Take Two Interactive Software (NASDAQ:) is scheduled to report third-quarter fiscal 2019 results on Feb 6.

The company beat the Zack Consensus Estimate in the trailing four quarters, delivering average positive surprise of almost 19%.

In the last reported quarter, Take Two’s earnings of 22 cents per share increased. The company had reported loss of 3 cents in the year-ago quarter. The company's net revenues increased 11.1% from the year-ago quarter to $492.7 million.

For third-quarter fiscal 2019, GAAP net revenues are expected in the range of $1.10 to $1.15 billion.

The Zacks Consensus Estimate for third-quarter earnings has increased 1.5% in the past 30 days to $2.75 per share. Earnings are estimated to increase 118.3% year over year. Further, the consensus mark for revenues is pegged at $1.48 billion, up roughly 126.8% from the year-ago quarter.

Let’s see how things are shaping up prior to this announcement.

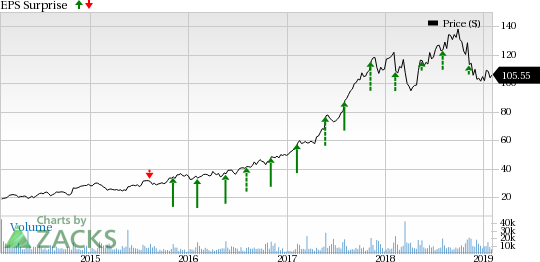

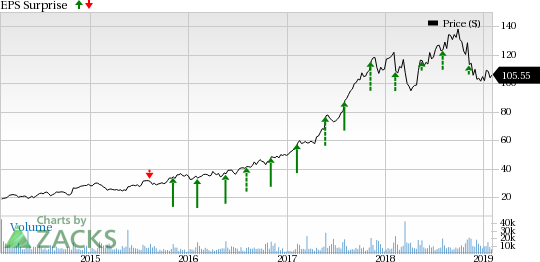

Take-Two Interactive Software, Inc. Price and EPS Surprise

Take-Two Interactive Software, Inc. Price and EPS Surprise | Take-Two Interactive Software, Inc. Quote

Portfolio Strength to Drive Top-Line Growth

Take Two’s innovative product portfolio is expected to drive its top line in the near term.

The company released the highly-anticipated Red Dead Redemption 2 in October and recorded sales of $725 million within the first three days of its release. Despite strong competition from Activision Blizzard’s (NASDAQ:) Call of Duty: Black Ops 4, robust demand for the game in the holiday season is expected to drive top-line growth.

In fact, Take Two expects net bookings in a band of $1.40 and $1.45 billion, primarily due to Red Dead Redemption 2 and higher recurrent spending on NBA 2K.

Moreover, Take Two partnered with HB Studios to publish The Golf Club 2019 in the to-be reported quarter, which features PGA TOUR. The deal gave Take-Two a competitive edge over Electronic Arts (NASDAQ:) , which was earlier the sole provider of PGA TOUR.

Take Two also released Borderlands 2 VR on Dec 14. The popularity of the Borderlands franchise is evident from the fact that the company has sold 16 million units of the game worldwide to date.

NBA Franchise a Key Catalyst

NBA 2K, one of Take Two’s popular franchises, continues to remain an important growth driver.

NBA 2K19 has gained significant traction with an increase of 10% in bookings compared to NBA 2K18’s release a year ago. Further, per the NPD Group, based on combined physical and digital sales in the United States, NBA 2K19 achieved the highest launch month in terms of dollar sales of any sports game released since it began tracking industry sales in 1995.

In the last-reported quarter, online games played, percentage of players who bought virtual currency and average revenue per user (ARPU) increased double digits for NBA 2K19 over NBA 2K18. Moreover, recurrent consumer spending on NBA 2K increased 70% and formed the biggest share of the company’s total recurrent spending in the second quarter.

Take Two launched NBA 2K Playgrounds 2 on Oct 16. Given Take Two’s efforts to be a distinct basketball video game player, the addition of NBA 2K Playgrounds 2 to the NBA franchise is expected to be accretive to its top line.

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. The Sell-rated stocks (Zacks Rank #4 or #5) are best avoided.

Take Two has a Zacks Rank #1 and an Earnings ESP of +3.36%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

A Stock That Warrants a Look

Here is a stock you may want to consider as our model shows that it has the right combination of elements to deliver an earnings beat in the to-be-reported quarter.

Twitter (NYSE:) has an Earnings ESP of +13.03% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Twitter, Inc. (TWTR): Free Stock Analysis ReportActivision Blizzard, Inc (ATVI): Get Free ReportElectronic Arts Inc. (EA): Free Stock Analysis ReportTake-Two Interactive Software, Inc. (TTWO): Free Stock Analysis ReportOriginal postZacks Investment Research