PREFACE

Alphabet Inc. (NASDAQ:GOOGL) has been on a tear of late — much like the rest of the market. The stock’s market cap has topped half a trillion dollars and may well be on its way to becoming the first trillion dollar company if its foray into self-driving cars with Waymo, and its Cloud computing businesses take off.

But, while the stock has risen to new heights, it’s reasonable to look for an option strategy that benefits if the stock simply doesn’t “go down that much.” That is, it’s semi-bullish, but really just “not bearish.”

It turns out there is such a strategy — and it’s been very profitable.

Risk Controls and Beating the Market

We can take a rather simple and fast look at Alphabet Inc (NASDAQ:GOOGL). Let’s just test a simple idea: Selling out of the money put spreads every 30-days. Here are the results:

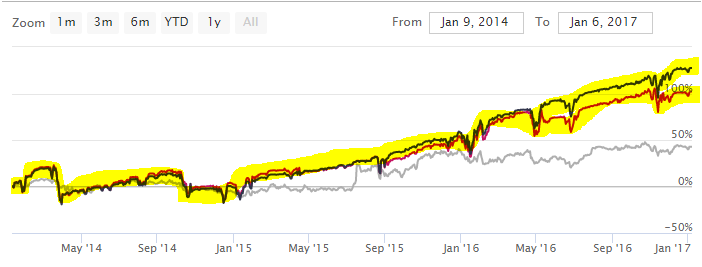

We can see a rather large 102% to 128% return depending on the exact put spreads we sold. And, of course, to make this relevant, we need the perspective of the stock performance during the last three-years. Here is the chart that plots the short put spreads in the yellow highlighted lines and the stock price in the gray line:

We’re looking at option strategies that essentially benefited from Alphabet not having any ‘black swan’ stock drops to return over 100% while the stock rose ‘just’ 43%. We find similar results with Apple (NASDAQ:AAPL), IBM (NYSE:IBM), Qualcomm (NASDAQ:QCOM) and even the S&P 500 (SPY (NYSE:SPY)).

What Just Happened

This is how people profit from the option market — it’s preparation, not luck. But even more, this was just one example in one company, now it’s time to find your own edge with your own ideas.

To see how to do this for any stock, for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.