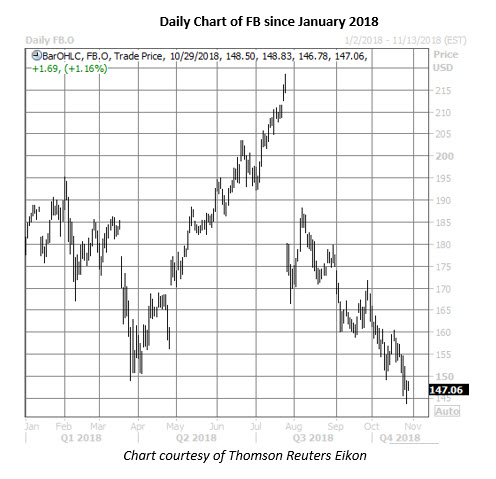

FAANG earnings will wrap up this week when Apple (NASDAQ:AAPL) unveils its quarterly results after the close on Thursday, Nov. 1. Ahead of this are earnings from Facebook, Inc. (NASDAQ:NASDAQ:FB), with the social media giant set to report its third-quarter numbers after the close tomorrow, Oct. 30. FB stock was last seen trading up 1.2% at $147.06, and options traders are anticipating an even bigger move for Wednesday's trading.

Currently, Trade-Alert pegs the implied earnings deviation for FB at 12.4%, much wider than the 5.5% next-day move the stock has averaged over the past two years. Five of these post-earnings moves have occurred to the downside, and just one -- a historic 19% plunge last July -- was large enough to match or exceed the percentage move the options market is pricing in this time around.

Over the past two weeks, pre-earnings options traders have targeted FB's November 155 call, with more than 10,000 new positions initiated. Data from the major options exchanges confirms at least some buy-to-open activity here, indicating options traders are positioning for a break above $155 by standard November options expiration.

In today's trading, volume is running below average levels, with 49,105 calls and 25,311 puts on the tape so far -- compared to an expected intraday amount of 52,000 calls and 37,000 puts. Most active is the November 170 call, where it looks like some new positions are being purchased for a volume-weighted average price of $1.03. If this is the case, breakeven for the call buyers at the close on Friday, Nov. 16, is $171.03 (strike plus premium paid).

Outside of the options pits, analysts have been bullish on Facebook. While 28 of 32 covering analysts maintain a "buy" or better rating, the average 12-month price target on FB stock sits all the way up at $206.74.

Looking at the charts, Facebook has struggled since that July 26 post-earnings plunge. Specifically, the shares are down 16.6% since closing at $176.26, and are off nearly 33% from their July 25 record high of $218.62. Plus, FB hit an 18-month low of $143.80 last Friday. This puts the FAANG stock at risk of bearish brokerage notes in the wake of another negative earnings reaction.