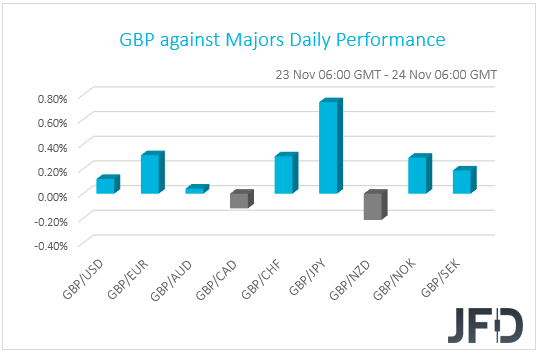

Yesterday, the British pound picked up some buying interest, which allowed it to rise against its major counterparts. Positive Brexit headlines hit the wires yesterday, which sparked a bit of hope in everyone’s eyes that a Brexit deal could be reached soon. However, still, not all is that clear as it seems.

GBP Got Attention From Buyers

Monday kicked off quite well for the British pound, as reports started coming in with positive developments in the Brexit talks. Ireland’s Prime Minister Michael Martin expressed hopes that a deal between EU and UK could still be done. Even if they start running out of time, the two sides might try to implement a “temporary deal”. Michel Barnier also came out with a note, saying that fundamental differences remain, but they are working hard to reach a consensus. GBP traders took a huge liking of the positive news headlines, giving a good boost to the British currency against its major counterparts.

However, the rally didn’t last for too long. Although GBP remained stronger than most of its major counterparts, it wiped out all of its gains against USD, which spiked higher after a few hours from the US opening bell. Most likely that the sentiment of the pound-traders changed, after they started digesting those initial positive Brexit headlines. Despite some positive remarks by the Irish PM, he still urged small and medium-sized businesses to prepare for difficulties, even if some sort of a deal between the two disputing parties is achieved. Although we had received news that around 95% of the deal is complete, it misses out important subjects like fishing, governance and dispute resolution. This means that if they continue to fail agree on those topics, this “95%-agreement” could just be seen as a possible extension again.

The Brexit transition period is set to run out on Dec. 31, 2020. At the moment, apart from trying to come to an agreement with the EU, Britain is also “shopping” around the world for deals with non-EU countries. Countries like India, Ukraine, the US, Canada and Japan are among those potential candidates. However, with Japan and Canada, the UK managed to sign major deals at the end of last week.

On Friday, Japan and UK signed an agreement of free trade, which will make English-made produce, such as sparkling wine, cheese, pork, biscuits and apparel cheaper and more affordable for the Japanese consumer. On Saturday, Canada and UK also signed an agreement, which guarantees continuity of trade after the UK’s transition period ends. The agreement is believed to be worth around £20 bln, whereas the new UK-Japan agreement is expected to increase to around £44 bln. Let’s remind our readers that EU-UK total trade equates to roughly around £614 bln.

For now, the British pound could remain in the spotlight, as Brexit talks have started appearing in the headlines again. This means that one should stay cautious, as economic data might not be a cause for sharp movement of GBP against other major currencies.

Yesterday, UK delivered its preliminary PMI figures for the month of November. The composite and manufacturing readings came out better than expected. The composite PMI showed up at 47.4 against the 42.5 expected. However, it was still well below the previous reading of 52.1. The manufacturing figure came out better than the forecast and the previous reading. That said, the service PMI was a disappointment, as it drifted back into contractionary territory, showing up at 45.8. The forecast was for the same as number as previous of 53.3. Let’s not forget that the service sector is UK’s largest part of its economy and forms around 80% of the GDP.

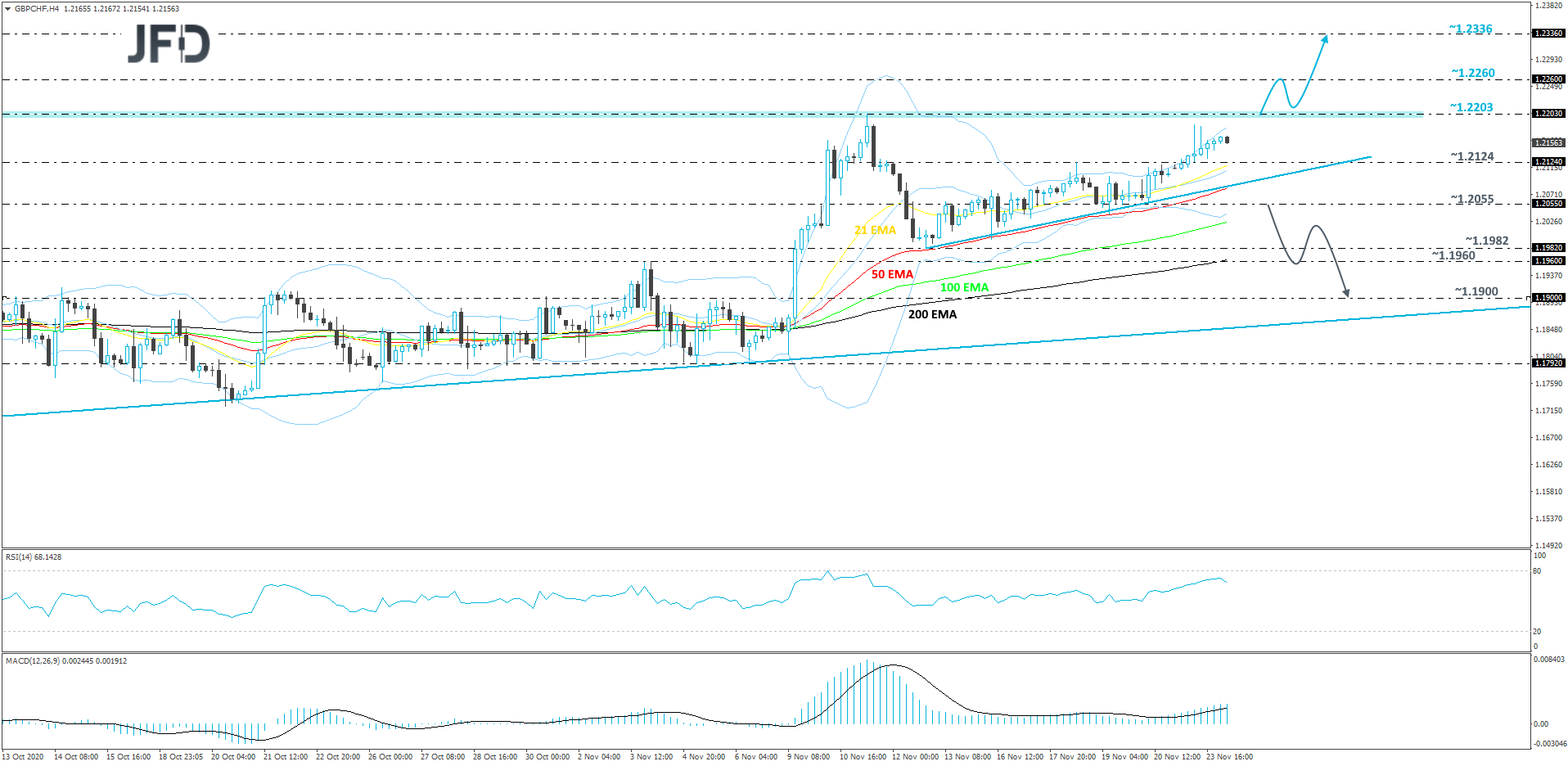

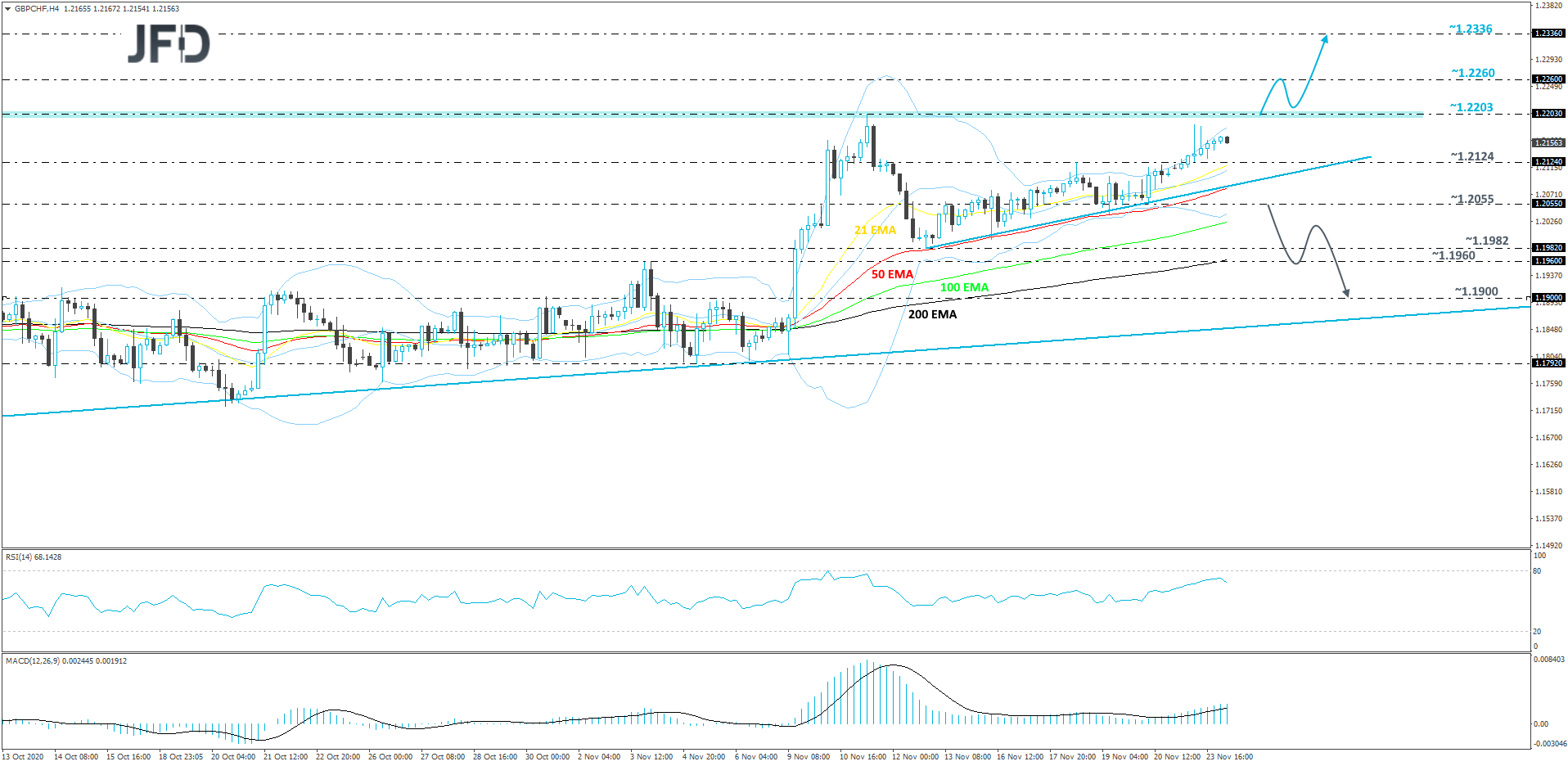

GBP/CHF Technical Outlook

GBP/CHF had a good run to the upside yesterday, getting closer to its key resistance area, at 1.2203, marked near the highs of Sept. 1 and Nov. 11. At the same time the rate is balancing above a short-term tentative upside line taken from the low of Nove. 12. In order to get a bit more comfortable with the upside, we would prefer to wait for a break above that 1.2203 hurdle first. For now, we will take a cautiously-bullish stance.

A strong push above the aforementioned 1.2203 barrier would confirm a forthcoming higher high, potentially opening the door for further advances. GBP/CHF may then drift to the 1.2260 obstacle, which if broken might open the door for a test of the 1.2336 level. That level marks the high of Mar. 5.

On the downside, if the rate suddenly drops below the previously-discussed upside line and then falls below 1.2055 hurdle, marked by the low of Nov. 20, that might spook the buyers from the arena for a bit. More sellers could join in and drive GBP/CHF towards the next possible support area between the 1.1960 and 1.1982 levels, which marks the high of Nov. 3 and the low of Nov. 12. Around there, the pair may also get supported by the 200 EMA on our 4-hour chart, however, if the sellers see all that as a temporary obstacle, a further slide might bring the rate to the 1.1900 level, marked near the high of Nov. 5.

Euro Stoxx 50 Technical Outlook

After a good run to the upside during the first half of November, the Euro Stoxx 50 is seen to be in some consolidation, at the moment. Some might even view it as a possible ascending triangle, which according to all technical analysis rules, could break out to the upside. That said, although all this looks quite positive, we would still prefer to wait for a push above the current highest point of this month, which is at 3505.

A strong move above the aforementioned 3505 barrier, would confirm a forthcoming higher high and may clear the way to the some higher areas. That’s when the index might travel to the 3527 obstacle, a break of which could clear the way to the 3597 zone, marked by the lowest point of December of 2019 and the high of Feb. 26. The index may get halted there temporarily, or even correct slightly lower. However, if Euro Stoxx 50 remains somewhere above the 3505 hurdle, we might see another attempt by the buyers to lift the index. If they succeed in doing that and then are able to overcome the 3597 area, the next potential target could be at 3728, marked by the high of Feb. 24.

Alternatively, if the price drops below the low of Nov.r 12, at 3395, that could clear the way for a larger move lower. The index may then drift to the 3308 obstacle, a break of which might set the stage for a move to the 3222 level, which is marked near the highs of Oct. 23 and Nov. 5.

As For The Rest of Today's Events

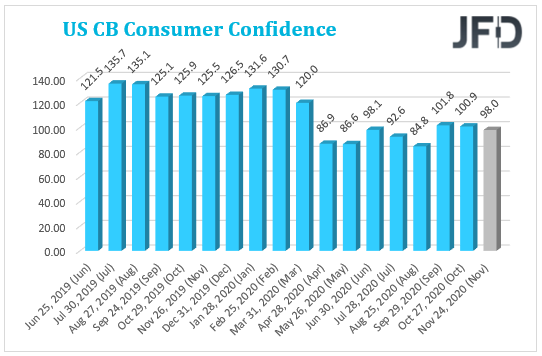

The US will post their CB consumer confidence number for the month of November, however that one is expected to be on the lower side, going from the previous 100.9 to 98.0. Certainly, this is not something that investors would like to see going further into the holiday season.