Market Review and Update

Last week, we stated:

“With valuations still extended, the recent correction didn’t reduce speculative fervor. Furthermore, prices remain well deviated above long-term means, particularly in the small and mid-cap space.

While more stimulus will likely support prices over the next few weeks, the threat of rising inflation and interest rates could undermine growth expectations.”

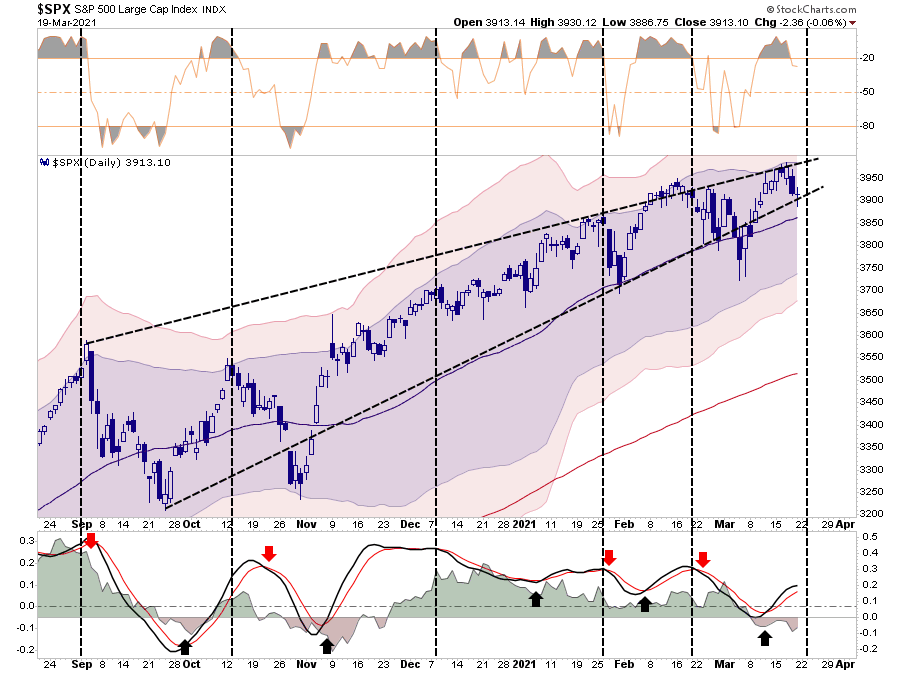

Over the past week, the market didn’t make a lot of headway, as price rises were limited while intraday dips got repeatedly bought. Such is what we would expect with the “money flow” indicators we have discussed over the last several weeks back on “buy signals.” (Importantly, note that Friday’s early morning decline held the uptrend line from the October lows.)

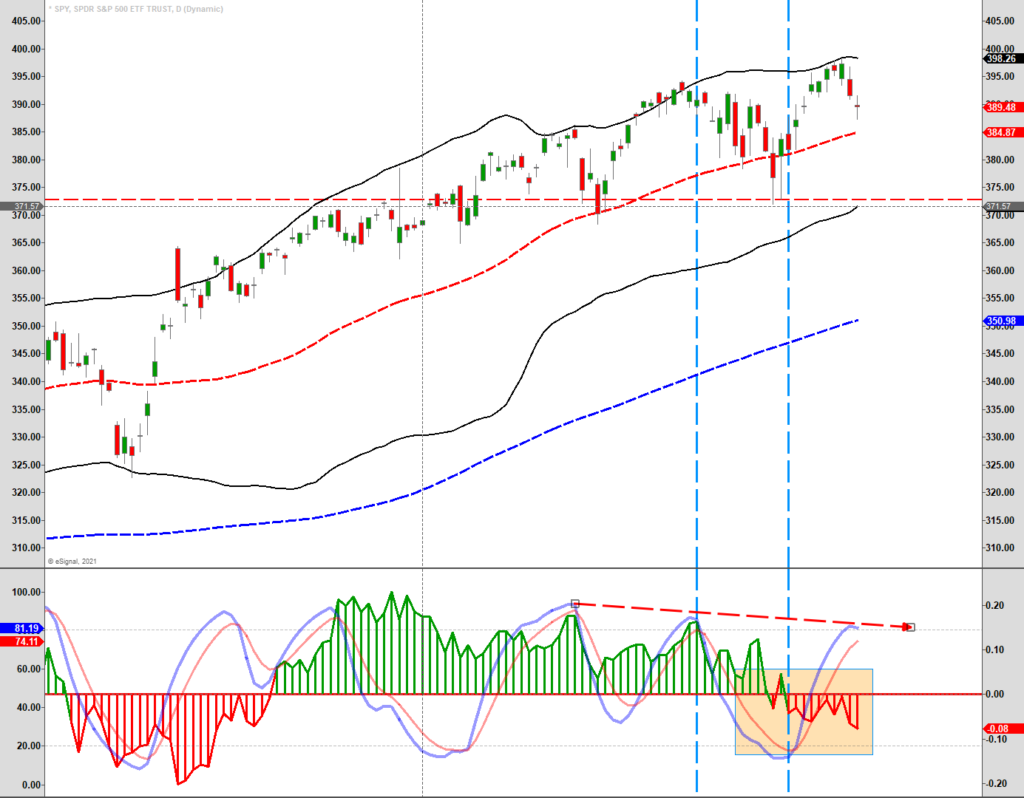

However, while overall market action remains bullish, there are two concerning points shown in the chart below. The highlighted box shows money flows remain negative currently. As stated previously, such suggests rallies may stay limited for now. The second is the negative divergence of the actual index (red dashed line) which also confirms the weakness of the underlying “buying.”

With our indicators still on “buy signals” across the board, the bias of prices near term is to the upside. However, with the oscillator now pushing into the upper zones, and starting to roll over, with the market overbought, further price increases will become more challenging.

We suggest using rallies over the next week or so to raise cash and reduce risk.

Rate Surge

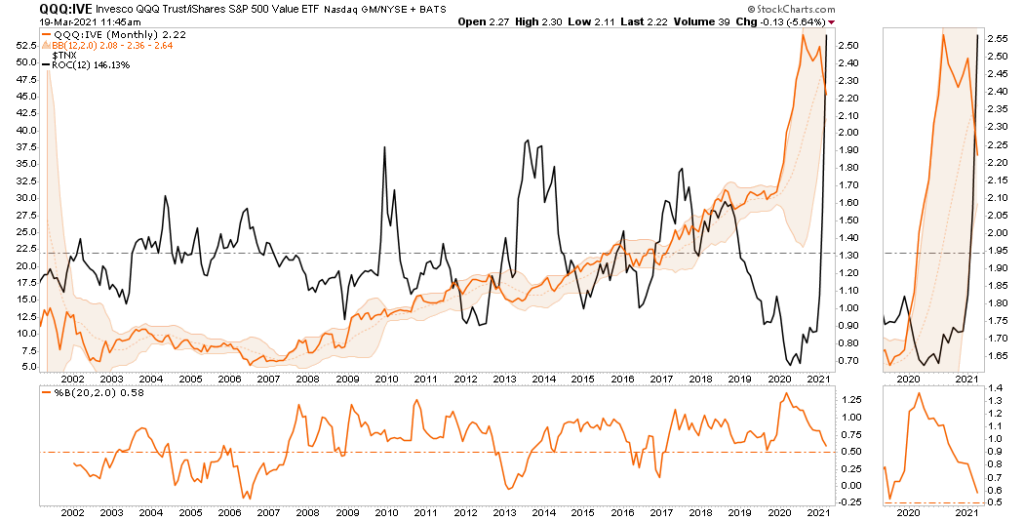

Another more critical concern remains interest rates. The recent surge in rates has caused problems over the “growth” trade. As shown, the annual rate of change in rates has surged by 146% in recent months. That spike is unprecedented over the last 20-years but is a function of rates hitting 0.50% during the pandemic.

However, the recent underperformance of Invesco QQQ Trust (NASDAQ:QQQ) versus iShares S&P 500 Value ETF (NYSE:IVE) is also unusual from a historical perspective. Previously, during swings higher in rates, the QQQ’s outperform IVE as investors sought companies that could generate earnings and had lower leverage.

Given the massive debt load corporations are carrying currently, combined with an inability to pass along higher input costs, I suspect we will see a rotation back towards growth. Such is particularly the case with companies already struggling with thin margins (especially in the small and mid-cap space.)

We suspect we may see a rotation from “value” (via SLYV) back to “growth” sooner than later given the massive overbought conditions of the “value trade.”

For now, we are primarily maintaining our core positions. However, we did recently take profits in the highly overbought energy and financial positioning. We are starting to seriously look at further increasing our “growth” side of the portfolio during the next correction.

Powell Says No Rate Hikes

On Wednesday, Jerome Powell announced the latest changes to monetary policy. Instead, it was the lack of changes to the policy that was the most interesting.

“The U.S. economy is heading for its strongest growth in nearly 40 years, the Federal Reserve said on Wednesday, and central bank policymakers are pledging to keep their foot on the gas despite an expected surge of inflation.” – Reuters

In other words, despite the Fed’s mandate of maximum employment and price stability, the Fed is opting to let things run “hot” for quite some time to ensure that growth is “sticky.”

That stance makes some sense, given the economy still requires massive liquidity support more than a decade after the financial crisis. As I discussed previously in “Forever Stimulus:”

“They are increasingly on what I call a no-exit paradigm.

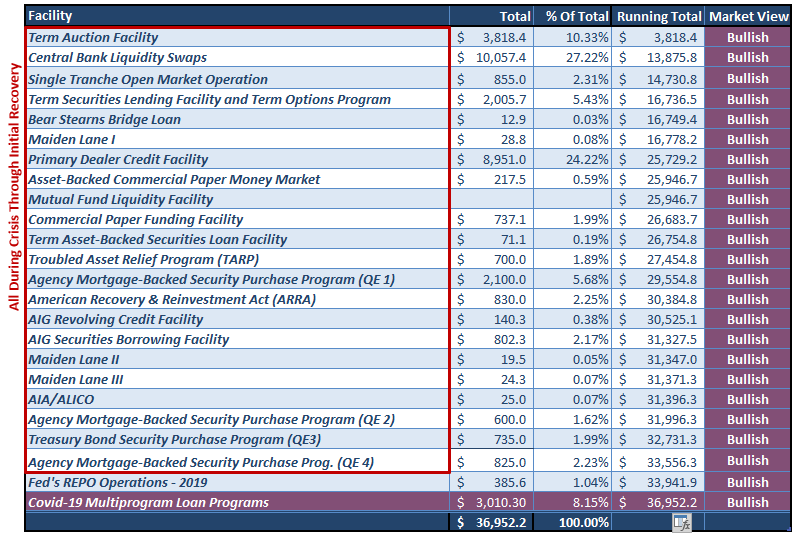

To understand the problem, we have to go back to the beginning. As we noted in our article on financial rescues, the bailouts and stimulus programs started in 2008 when the Federal Reserve intervened with the insolvency of Bear Stearns. They haven’t stopped since.”

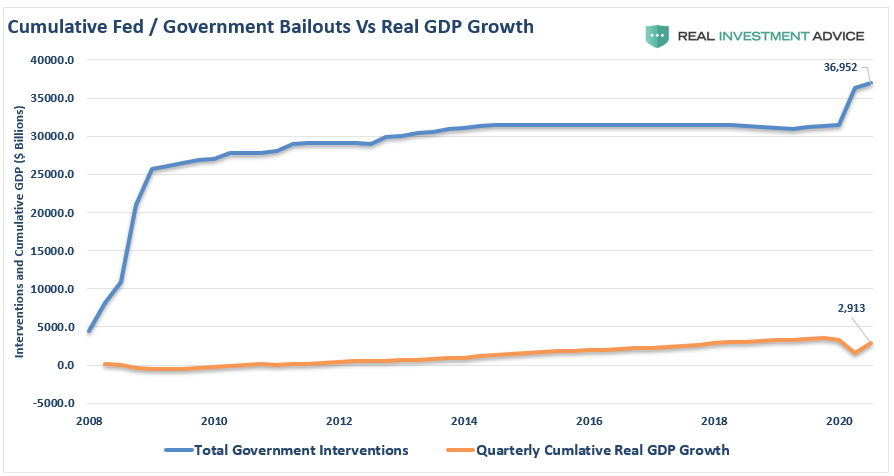

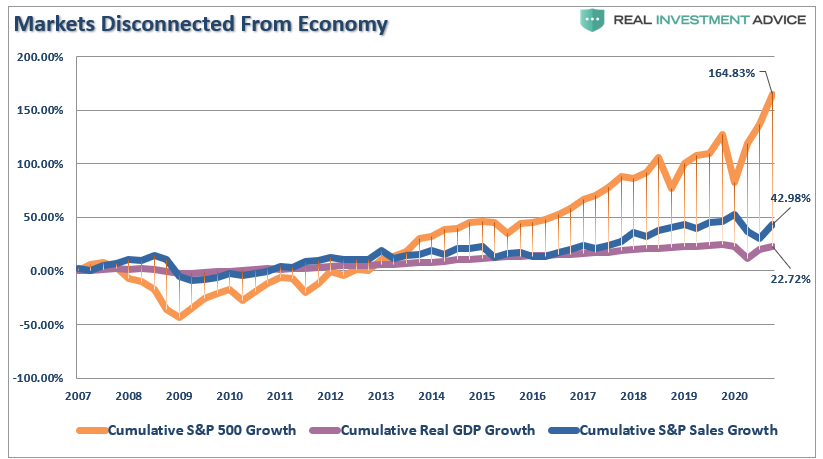

“To date, the Federal Reserve, and the Government, have pumped more than $36 Trillion into the economy. As shown below, the amount of economic growth achieved has been minimal during that same time frame. (The chart is the cumulative growth of interventions compared to the incremental increase in GDP.)”

“What this equates to is more than $12 of liquidity for each $1 of economic growth.”

Not Won’t, But Rather Can’t

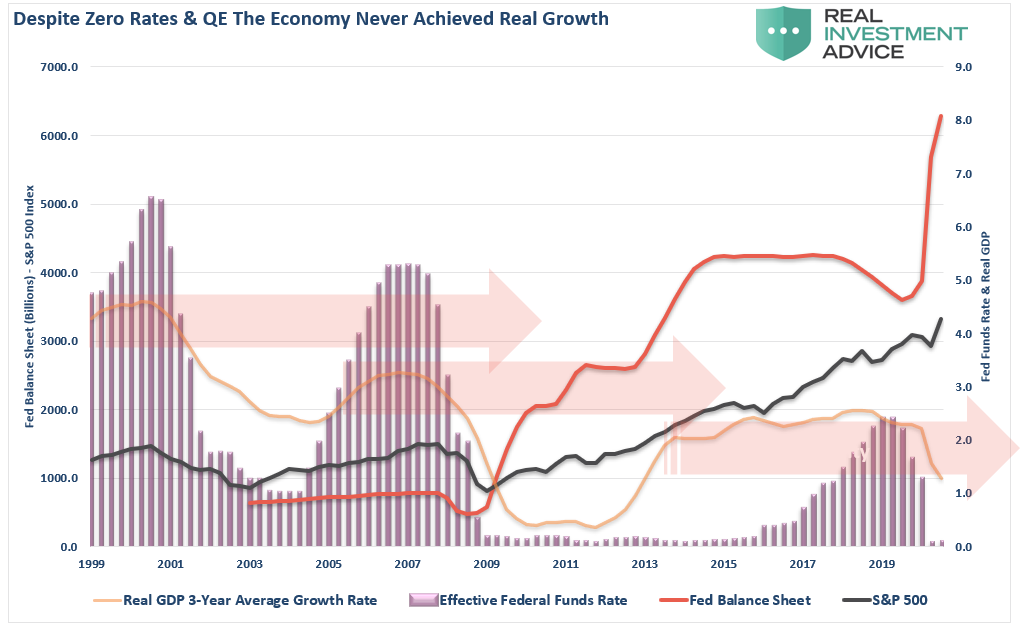

The Federal Reserve stumbled into a trap where continual interventions are required to sustain lower economic growth rates. Whenever the Fed withdraws interventions, economic growth collapses.

Such is why the applause by the media that Powell “won’t” raise rates is “silly.” The Fed had “no choice” but to keep rates unchanged and continue buying $120 billion a month in bonds. Any other choice would have been a disaster.

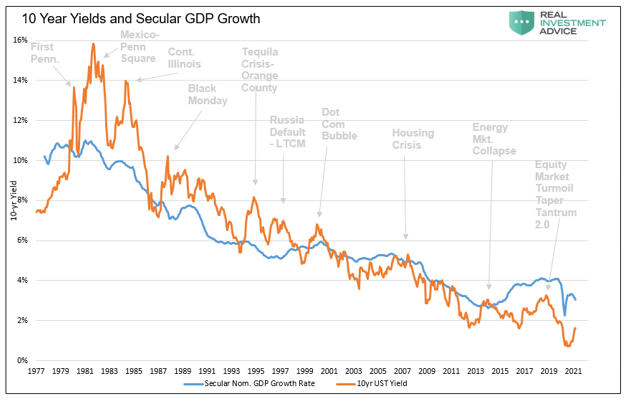

History also shows why the Fed is trapped. Since the turn of the century, each economic cycle has failed to attain a higher growth rate than previously. The Federal Reserve lowers interest rates to stimulate growth without much return on the capital spent. However, after reaching the “zero bound,” lower rates alone were ineffective, forcing the Fed into liquidity measures.

The problem now is that even if they wanted to increase rates and slow bond purchases, they can’t. Therefore, their only option is to “hope” that inflation will rise without getting out of control.

I suspect the result will not be great.

An Economic Coma

“We stand at a monetary crossroads as we continue to double down and embark on monetary policy that is detrimental to society and to our financial markets.

Yesterday, current Fed Chair Powell, like former Fed Chair Bernanke exhibited that he is out of touch and that he lives in a bubble that he has helped to create.” – Doug Kass

The mainstream media missed another crucial point while tripping over each other to fawn over Powell’s statement. It also underscores our comment about why growth will remain elusive.

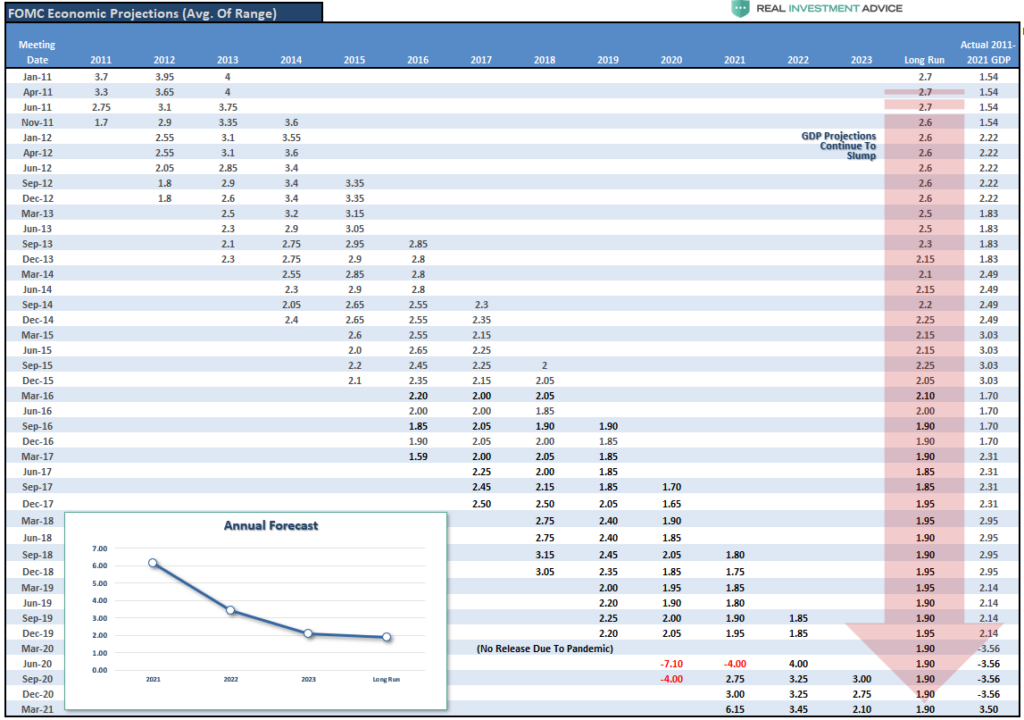

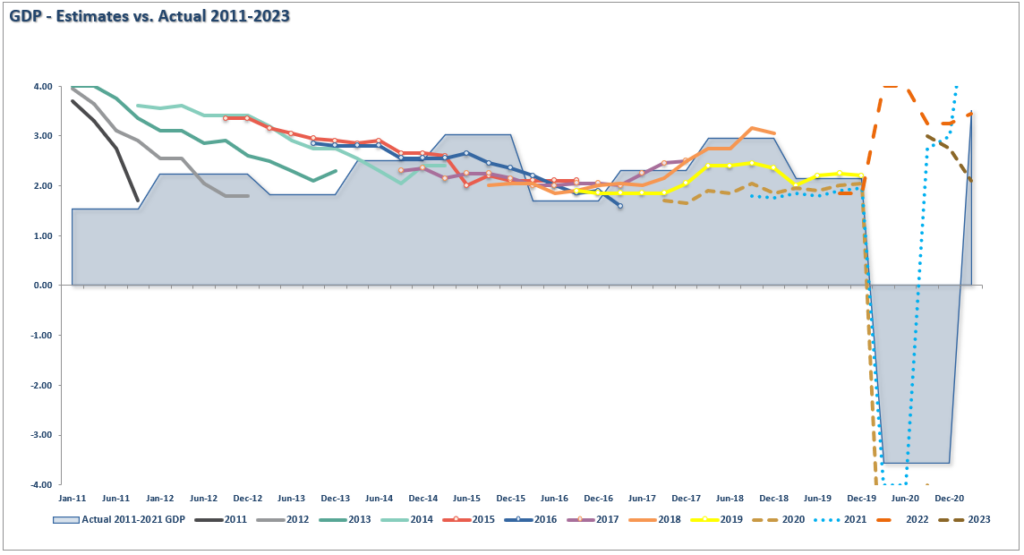

In the short-term, yes, there will be a surge in economic growth. However, as the table of the average of the Fed’s projections shows, after a short-term bump of activity, the economy will quickly slip back into its “coma” from the last decade.

The chart below shows that the Fed tends to be overly optimistic in its assumptions in almost all cases. The actual real GDP growth rate disappoints more often than not.

The point here is that despite protestations from the financial media, monetary policy does not create or sustain economic growth or employment. All monetary policy does is drag forward future consumption.

Growth, as a result, is primarily an illusion.

(From the peak in 2007 through year-end 2020, the S&P rose 165%, actual revenue increased by only 43%, while economic growth struggled to rise a cumulative 23%.)

While the Fed hopes they can sustain inflation above 2% for 3-years, I think the Fed realizes deflation remains a more significant threat. (here)

The Rate Trap

I want to be very clear.

In the short-term, we will see rising inflationary pressures and economic activity from the massive amount of liquidity flooding into the economy.

However, longer-term, it is all deflationary. My partner Michael Lebowitz made an important observation on Wednesday in “The Next Crisis:”

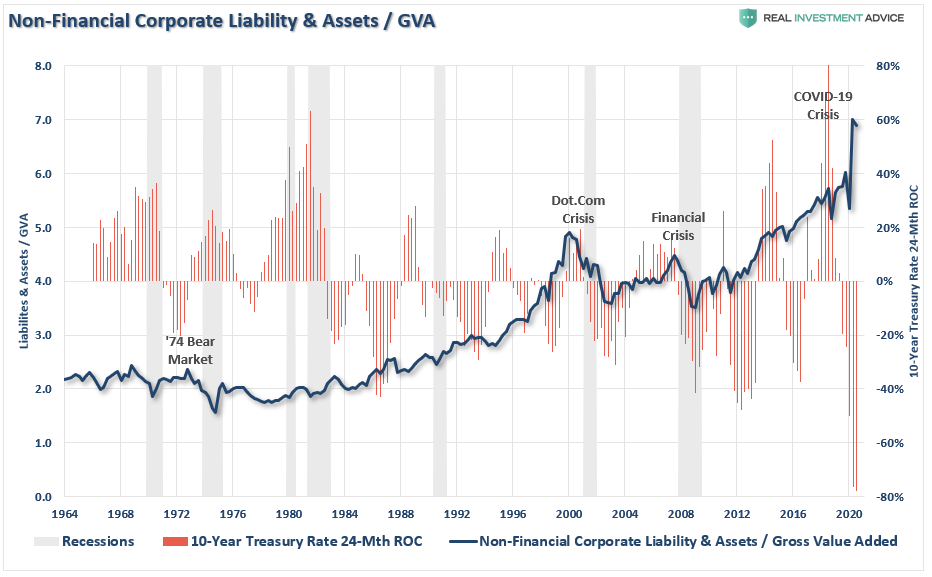

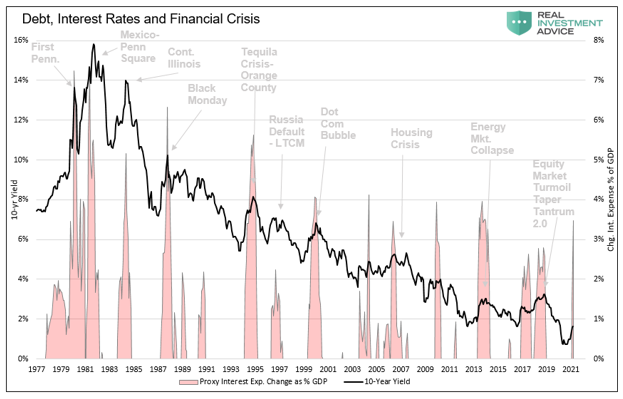

“Looking back over the last 40 years reveals a troubling problem. Every time interest rates reach the upper end of its downward trend, a financial crisis of sorts occurred.”

“Given crises frequently occur when rates rise sharply, we should contemplate how high rates can rise before the next crisis. Notice, as time goes on it takes less and less of a rate increase to generate a problem. The reason, as highlighted earlier, is the growth of debt outpaces the ability to pay for it.

The current one-year change in the proxy interest expense is up 3.50% from a year ago. As shown, the last two significant crises (2000 and 2008), along with a few minor ones, all happened when the proxy rose between three and four percent.

If 10-year UST yields increase to 2.0% (currently 1.60%) by May, the proxy will increase to 5.25%, well above the 4.0% that popped the dot com and housing bubbles.”

The Fed’s problem is that while they may not be hiking rates, the bond market is doing it for them. Given the Fed’s actions are what causes rates to rise, by shifting risk preference, the result is a deflationary crash requiring more interventions and lower rates.

Wash. Rinse. Repeat.

I am going to leave you with one question:

“If monetary policy does create economic growth, inflation and sustainable employment, then why, after more than a decade, is the Fed still having to support the financial markets?”

Portfolio Update

The market continued to fluctuate this past week, as recent highs remain a challenge to hold onto. While over the last two weeks, we repeated steps to rebalance portfolio risk, portfolios continued to remain under pressure on the “growth” side.

We continued to take profits earlier this week by reducing our energy and financial names a bit to take profits. Such increased our overweight cash position slightly. Even though we are very short in the duration of our bond holdings, the sharp rise in yields this week pressured that side of the portfolio.

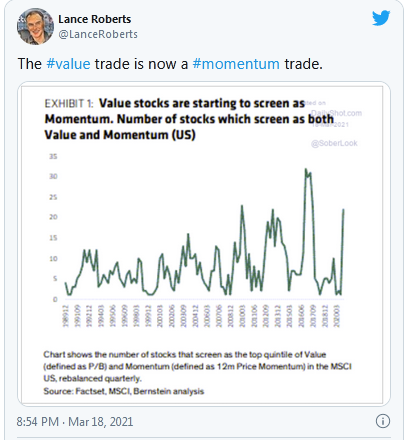

As noted in our market update, we are more than 2/3rds of the way through the current rally cycle, which increases downside risk as we head into April. The rise in yields, and ultimately the dollar, remains the key to the current market cycle. With the “value trade” excessively overbought and has become the recent “momentum” trade, we may see a relatively rapid rotation back into recently beaten-up sectors.

The #value trade is now a #momentum trade.

— Lance Roberts (@LanceRoberts) March 18, 2021

We believe the Fed is once again making a policy-mistake that will cost investors dearly. However, such will take time to play out, so investors will dismiss the warning short-term as “it’s different this time.”

They don't ring a bell at the top. Instead they put a sideshow barker on every street corner touting the ten-headed lady they've got inside the tent.

If you listen closely, you can almost hear "Step right up and behold the most amazing, the most extraordinary opportunity ever."

— Peter Atwater (@Peter_Atwater) March 17, 2021

I suspect it won’t be.