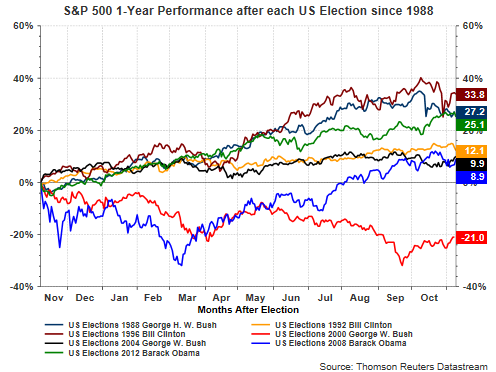

Absent an election year, equity markets generally trend higher until the seasonally weak September/October months. However, during an election year, equity market weakness tends to occur during the summer months and subside as the November election draws near. Historically, markets then rally into year-end. The market has followed this pattern so far this election year. As the below chart shows, when reviewing each November election dating back to 1988, the S&P 500 Index’s performance for the following 1-year is positive 7 out of 8 times. The only negative period was during the bursting of the tech bubble in 2001.

This election year certainly seems to be a very polarizing one. The newly elected President will need to tackle many policy issues: foreign policy, foreign trade, U.S. deficits, student loans, health care, global terrorism and defense, immigration, individual and corporate tax reform, just to name a few issues.

We would, however, reiterate what we wrote in our Spring 2016 Investor Letter. We believe a President can exert significant influence over a specific industry (the Obama presidency and the impact on health care and coal), but, he/she has limited influence on the overall direction of the broader market. So as election day draws closer, the uncertainty of the outcome will clear; thus, potentially, paving the way for higher equity prices into next year.