Pennsylvania Real Estate Investment Trust (NYSE:PEI) — better known as PREIT — announced the opening of three new retailers — DICK’S Sporting Goods (NYSE:DKS) , Field & Stream and HomeGoods — at Viewmont Mall in Scranton, PA, within the space which was previously occupied by Sears Holdings Corp. (NASDAQ:SHLD) .

This marks the conclusion of the anchor-improvement program at this mall which is aimed at diversifying the tenant mix, meet shoppers’ demand and boost sales per square feet of this retail property.

HomeGoods occupies 23,000 square feet of space in the property, while DICK’S Sporting Goods and Field & Stream occupy 90,000 square feet in one dual store concept store.

Notably, PREIT had recaptured the spaces previously occupied by Sears and secured these high-performing replacement anchors for filling up the spaces again. This was achieved within 14 months of Sears’ closing.

In fact, PREIT has been strategically focusing on enhancing the value of the Viewmont Mall through its portfolio-wide remerchandising efforts. The company added national tenants — Ulta Beauty (NASDAQ:ULTA) , Wild Wings and others — together with new prototype stores for a number of major tenants. With these diligent efforts, the company has been able to organically increase 16% in sales per square feet since Dec 31, 2013.

No doubt, the shrinking mall traffic and store closures amid aggressive growth in online sales have kept retail REITs on tenterhooks. In addition, tenants are demanding substantial lease concessions owing to a choppy retail market scenario. Nonetheless, retail REITs are countering this dreary situation and putting in every effort to boost the productivity of the malls, by trying to grab attention from new and productive tenants and disposing the non-productive ones on the other hand.

PREIT, too, along with its remerchandising efforts, has resorted to a portfolio rejig, selling 17 lower productivity malls, as well as other non-core properties since January 2013. This helped the company reap more than $750 million in gross proceeds. (Read more: PREIT Closes Sale of 17th Low-Productivity Mall for $33.2M)

The company’s above discussed efforts are likely to help it efficiently tide over the lackluster retail environment and ride on the growth curve as well.

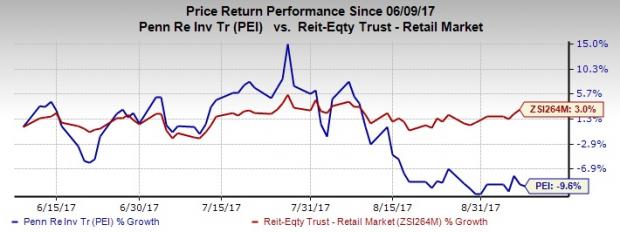

PREIT currently has a Zacks Rank #3 (Hold). The company’s shares have descended 9.6% over the past three months, underperforming the industry’s rally of 3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Dick's Sporting Goods Inc (DKS): Free Stock Analysis Report

Ulta Beauty Inc. (ULTA): Free Stock Analysis Report

Pennsylvania Real Estate Investment Trust (PEI): Free Stock Analysis Report

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

PREIT Enhances Viewmont Mall With Anchor Improvement Program

Published 09/08/2017, 06:12 AM

Updated 07/09/2023, 06:31 AM

PREIT Enhances Viewmont Mall With Anchor Improvement Program

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.