I trust Slopers had a safe and enjoyable Independence Day. My family watched about seven different shows from our lofty air-conditioned perch, while I played Sousa music through a laptop. It isn’t exactly like being there, but it’s awfully close.

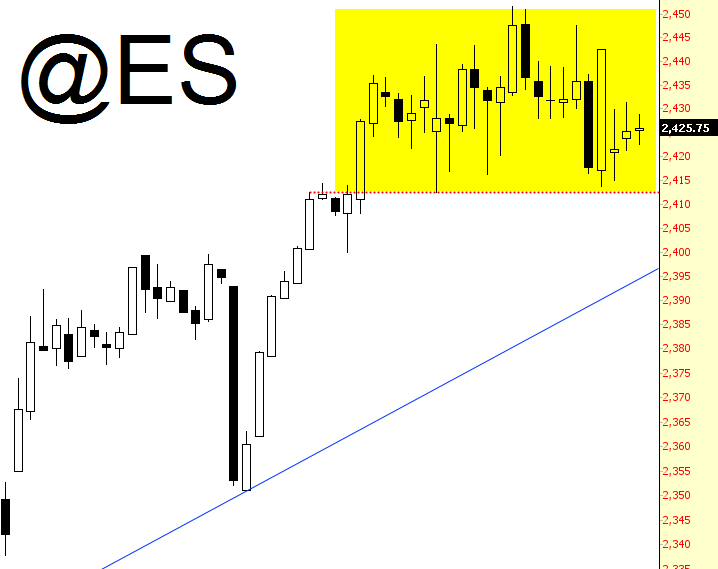

Looking at the markets this pre-market, the ES is doing a whole lot of nothing. I’ve tinted out what I’m hoping is a decent top, with 2412 being a key failure point.

Crude oil, my nemesis for the past couple of weeks, is showing some weakness. I am trying to caution myself against shorting like crazy in the energy sector, since I don’t want to do so based on merely the slightly sign of weakness. As I’ve pointed out before, the longevity of prior counter-trend bounces has been around 13-14 days, and that puts us into next Monday, at least. So I’m going to try to control myself.

The NASDAQ had a wild ride over the holiday, but at the moment, it’s actually showing signs of life. I’m holding on to my ProShares UltraShort QQQ (NYSE:QID), however, with an eye toward this being a more meaningful top.

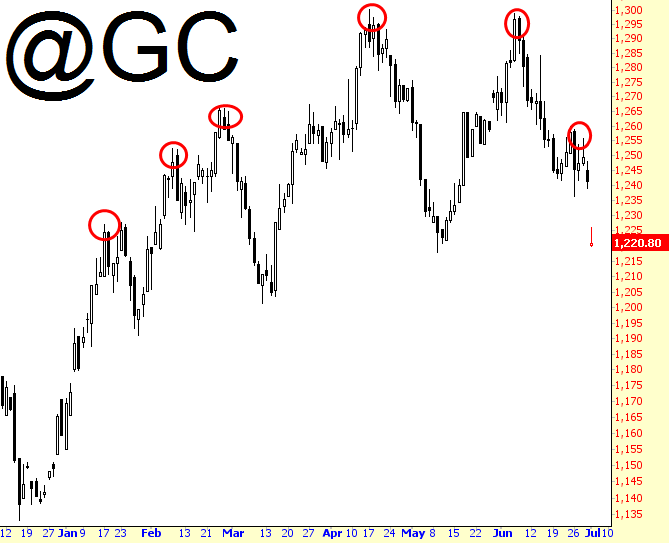

Lastly, gold – – – as we all know, gold has three principal functions (a) a store of value (b) a highly-malleable metal for industry (c) helping people lose money for the past six years. It’s performing its third function particularly well lately, and my ETF position Direxion Daily Junior Gold Miners Bear 3X Shares (NYSE:JDST) I also intend to retain.