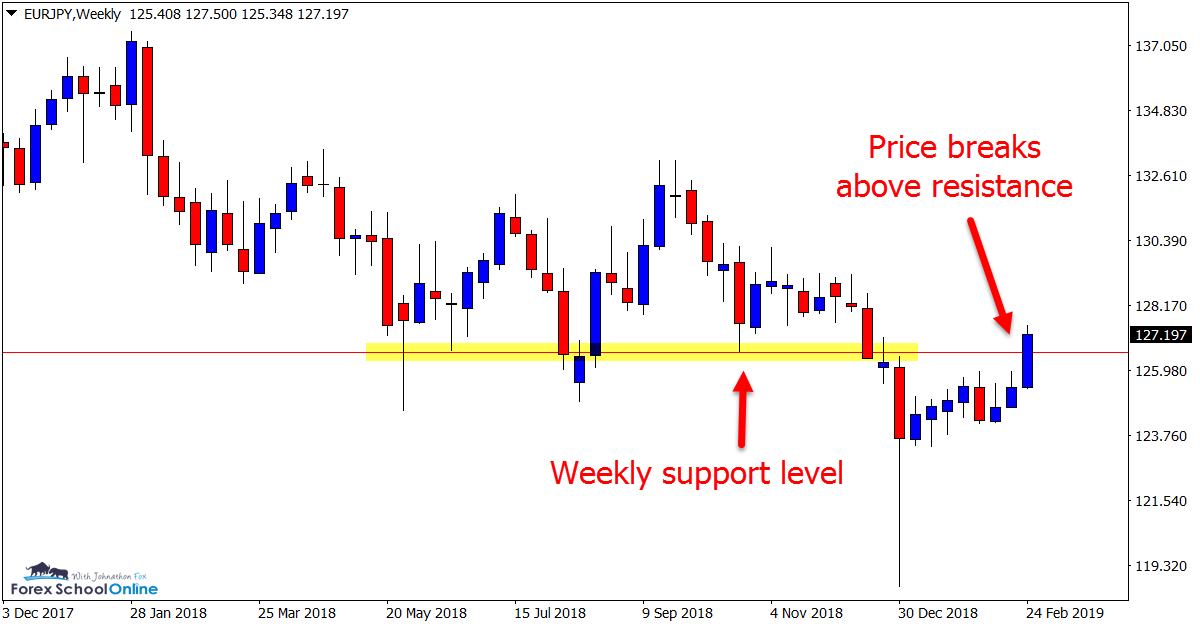

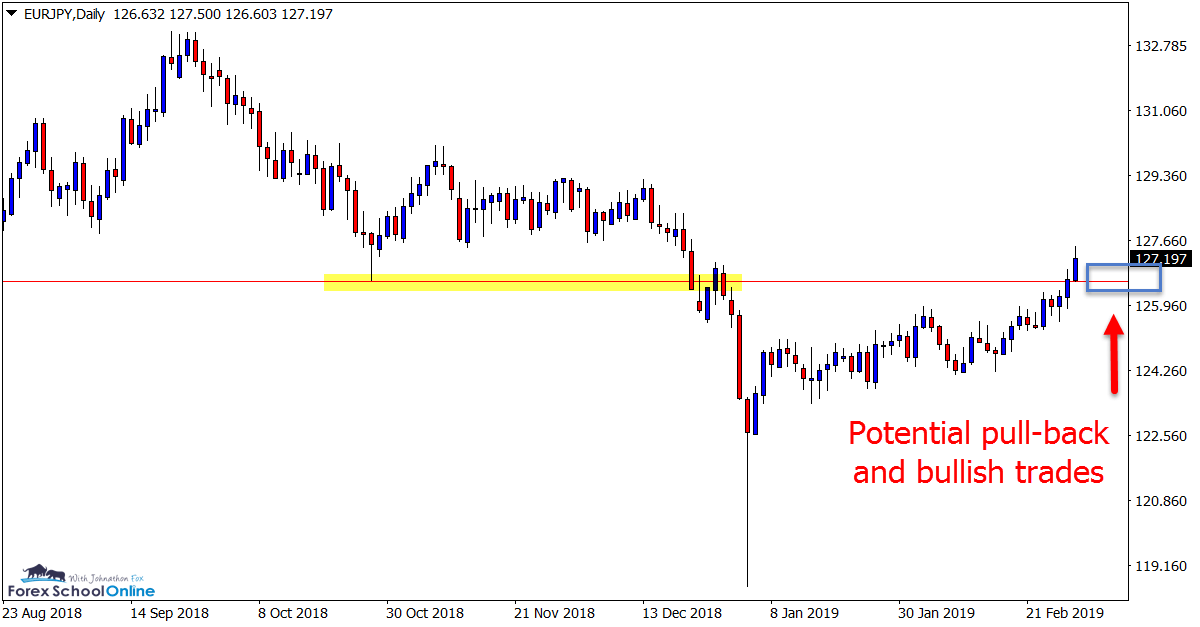

Price Action Preview: March 3 - 8EUR/JPY - Price Action Breaks Major Weekly Level

Price action broke through a major daily and weekly level on the EUR/JPY. Whilst we don’t often discuss the weekly charts, the weekly time frame on this pair shows this major level and the breakout the most clearly. In our recent trade ideas from January 25th, we were looking for a potential quick move into the 125.00 and 126.60 area. As you can see from the charts, the price broke through this level with strong momentum. Any quick pull-back into the old resistance and new support could provide long trade setups.

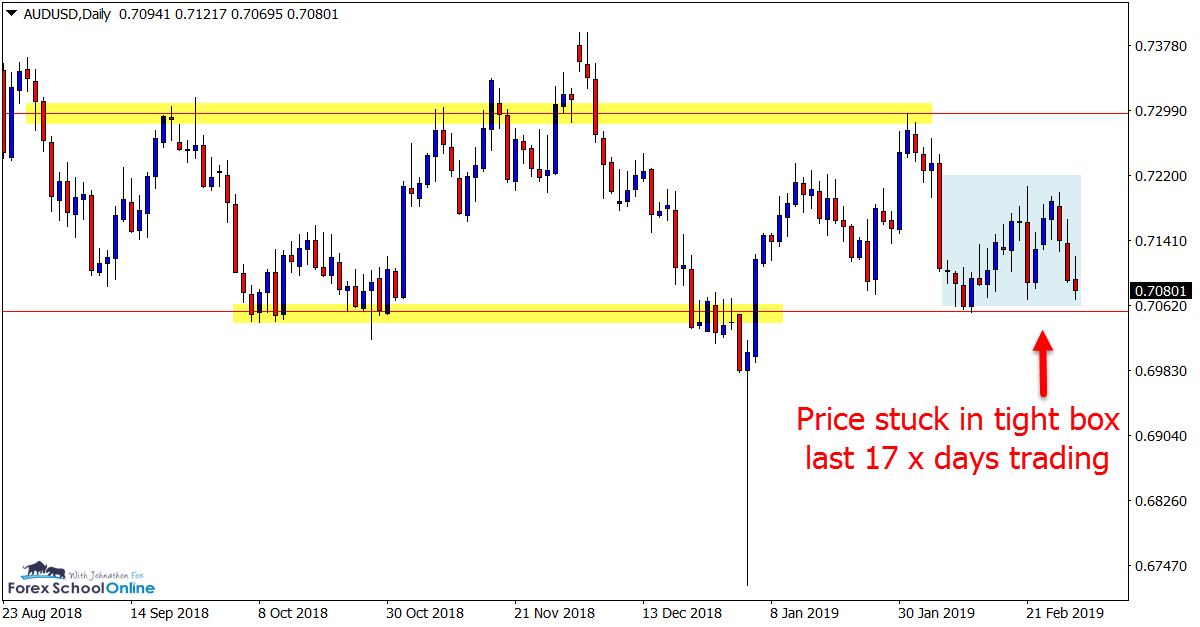

AUD/USD - Price Moving Into Crossroads

AUD/USD has been trading in a tight box for the last 17 sessions. Whilst the price is trading within an overall sideways ranging pattern, price looks to be coming to a crossroads and we may finally see where it wants to move. Before moving into this sideways consolidation pattern, the price was in a heavy down-trend since the start of 2018. If the price can now finally break out of the range and tight box price has been in, then we could see a fast break lower with potential breakout trades opening up.

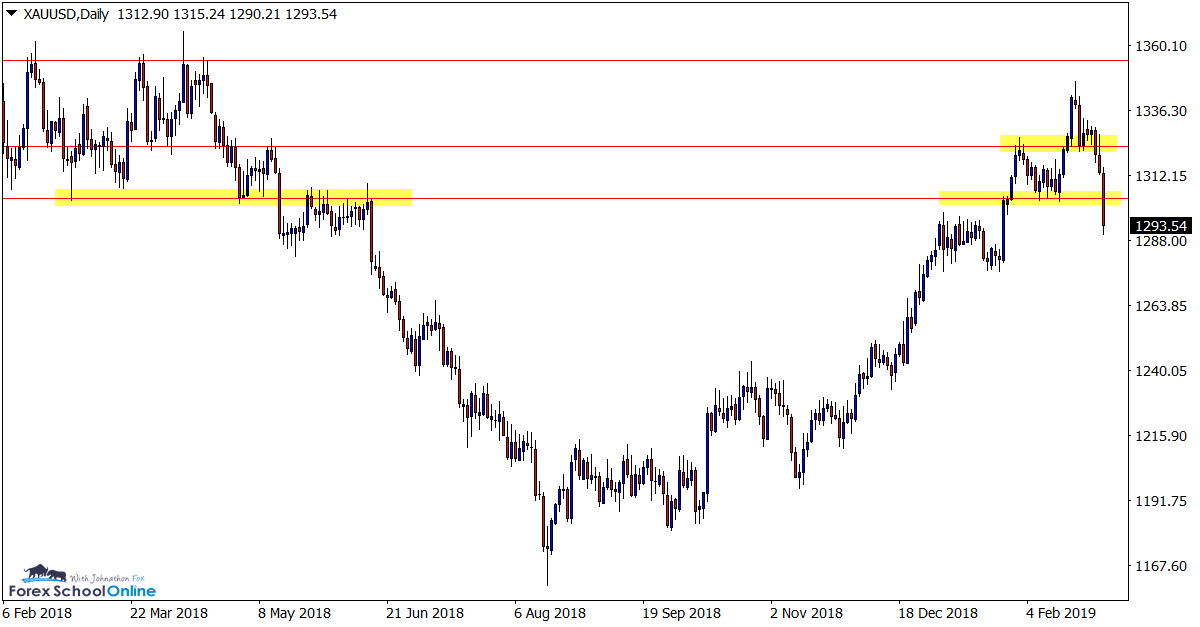

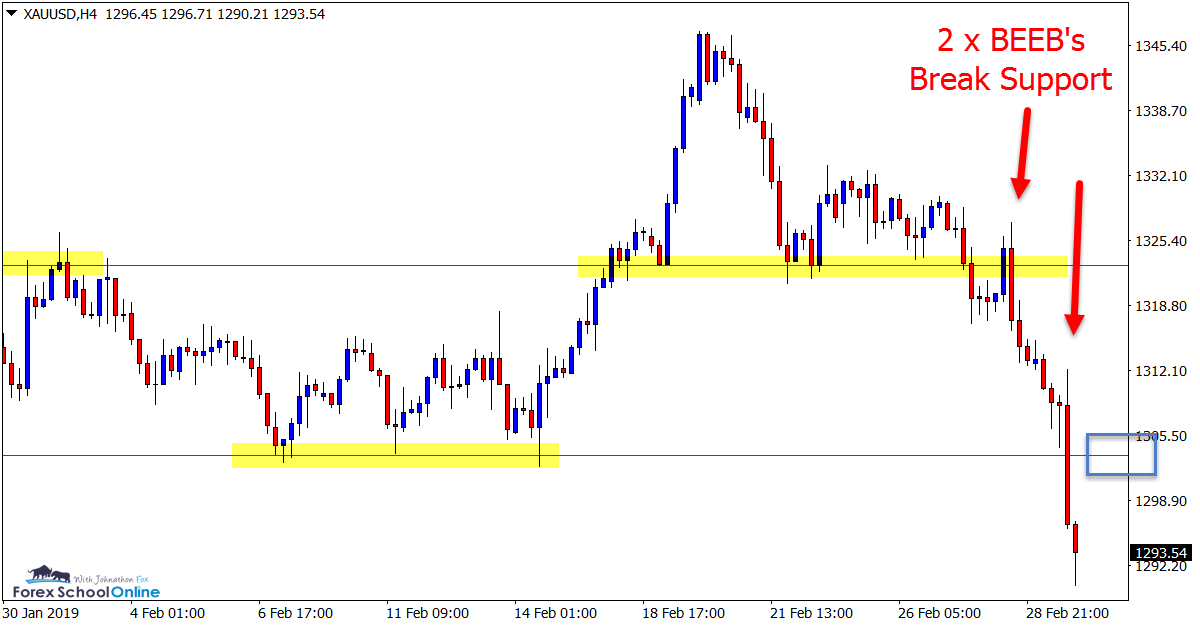

Gold- Price Slams Through Daily Support Level

In last week’s commentary, we posted about this market, looking to see if the price would continue higher after a small hesitation. Whilst price tested the near-term support level, it soon slammed lower and in the process broke through two major daily support levels. As you can see on the intraday 4-hour chart below; this move was very aggressive with price forming two large Bearish Engulfing Bars; BEEB’s. This breakout support level will now be super interesting to watch over the coming sessions to see if the price will make a quick move back higher and to re-test as new resistance.

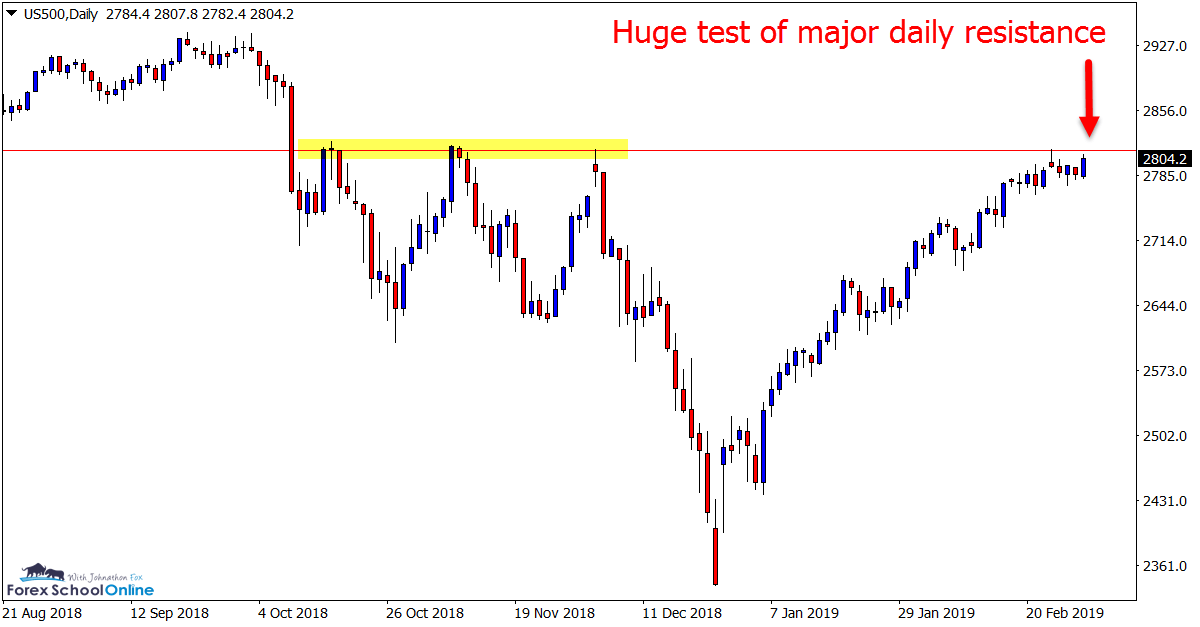

US500 - Price Testing Major Daily Levels

On February 22, we posted about watching the major daily resistance level in theS&P 500 as it looked a clear daily level for the price to move into and make a fresh re-test. The first test we saw was small with the pull-back lower a minor move. Price is now looking to make a fresh attempt at breaking higher. A break higher in the next few sessions and we could see price continue this strong and aggressive move higher that price has been moving in.