Though precious metals are rallying on the day we penn this, we expect more downside before a final bottom or at least before we’ll exit hedges and begin buying. Since the hard reversal in March we’ve had the view that precious metals would decline and the miners could retest their December lows. We’ve held firm on this belief in recent weeks and wrote that a May decline could setup a June buying opportunity. Our analysis leads us to believe we are almost there but not quite yet. A little bit more patience is required.

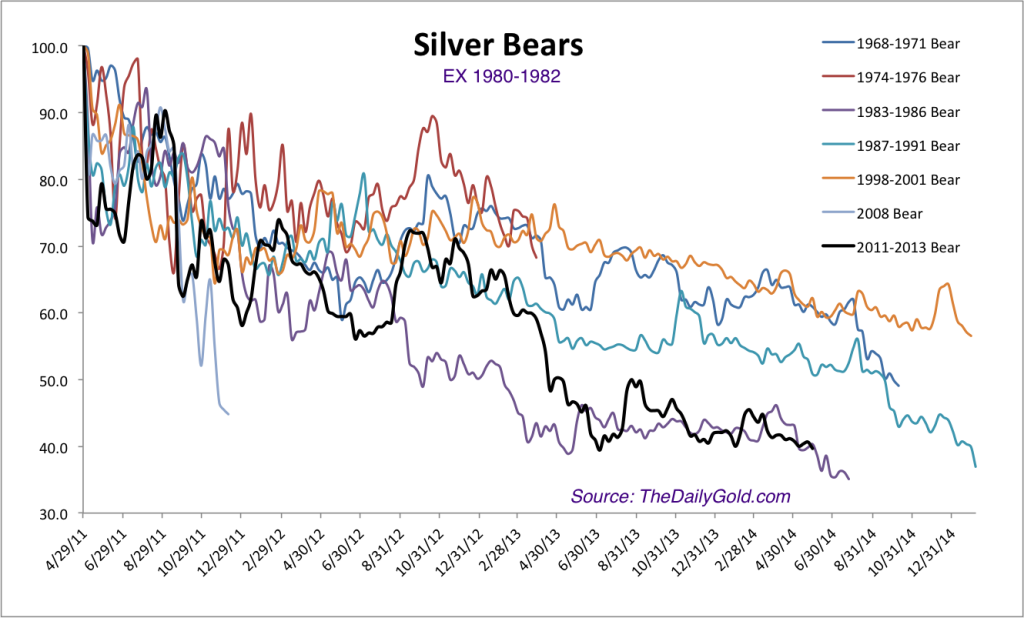

I want to begin with Silver for several reasons. Recall that Silver peaked in April 2011 while Gold didn’t peak until the late summer. It makes sense that Silver would bottom first. In addition, the turn towards an inflationary environment (rather than a deflationary one) which we’ve discussed recently benefits Silver against Gold. Finally, Silver is giving us clear and strong signals. The bear analog chart below shows that a little bit more downside should mark the end of the current bear (black line).

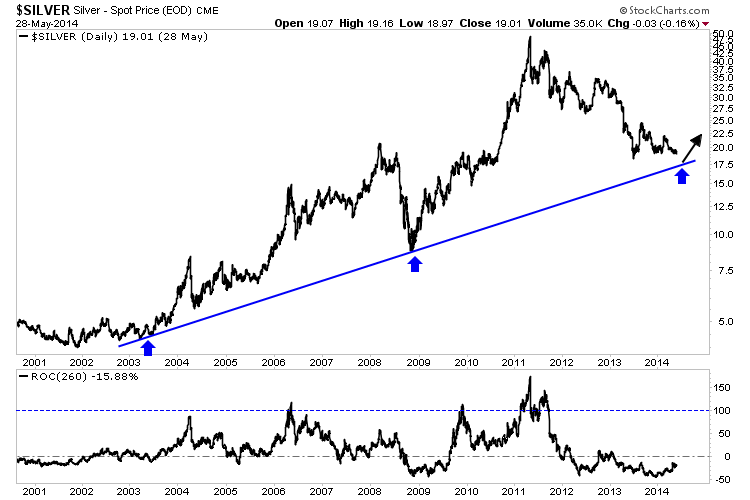

In addition, here is a chart we posted in late March when we discussed the coming opportunity in Silver. The chart shows an 11-year trendline marking what should be rock solid support at or slightly above $17. A final decline could touch the trendline and then begin a strong reversal.

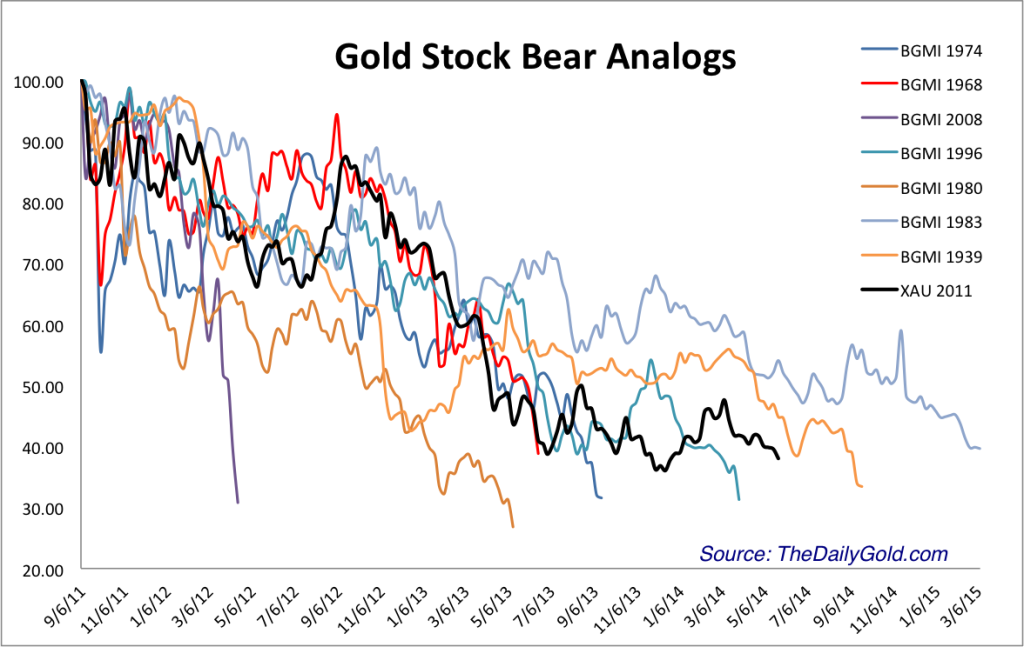

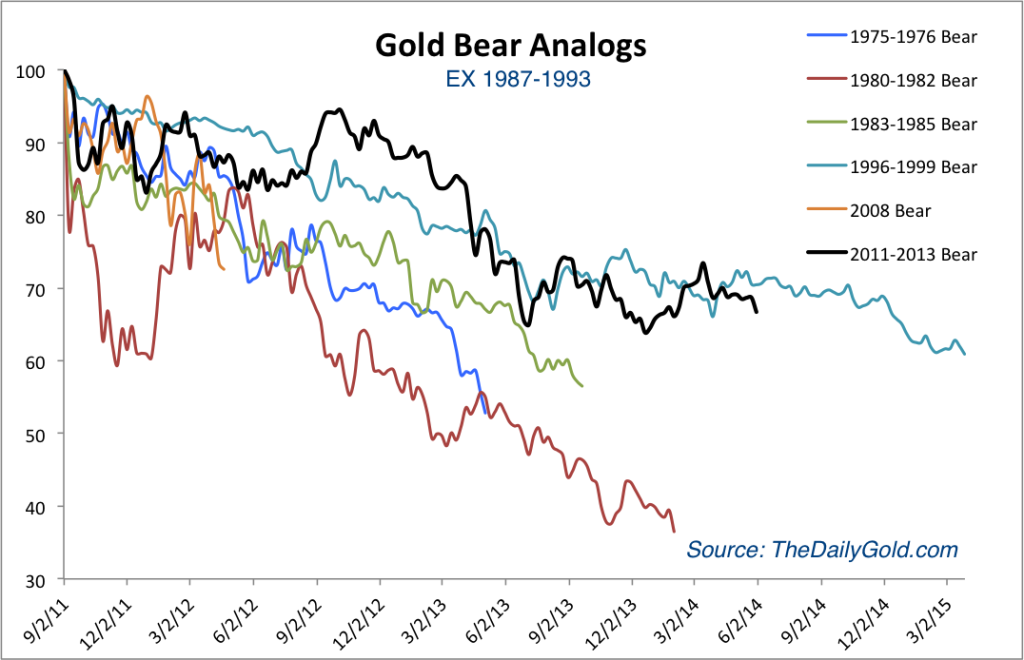

Gold’s bear market has been severe to this point but not when judged through the lens of history. The bear analogs below suggest Gold has more downside potential and could easily make a new low. If and when the weekly low of $1200 breaks, Gold could plunge to its bottom within a few weeks. Keep an eye on $1080, which is the 50% retracement of the entire bull market.

The potential decline in Gold sounds severe but consider the following. We already mentioned why Silver should bottom before Gold. Also, the gold stocks began topping in December 2010, well before Gold. Silver stocks and junior miners (NYSE:SIL), (ARCA:GDXJ), (NYSE:GLDX) peaked in April 2011. Although the large-cap miners (ARCA:GDX) peaked at the same time as Gold in summer 2011, the majority of the mining sector peaked months before. Hence, it would not be a surprise to see the mining stocks or some of the sector bottom before Gold.

History makes a strong argument that this leg down in the miners is the final leg down.

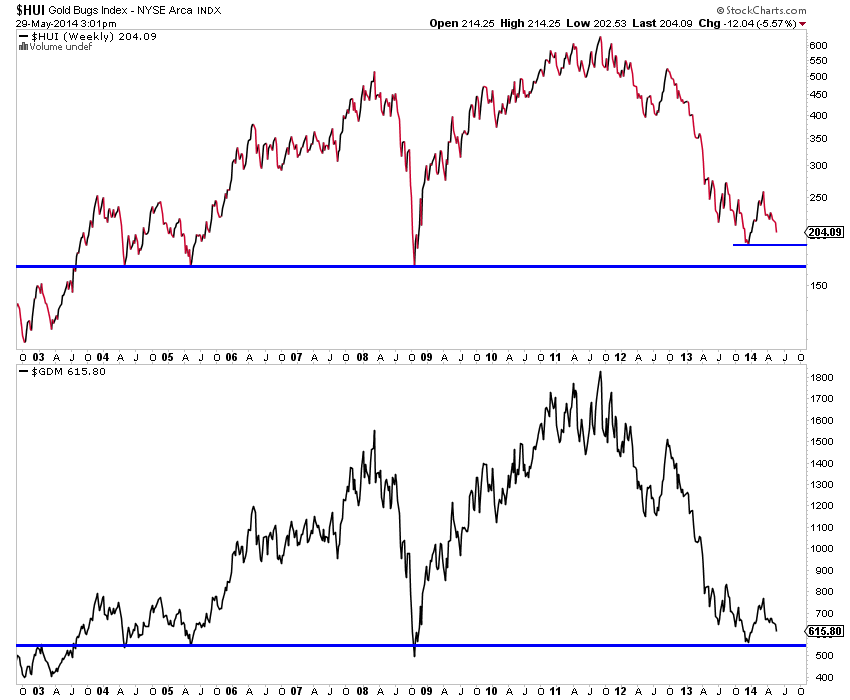

The bears analog chart argues that gold stocks could make a double bottom or perhaps a marginal new low. In my opinion, a new low would be a false new low. The next chart is a weekly plot of the HUI and GDM, the forerunner to GDX. The support (or buy) targets are quite clear.

Although gold stocks are rallying today, my work leads me to believe that there is more downside before a bottom. The good news is the sector is now much closer than it was a few weeks ago. Yet, patience and discipline will be the name of the game over the coming days and weeks. Discipline is required to exit hedges at the right time while patience is required to buy as low as possible. I am looking at JNUG (3x long GDXJ) as well as several juniors I believe have exceedingly strong upside potential over the coming quarters and years.

Good Luck!