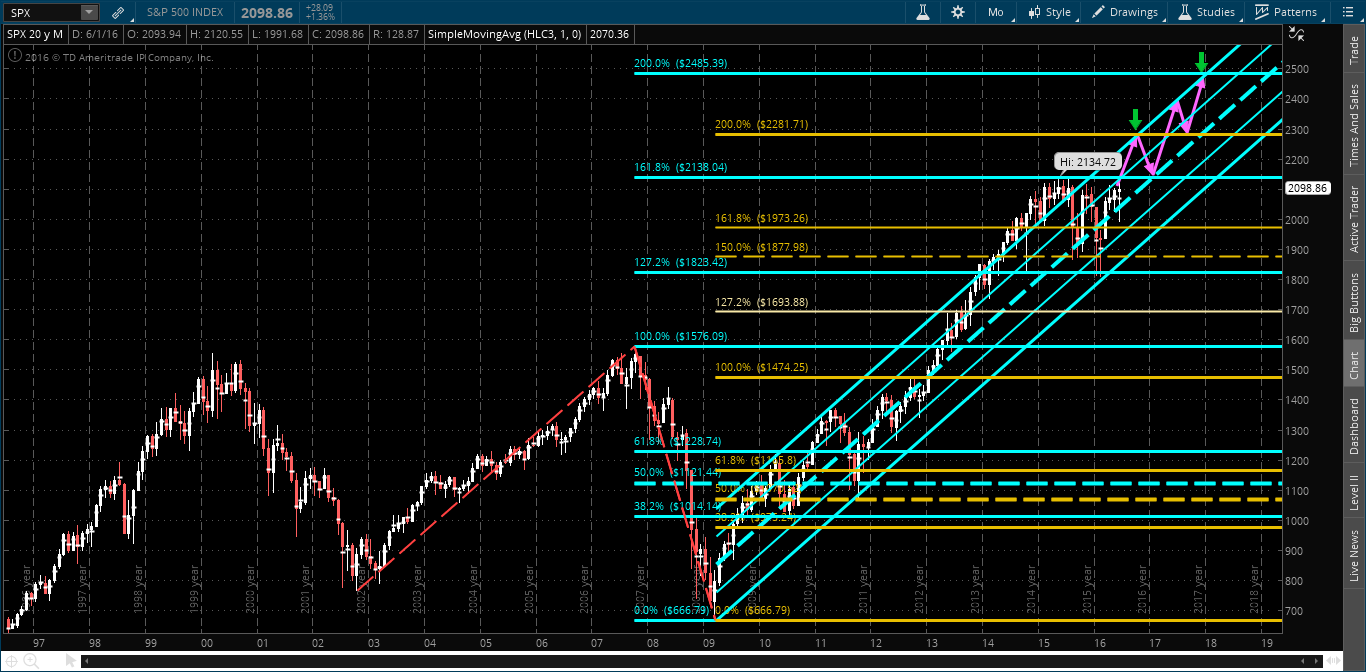

Each candle on the SPX chart below represents 1/4 of one year.

Further to my post of June 27th, and, as shown on the following updated 20-year quarterly chart of the SPX, the 2016 Q2 candle closed today at a higher level than -- on what was a previously potential bearish hanging man -- the Q1 candle. This bearish reversal warning was not confirmed.

Instead, what we're left with, at the moment, is a wide-range high-base consolidation for the past 6 quarters, with price now near all-time highs.

As shown on the following 20-year monthly chart of the SPX, a solid breakout and hold to the upside of this large range could produce a rally to a confluence of the top of a long-term channel and a 200% Fibonacci Extension level of 2280 (yellow) by roughly October of this year, and, eventually, another confluence of the channel top and a 200% External Fibonacci level of 2485 (blue) by approximately December 2017.

That's a very bullish scenario and one that may take quite a bit longer to play out, with, possibly, a lot more volatility sprinkled into the mix than what I've shown...anything can happen between now and then, but the potential is there, nonetheless.