The pound traded lower throughout the week thanks to a surge in the USD on the uncertainty in global markets. There were some mixed results from a UK economic point of view which didn't help. A positive result in the UK Services PMI at the end of last week could provide support for the pound this week, especially as we hit the bottom of a rising wedge pattern on the chart.

Greece is having an effect across the board as investors exit anything with risk and head towards the US dollar. The pound was sold off during the week thanks to the demand for the dollar and some mixed economic signals out of the UK.

House prices fell -0.2% m/m in a sign that the London housing market could be cooling. The current account returned a disappointing -£26.5b and both the Manufacturing and Construction PMIs were weaker. Good news was found in the GDP q/q result which lifted from 0.3% to 0.4% and the Services PMI which rose from 56.5 to 58.5.

The week ahead will likely see the positive services PMI result provide support while the market awaits the Manufacturing Production result due Tuesday. Thursday will see the Bank of England meet to set rates which are expected to be held at 0.5%. Their statement on the economy will be interesting.

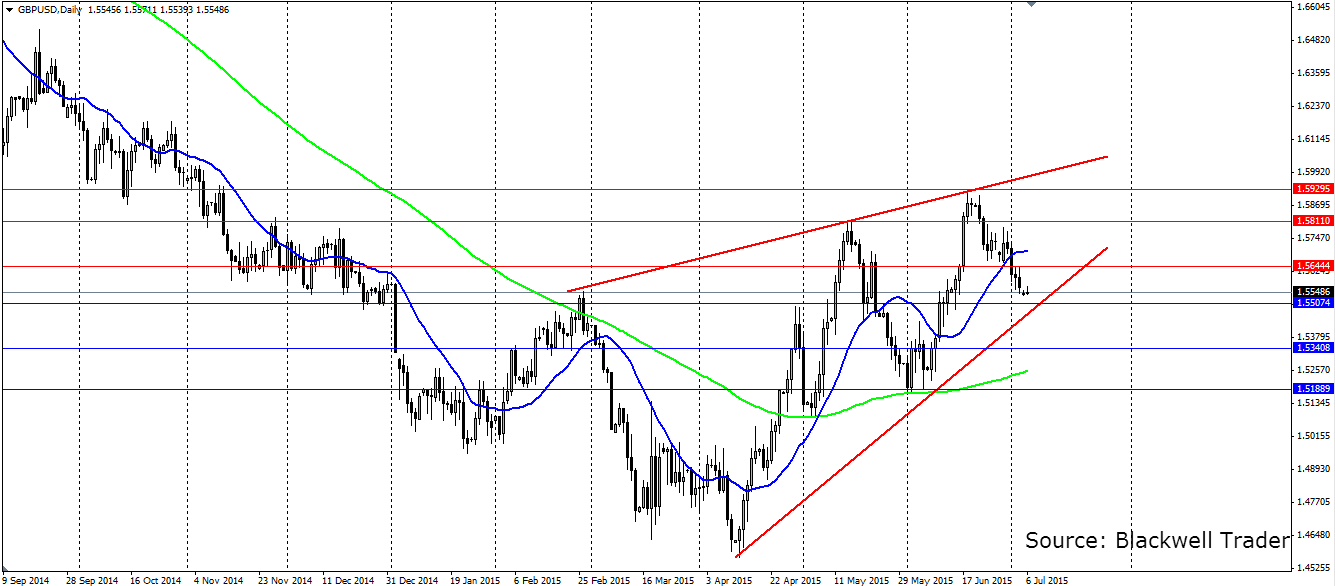

From a technical perspective, the rising wedge seen on the daily chart is straight out of a text book. The pair is almost at the bottom of the shape where it will likely find support and create another wave upwards. Watch for the patter to eventually result in a bearish breakout, but that could be some time away. Support can be found at 1.5507, 1.5340 and 1.5188 while resistance is found at 1.5644, 1.5811 and 1.5929