting the right signals on a stock can be the key difference between enduring years of lull and realizing impressive market gains.

Take Vistra and MicroStrategy, for example: While these rallies happened in different industries, the one thing they have in common is the AI's big data modeling spotted the fact that their fundamentals had finally aligned for explosive gains.

Don’t miss November’s rebalance update, which could unlock new potential for your portfolio.

Stay tuned, too, as we reveal the top two picks from ProPicks this year in our final articles of the series!

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.