Industrial gas producer and supplier, Praxair Inc. (NYSE:PX) announced that it has started operating a new air separation plant at Samsung Electronics (KS:005930) Co., Ltd’s (OTC:SSNLF) display manufacturing plant in Tangjeong, South Korea.

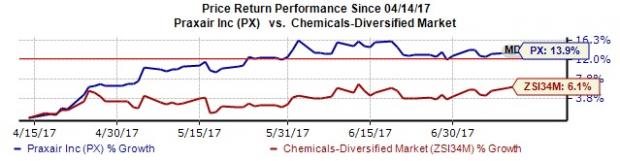

Over the last three months, shares of Praxair have yielded a return of 13.9%, outperforming the gain of 6.1% recorded by the Zacks categorized Chemicals diversified industry.

We believe that expansionary initiatives will help the company meet the growing preference of customers for its world-class products and services. Also, increasing application of industrial gases in manufacturing, transportation, healthcare, food & beverages, and metal fabrication industries will prove to be a boon for industrial gas producers.

Praxair’s New and Existing Businesses with Samsung

As revealed, the new plant is Praxair’s third of its kind at the Tangjeong site, supplying nitrogen to serve as a cooling agent in the manufacturing process of Organic Light Emitting Diodes (OLED) displays. The plant has a daily production capacity of 700 tons of nitrogen. We believe that increasing use of OLED displays, particularly in televisions, laptops, digital cameras and others, will bode well for the company’s businesses.

Praxair has been associated with Samsung for over 25 years, supplying the latter industrial gases like nitrogen, oxygen, argon, helium and other gases. In January, the company started operating a new air separation plant at Samsung’s Hwasung site in South Korea’s Gyeonggi Province. Also, it upgraded the pipeline system serving Samsung.

Zacks Rank & Stocks to Consider

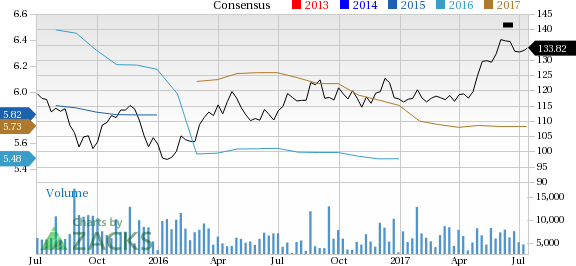

With a market capitalization of $38.2 billion, Praxair currently carries a Zacks Rank #4 (Sell). Despite solid long-term prospects, we believe that the company’s exposure to certain near-term headwinds, including unfavorable foreign currency movements, higher production costs, stiff competition, and high-debt levels will restrict its growth momentum in the near term.

Also, the stock’s earnings estimates have been lowered by two broker firms for 2017 and by one for 2018, in the last 60 days. Estimates are now pegged at $5.72 per share for 2017 and $6.25 for 2018, both representing 0.2% decrease from their respective tallies, 60 days ago.

Two better-ranked stocks in the chemical industry include Asahi Kasei Corporation (OTC:AHKSY) and Koninklijke DSM NV (OTC:RDSMY) . These stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Asahi Kasei’s earnings estimates for fiscal 2018 and fiscal 2019 have improved over the past 60 days.

Koninklijke DSM’s earnings are predicted to grow 7.7% in the next three to five years. Also, its estimates for 2017 and 2018 have been revised upward over the last 60 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Praxair, Inc. (PX): Free Stock Analysis Report

Asahi Kasei Corp. (AHKSY): Free Stock Analysis Report

Koninklijke DSM NV (RDSMY): Free Stock Analysis Report

Original post