PPG Industries (NYSE:PPG) will be showcasing an entire range of integrated transportation coatings technologies during Intermodal Expo 2017. The event will be held at the Long Beach Convention Center, California from Sept 17-19.

These pre-treatment products are used for rail, trailer and intermodal applications. The products to be showcased include surface cleaners and zinc-rich and zirconium-based primers to maximize the ability of its liquid, e-coat and powder coatings. These products are known to resist corrosion and extend the service life of trucks, trailers and shipping containers.

PPG Industries will also exhibit Spectacron and Aquacron primers and topcoats available in a broad range of colors and in acrylic, alkyd, epoxy and urethane formulations. Additionally, information on Powercron e-coats and Envirocron powder coatings will also be made available at the expo.

Being the most commonly used e-coat products, Powercron coatings provide exceptional protection against corrosion and ultraviolet exposure for specialty frames and chassis-related components. Envirocron powder coatings being hard, durable and cost-effective provides exceptional corrosion and weather resistance in proven solvent-free, low volatile organic compound formulations.

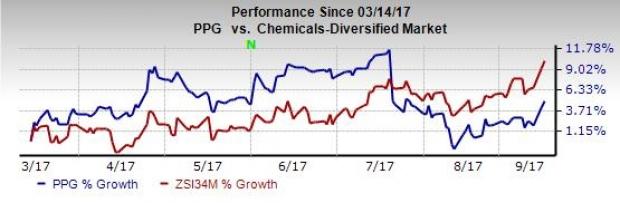

PPG Industries has underperformed the industry over the last six months. The company’s shares have moved up around 4.9% over this period, compared with roughly 10.2% gain recorded by the industry.

PPG Industries expects modest global economic growth. Also, the company anticipates a higher level of earnings-accretive cash deployment in the second half of 2017 including acquisitions and share repurchases. The company announced that it will resume share repurchases from the third quarter.

PPG Industries is taking steps for growing organically. The company is also taking measures to lower costs. The company also remains committed to deploy cash on acquisitions and share repurchases. It plans to deploy $2.5-$3.5 billion cash for acquisitions and share repurchases in 2017 and 2018 combined and is now targeting the top end of that range at a minimum.

However, PPG Industries faces currency headwinds and macroeconomic challenges. Some of its end-markets including marine still remain sluggish. It is also exposed to volatility in raw materials and energy costs.

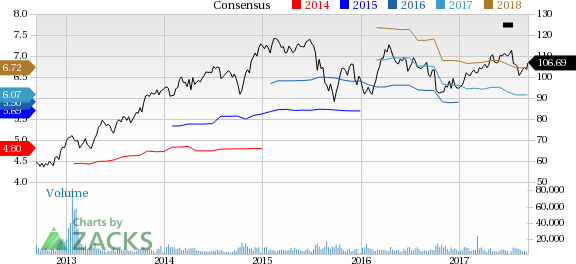

PPG Industries, Inc. Price and Consensus

PPG Industries currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the chemical space are Kronos Worldwide (NYSE:KRO) , Air Liquide (OTC:AIQUY) and BASF SE (OTC:BASFY) .

Kronos Worldwide has expected long-term earnings growth of 5% and sports a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Air Liquide has expected long-term earnings growth of 8.1% and carries a Zacks Rank #2 (Buy).

BASF has expected long-term earnings growth of 8.6% and carries a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

PPG Industries, Inc. (PPG): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

Air Liquide (AIQUY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Original post

Zacks Investment Research