Thursday the S&P 500 closed nearly unchanged for a second day in a row. Not bad considering the week started with one of the biggest selloffs in over a year. Volume has been above average, telling us traders are clearly paying attention.

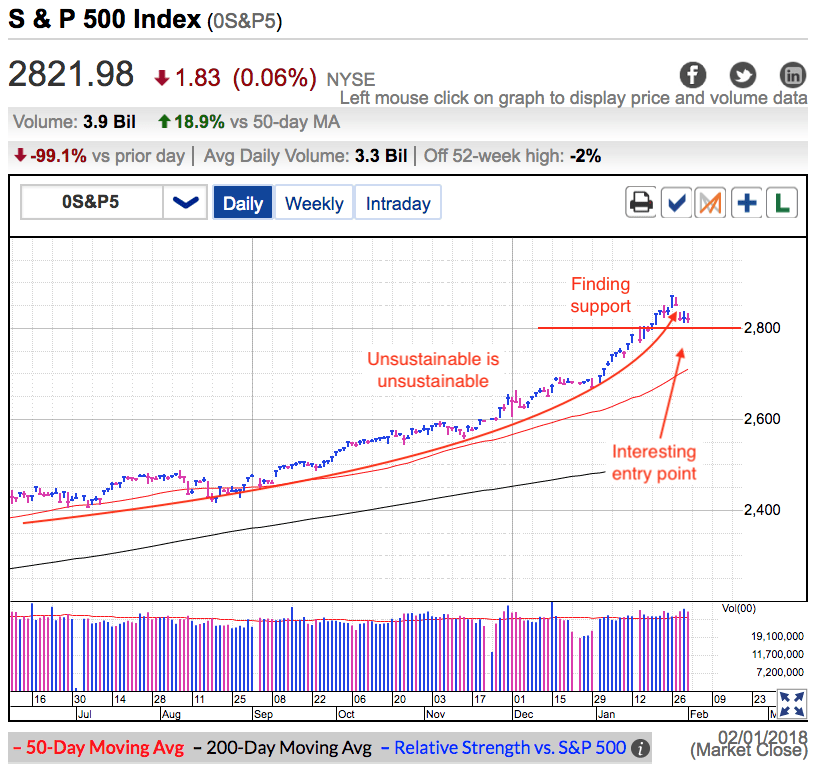

2017 was a great year for stocks, but even it couldn’t compare to the way 2018 kicked off. But as I’ve been writing over recent weeks, the rate of gains was clearly unsustainable and running out of steam was inevitable. This isn’t rocket science and knowing what is going to happen is the easy part because the same thing always happens. The challenge is knowing exactly when it will happen. Never forget, we are paid for getting the timing right, not predicting what will happen.

To be honest, I didn’t expect this to go as high as it did, but I was smart enough to know it was powerful and wasn’t about to get in its way. But I also didn’t need to be apart of it either. Unsustainable moves are unsustainable. If you miss it, or get out too early, don’t worry about it, there is no need to chase because there will be another opportunity to get in when the risks are lower.

As I wrote Tuesday, we didn’t need to fear this dip because it wasn’t driven by a spooky headline. Instead we tumbled because we went a little too far, too quickly. Fear mongering headlines trigger large moves. Imbalances in supply and demand lead to relatively modest price swings. Rather than overreact to Monday and Tuesday’s weakness, the lack of a headline catalyst told us the move wouldn’t be all that big and there was no reason to sell fearfully or short aggressively. This is a normal gyration and we should respond in kind.

If we close above 2,820 Friday, then Monday and Tuesday’s selloff is done. That doesn’t mean we cannot sell off next week, but any further weakness will need a new catalyst. Crashes are frighteningly quick and holding 2,820 support for four days is anything but frighteningly quick.

I would love to see us dip a little further and create a more attractive dip buying opportunity, but the flat trade the last couple of days tells us confident owners are still confident and their lack of selling is keeping supply tight. If this selloff had greater potential, we would have felt it by now. Unfortunately this dip leaves us in no-man’s land. Not deep enough to become oversold and create a safe entry point, but so shallow that there is still risk underneath us. There is no reason to bailout of our favorite buy-and-hold positions and there is not enough potential to make a short-term swing trade worthwhile. And so we keep waiting for something more interesting to come along.

As I wrote on Tuesday, Bitcoin’s inability to escape $10k support meant lower prices were coming. And Thursday's selloff knocked another $1k off the price as we find ourselves at the lowest levels in months. Anyone who bought December’s parabolic rise higher is sitting on losses, as is anyone who was brave enough to buy the dip.

Last month’s greed has quickly turned into this month’s fear. The thing to remember is major selloffs take a long time to play out. We are already more than six weeks into this and we won’t find the real bottom for several more months. It will be a very choppy ride lower and that means lots of big bounces along the way. I expect prices will fall under $8k real soon, but we will rebound as high as $10k. But remember, this is a pattern of lower highs and lower lows. Buy the dips and sell the rips.

For the “hodl” crowd (aka hold for those born in the last century), they better be prepared for much larger losses. In 2013, BTC fell nearly 80% from the highs. If history repeats itself, which it looks like it is doing, I wouldn’t expect to find a bottom until we slip under $4k sometime this summer. Every bounce continues to be a selling opportunity because the worst is still ahead of us.