In theory, nothing changed for the precious metals market yesterday, but in reality, it was the opposite, thanks to the signs from the USDX and stocks.

Let’s start with the latter.

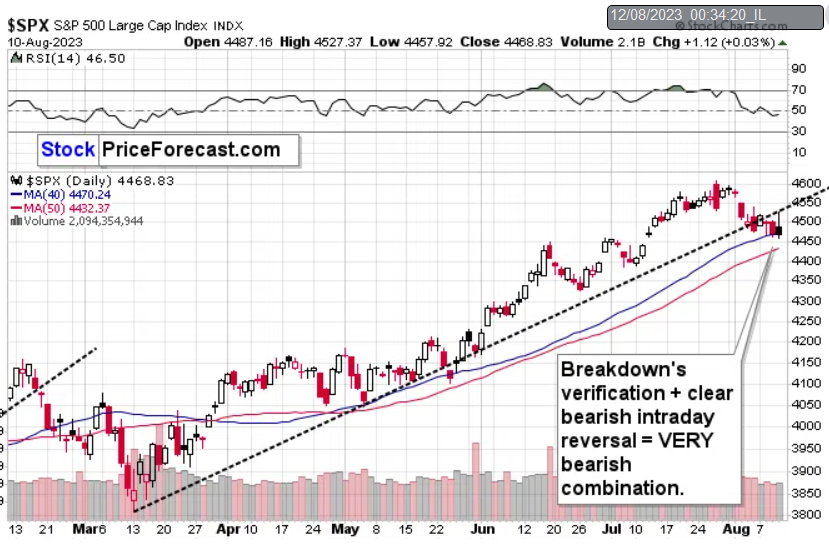

We just saw a combination of verification of the breakdown below the rising support line and an intraday reversal. Both are bearish developments, and their combination indicates that lower – likely much lower – stock market prices are to be expected.

For now, stocks are still at their 50-day moving average and their June highs, but once these support levels are broken, the fall is likely to be substantial.

Why?

Because stocks were just very overbought, as proven by the RSI indicator (moved well over 70), and when we saw similar developments in the past, it meant that huge declines were about to start. We saw that in early 2022 and in August 2022. Compared to those declines, we have seen nothing yet.

Interestingly, so far, the pace of the decline is very similar to the pace at which stocks declined on the two above-mentioned occasions.

Also, please note the red rectangle – it shows how weak mining stocks (brown line) have been compared to what the S&P 500 did – extremely so. When stocks declined earlier this month, miners declined significantly. Consequently, the above points to much lower mining stock values in the near future.

The USD Index did almost nothing in terms of the daily price changes, but this nothing was meaningful. This way – by not declining – the USD Index confirmed its breakout above the declining, green resistance line. This is a very bullish development.

Besides, it’s not that we didn’t see any action yesterday – we did see it, but it happened during the session.

The USDX tried to move lower and… Failed, as the bullish forces pushed it back up.

What’s particularly interesting is that this reversal – and an intraday bottom – formed right when the support and resistance lines crossed. The triangle-vertex-based reversal technique worked once more. And it worked just as well as it did in a different fundamental and geopolitical situation, simply because the underlying factors: emotional buying and selling due to fear, and greed don’t really change over time. And it is due to this that the technical analysis will continue to work when the economic landscape changes even more.

Moving back to the precious metals sector, as I wrote previously, nothing really happened in it and this means that my previous comments on the junior miners remain up-to-date:

Another day, another decline in the junior miners. That’s a new reality. And with just a small push, the waterfall selling will start. Why? For instance, because of the head-and-shoulders pattern that is about to be completed.

The rising, red support line was broken, and the breakdown was verified last month, so it’s already quite clear that the next big move is to the downside. There is, however, another support line (marked with blue) that is particularly important at this time.

This blue line is not important just on its own, but because it’s part of a bigger pattern called “head and shoulders”. This line serves as the neck level of the pattern, and the way those patterns work is that after the breakdowns below the neck levels (once they’re verified!), the price tends to decline and the size of the move lower is usually equal to (or greater than) the size of the head of the pattern.

I marked this with blue, dashed lines. This pattern (btw, we see something analogous in the price of gold) suggests a move lower – to the $26 level, which is in tune with other techniques pointing to this as being the intermediate target level.

On a very short-term basis, we might see a correction from the previous 2023 low close to $33. Why? Because – as I wrote above – the breakdowns below the neck levels usually need to be verified by a corrective upswing – oftentimes back to the previously broken neck level.

So, a move higher from about $33 to about $35 would be quite likely from the above point of view. Zooming in confirms this scenario even more.

Looking at the orange ellipses immediately shows which part of the previous decline is currently being repeated. We see a consolidation that follows a move below the previous lows. What happened next during a similar, recent decline? We first saw another move lower, and then a bigger correction, before the decline resumed. This perfectly fits the previously described scenario.

Also, did I mention that 2023 is already a down year for the GDXJ) and the price of silver? Because this actually is the case (despite moves lower in the USDX and moves higher in the main stock indices), which further emphasizes the reliability of the bearish narrative.

Something big is brewing for the precious metals sector, and in particular for junior mining stocks – are you ready?