Online travel agency Priceline.com Incorporated (NASDAQ:PCLN) late Monday posted better-than-expected third quarter earnings results and offered a weak fourth quarter outlook, but its shares surged in late trading anyway.

The Norwalk, CT-based company reported Q3 EPS of $31.18 per share, $1.26 better than the Wall Street estimate of $29.92. Revenue jumped 18.9% from last year to $3.69 billion, beating out analysts’ view of $3.61 billion.

Looking ahead, Priceline forecast Q4 EPS of $12.20 to $12.80, which would badly miss Wall Street’s $14.21 estimate. PCLN also expects room nights booked in Q4 to rise 20-25%, with total gross travel bookings up 16-21%.

Along with the earnings release, Priceline noted its current interim Chief Executive Officer, Brett Keller, has been named permanent Chief Executive Officer, effective immediately.

The company commented via press release:

“The Priceline Group brands executed well during our peak summer travel season,” said Jeffery H. Boyd, Chairman and Interim Chief Executive Officer of The Priceline Group. “Globally, our accommodation business booked 150 million room nights in the 3rd quarter, up 29% over the same period last year. The acceleration in room night growth demonstrates the favorable market in which we operate as well as the value of our diverse global platform.”

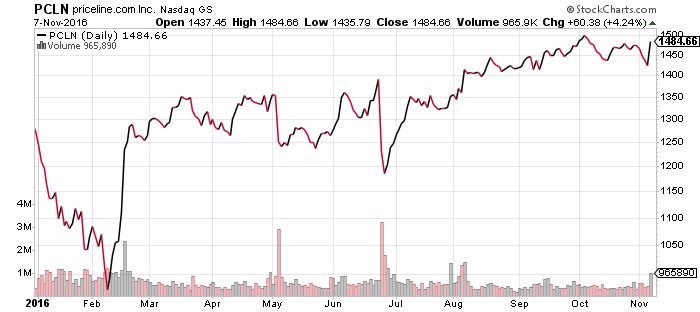

Priceline shares rose $70.22 (+4.74%) to $1,550.55 in after-hours trading Monday. Prior to today’s report, PCLN had gained 16.11%, versus a 4.53% rise in the benchmark S&P 500 index during the same period.