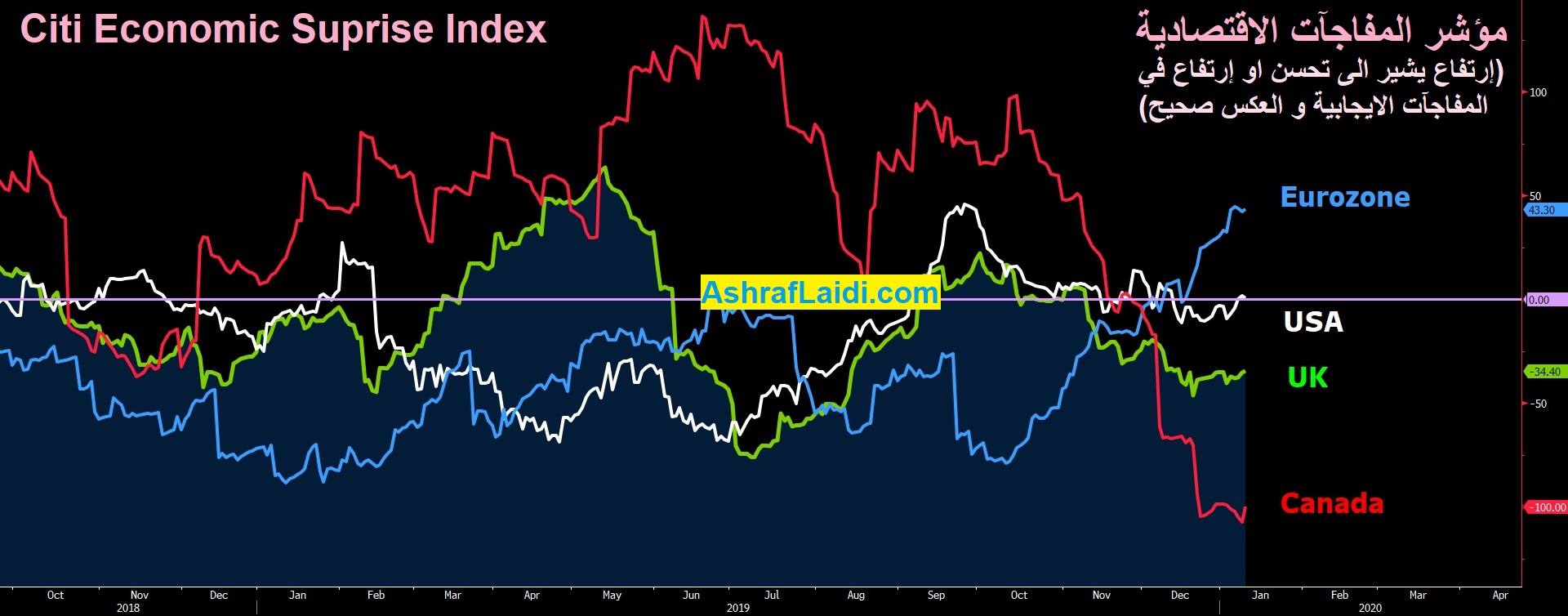

The BOE's monetary policy committee member Gertjan Vlieghe made a surprisingly explicit call for a rate cut on Sunday as policymakers lose patience waiting for economic resurgence. NZD and AUD are the leaders on Monday while GBP lags. CFTC data showed futures traders shifting out of US dollar longs. Below is Citi's economic surprise index, highlighting a contrasting performance between the Eurozone and Canada. A new Premium trade supported by 6 charts, was posted on Friday.

BOE external member Vlieghe said over the weekend the next few MPC meetings are absolutely live and that he “really needs to see an imminent and significant improvement in the UK data” or he is going to vote for a cut. The most-recent vote was 7-2 in favor of holding rates steady, as Haskel and Saunders came off the sidelines in favor of a cut. Now Vlieghe says he would join them.

The comments also put a heavy emphasis on a busy UK data calendar this week that began today with disappointing industrial production, before turning to CPI and retail sales later in the week.

On Friday, both US non-farm payrolls and the wage data in the report were soft. That led to some modest dollar selling and gold strength. Note the yield curve as well as falling long-end yields have pushed the 2/10-year spread down 10 basis points since the start of the year to 25 bps.

In contrast, Canadian employment rose 35.2K in December compared to 25.0K expected to cap the best year for jobs in the country since 2007. However, the initial loonie rally stumbled in part because of wage growth at 3.8% compared to 4.2% expected. Some risk aversion also crept in late in the day Friday.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -61K vs -74K prior GBP +17K vs +12K prior JPY -12K vs -25K prior CHF -4K vs -6K prior CAD +26K vs +12K prior AUD -27K vs -38K prior NZD -1K vs -5K prior

The theme in all these changes is fading conviction in US dollar longs. That's been a great trade for most of the past decade but there are new questions with the turn of the calendar in an election year.