The Pre-Holiday Effect Can Be Used As An Effective Trading Strategy Ahead Of The Most Festive Season Of The Year.

Two weeks before the Christmas holiday, the stock market has been fluctuating due to various market events before the end of the year. We have the Federal meeting on the way and the successive economic data of the largest economies in the world. Taking consideration of the possibilities in the market, traders would definitely have a hard time in predicting the future path of the stocks.

Theoretically speaking, there’s one strategy which has been used by most professional and experienced traders prior to a holiday. This strategy is collectively known as the “Pre-holiday effect.” This strategy has been traditionally used, whereas the stocks have been thought of surging days before a specific holiday. The behavior of the stock tends to be predicted and/or expected, thus, traders take advantage of this momentum.

Based on the in-depth observation, the market return before the holiday itself is bigger compared to the average return during and after the holiday. Psychologically, this scenario is only due to the optimistic outlook by most of the traders during the pre-holiday days. However, in the financial side, traders with short positions choose to close risky assets before the holiday.

There are also a few instances wherein the market does not make a significant movement. This happens when traders become extra careful and they decide to lower their exposure instead.

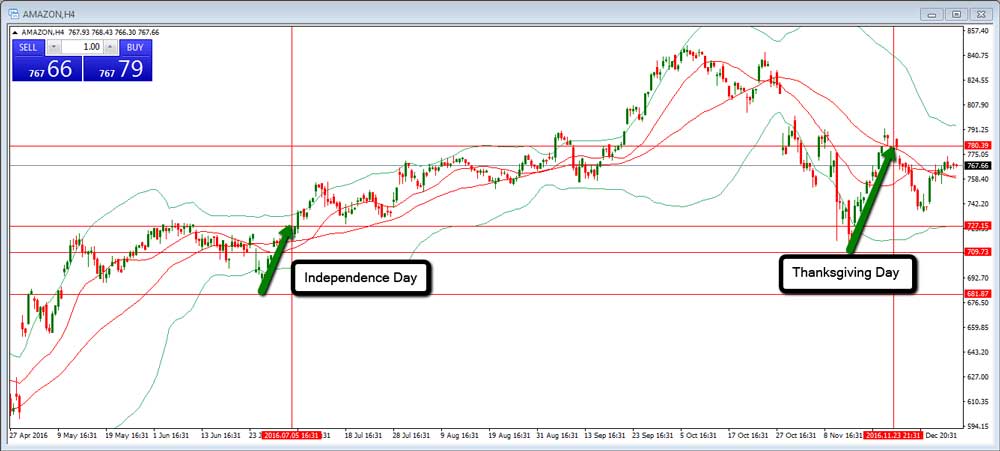

Let’s take a look of the movement of the following stocks before a specific holiday.

The first chart shows the stock movement of Apple (NASDAQ:AAPL). A few days before the Independence Day, the stock was down at 91.34. In the following sessions, the iPhone creator touched 96.10, advancing 4.76 points. Further, the stock was at 104.04 prior to the Thanksgiving Day. Apparently, it ticked higher at 111.33 before the market closed on November 23.

Amazon (NASDAQ:AMZN) stock had also similar trend. As the chart shows, Amazon was down at 681.87 ahead of the Independence Day. It managed to go up at 727.15 a day before the commencement of the holiday. Typically, the market is closed during this day – something to be considered. Before the Thanksgiving Day, Amazon fell at 709.73, but a recovery was seen eventually when the stock hit 780.39.

Lastly, Facebook (NASDAQ:FB) declined at 108.21 before July 4. The stock climbed to 114.43 before the market close on the Independence day. Since the market was close during Thanksgiving day, the prior closed of the social media provider at 120.96 was far from its recent plunge in 113.50, days before the holiday celebration.

Apart from the Independence and Thanksgiving Day, the market closely-watches the Election Day, Labor Day, Memorial Day, Christmas and New Year. (See how Walmart (NYSE:WMT) advanced during the Black Friday deals on Thanksgiving at FSM News Walmart Black Friday 2016: Great Deals)

The Pre-Holiday effect is also considered as a calendar anomaly in equities. In the book The Journal of Finance, it was written in its abstract that “On the trading day prior to holidays, stocks advance with disproportionate frequency and show high mean returns averaging nine to fourteen times the mean return for the remaining days of the year. Over one third of the total return accruing to the market portfolio over the 1963–1982 period was earned on the eight trading days which each year fall before holiday market closings. Examination of hourly pre-holiday stock returns reveals high returns throughout the day.”

On the other hand, under the Applied Financial Economics, it was concluded that even if these anomalies (security price anomalies or calendar effects) are persistent in their occurrence and magnitude, the cost of implementing any potential ‘trading rules’ may be prohibitive due to the illiquidity of the market and ‘round trip’ transaction costs.