PPG Industries (NYSE:PPG) and University of Michigan’s (U-M’s) Mcity have entered into a partnership for autonomous vehicle testing and research.

PPG Industries, Inc. (PPG): Free Stock Analysis Report

Methanex Corporation (MEOH): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Original post

PPG Industries is developing a broad portfolio of coatings technologies that is anticipated to increase functionality and enable broad deployment of autonomous vehicles. These include exterior coatings that enhance vehicle visibility to radar and light detection and ranging systems as well as easy-to-clean coatings that help in preventing obstruction of autonomous vehicle sensors.

The technologies will play an important role in the development of safe and reliable driverless vehicles and are scheduled to be showcased at the North American International Auto Show (NAIAS) during the Jan 14-20 at Cobo Center in Detroit.

Opened in 2015, the Mcity Test Facility was developed by U-M with support from the Michigan Department of Transportation. The facility aims to re-create a number of operating challenges faced by vehicles on the road with simulated urban and suburban environments. Also, Mcity funds academic research and works with its partners to deploy connected and automated vehicles in Ann Arbor and Southeast Michigan.

Mcity’s state-of-the-art facility will offer a controlled environment for PPG to develop specialized coatings and related technologies of autonomous vehicles that will play an integral role in the development of safe and reliable driverless vehicles.

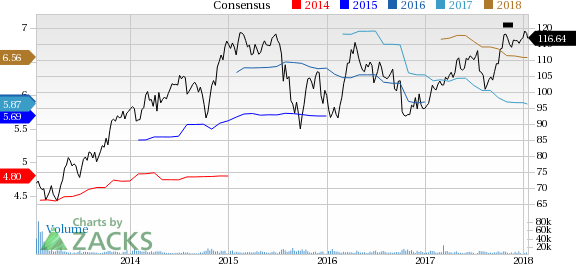

PPG Industries’ shares have gained 3.3% in the past six months, underperforming the industry’s 17.7% growth.

The company expects continued moderate economic growth, globally. Post the mayhem caused by the recent natural disasters PPG Industries does not anticipate any further decline in the level of raw material cost inflation.

Furthermore, it sees an additional selling price increase. Along with addressing the inflationary environment, the company remains on track with its restructuring program which is expected to deliver full-year 2017 savings of more than $45 million.

The company is also taking steps for growing organically as well as cut costs. It also remains committed to deploy cash on acquisitions and share repurchases.

However, PPG Industries is exposed to raw materials cost pressure. Moreover, lingering impacts of natural disasters may continue to affect sales volume and margins in the fourth quarter. PPG Industries expects natural disasters to adversely impact fourth-quarter earnings by up to 5 cents per share.

PPG Industries, Inc. Price and Consensus

PPG Industries, Inc. (PPG): Free Stock Analysis Report

Methanex Corporation (MEOH): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Original post