Swiss francKathy Lien, Managing Director Of FX Strategy For BK Asset ManagementDaily FX Market Roundup July 9, 2019

In the next 24 hours, there are 3 major event risks that could change the course for currencies. The most significant will be Federal Reserve Chairman Powell’s testimony on the economy and monetary policy and then the Bank of Canada’s monetary policy announcement. Both of the events could amount to nothing but there’s also a high possibility of market moving new revelations.

For the U.S. dollar, everyone is looking at Fed Chairman Powell’s testimony for justification for the currency’s latest rally. The jobs report was better than expected but was it good enough to tip the scales for the Fed? Could they consider keeping rates unchanged this month or deliver no more than an insurance cut?

At their last monetary policy meeting, the central bank made it very clear that easing is data dependent. Since then, outside of the increase in hiring, the rest of the economy is weaker – the unemployment rate is up, wage growth is lower, home sales are mixed, confidence is down as manufacturing and service-sector activity slowed. However with the U.S. and China agreeing to restart trade talks, aggressive easing may not be needed.

Given the positive tone of the last Fed meetings and the amount of time since his last Congressional testimony, we believe Powell will spend a good portion of his time on Capitol Hill explaining why the central bank believes that the case for a rate cut increased significantly over the past few months. If the Fed Chair focuses on the risks ahead and spends a large part of his testimony reviewing the slowdown in the economy, we could see USD/JPY u-turn and fall back below 107.50. EUR/USD could squeeze back above 1.13 but the biggest gains should be in the Swiss franc and New Zealand dollar. However if his testimony is laced with optimism, we should see a much stronger rally in the U.S. dollar. The FOMC minutes will most likely be dovish and it will be ignored if Powell is optimistic but exacerbate a negative reaction in the dollar.

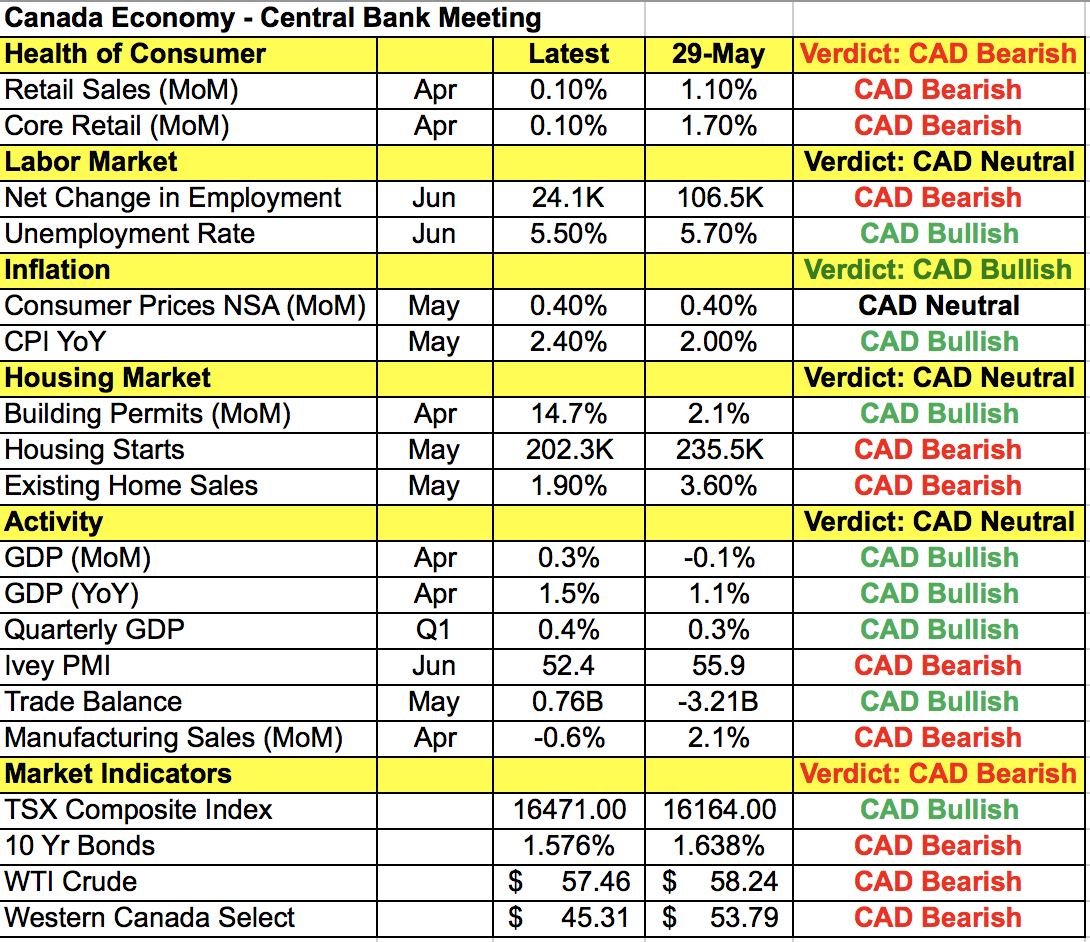

As for the Bank of Canada, they are the last man standing and everyone is wondering if the central bank will finally turn dovish. When they met back in May, the Canadians put on a brave face and described their recent slowdown as temporary. Since then we have seen the first signs of weakness in Canada’s economy but it is too early to tell whether this is a slowdown or normalization. Retail sales barely grew in April but that was after very strong spending in March. Jobs were lost in June but May was a record-breaking month for the labor market and wage growth accelerated. As these are tentative signs of slowing, we think the Bank of Canada may want more evidence before turning dovish. So if they maintain their positive outlook and say the recent data misses are temporary, USD/CAD will resume its slide toward fresh 1.5-year lows. However if the tone of their monetary policy statement is more cautious, we could see the beginnings of a longer term bottom in USD/CAD.