“Our greatest weakness lies in giving up. The most certain way to succeed is always to try just one more time.” – Thomas A. Edison

Well, well well.

We did see some heavy weakness Thursday afternoon which didn’t last too long but it is always a warning when we see that type of move lower on heavy volume.

Sometimes it’s a warning shot across the bow, other times it hits, so time will tell, likely

Friday will be that time.

Amazon.com Inc (NASDAQ:AMZN) was down Thursday tonight as well as Starbucks Corporation (NASDAQ:SBUX) which started higher, so Friday may be a gong show in the market and I’ll be doing lots of selling.

Things may change overnight but so far the end of this week looks sketchy.

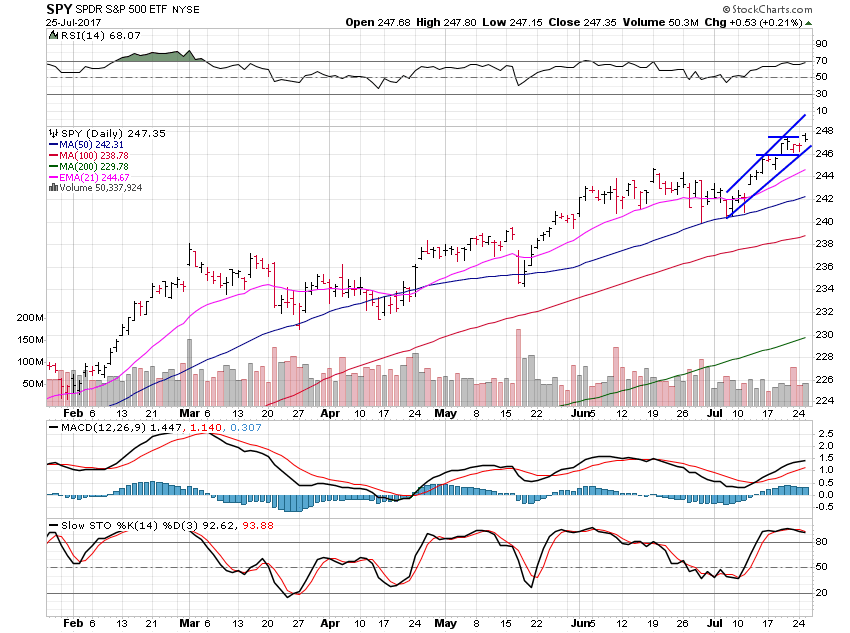

SPDR S&P 500 (NYSE:SPY) looks fine in this normal range action but let’s see how Friday goes.

Under 246 on a closing basis wouldn’t be great but it may be hard to give it until the close if we see volatility really pick up.