Huntsman Corporation (NYSE:HUN) and Venator Materials PLC has announced plans to privately offer senior notes worth around $350 million, due in 2025. The notes will be offered through their fully-owned subsidiaries Venator Materials Corporation and Venator Finance S.a r.l., subject to market and other conditions.

The notes will be offered to qualified institutional buyers under Rule 144A and will be exempt from registration requirements under the United States Securities Act of 1933.

As communicated earlier, Huntsman plans to separate its Pigments & Additives business this summer through initial public offering (IPO) of Venator Materials PLC, subject to market conditions. The company intends to initially keep the proceeds from note issue into escrow pending the IPO. It will then use the funds to repay intercompany debt owed to Huntsman, dividends and other related fees and expenses.

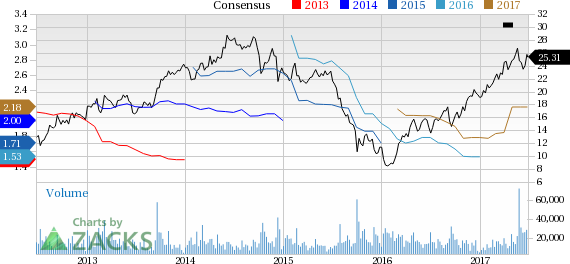

Shares of Huntsman have rallied around 10.7% over the past three months, outperforming the Zacks categorized Chemicals-Diversified industry’s 1.5% gain.

Huntsman witnessed positive business development during the first quarter and the performance of almost all the business segments exceeded quarterly expectations. Based on the strong first-quarter performance and an improved outlook for the remaining year, the company expects to generate free cash flows of over $450 million in 2017.

Recently, Huntsman and Clariant AG entered into a definitive agreement to combine in an all-stock deal that will create a leading chemical specialty company with revenues of roughly $13.2 billion and enterprise value of about $20 billion. This merger of equals will create a formidable industry player that will help the companies grow its foothold in high-growth markets, cut operating costs and expand margins.

Huntsman currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies in the basic materials space include The Sherwin-Williams Company (NYSE:SHW) , Potash Corporation of Saskatchewan Inc. (NYSE:POT) and The Chemours Company (NYSE:CC) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sherwin-Williams has expected long-term earnings growth rate of 11.4%.

Potash Corporation has expected long-term earnings growth rate of 6.5%.

Chemours has expected long-term earnings growth rate of 15.5%.

Sell These Stocks. Now.

Just released, today's 220 Zacks Rank #5 Strong Sells demand urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. These sinister are companies because many appear to be sound investments. However, from 1988 through 2016, stocks from our Strong Sell list have actually performed 6X worse than the S&P 500.

See today's Zacks "Strong Sells" absolutely free >>

Huntsman Corporation (HUN): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Potash Corporation of Saskatchewan Inc. (POT): Free Stock Analysis Report

Sherwin-Williams Company (The) (SHW): Free Stock Analysis Report

Original post