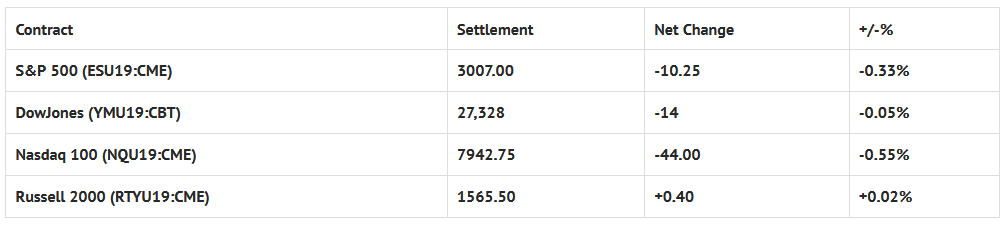

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp -0.20%, Hang Seng -0.09%, Nikkei -0.31%

- In Europe 10 out of 13 markets are trading lower: CAC -0.15%, DAX -0.16%, FTSE -0.24%

- Fair Value: S&P +3.48, NASDAQ +20.18, Dow -11.33

- Total Volume: 935k ESU & 246 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, Housing Starts 8:30 AM ET, EIA Petroleum Status Report 10:30 AM ET, Esther George Speaks 12:30 PM ET, and Beige Book 2:00 PM ET.

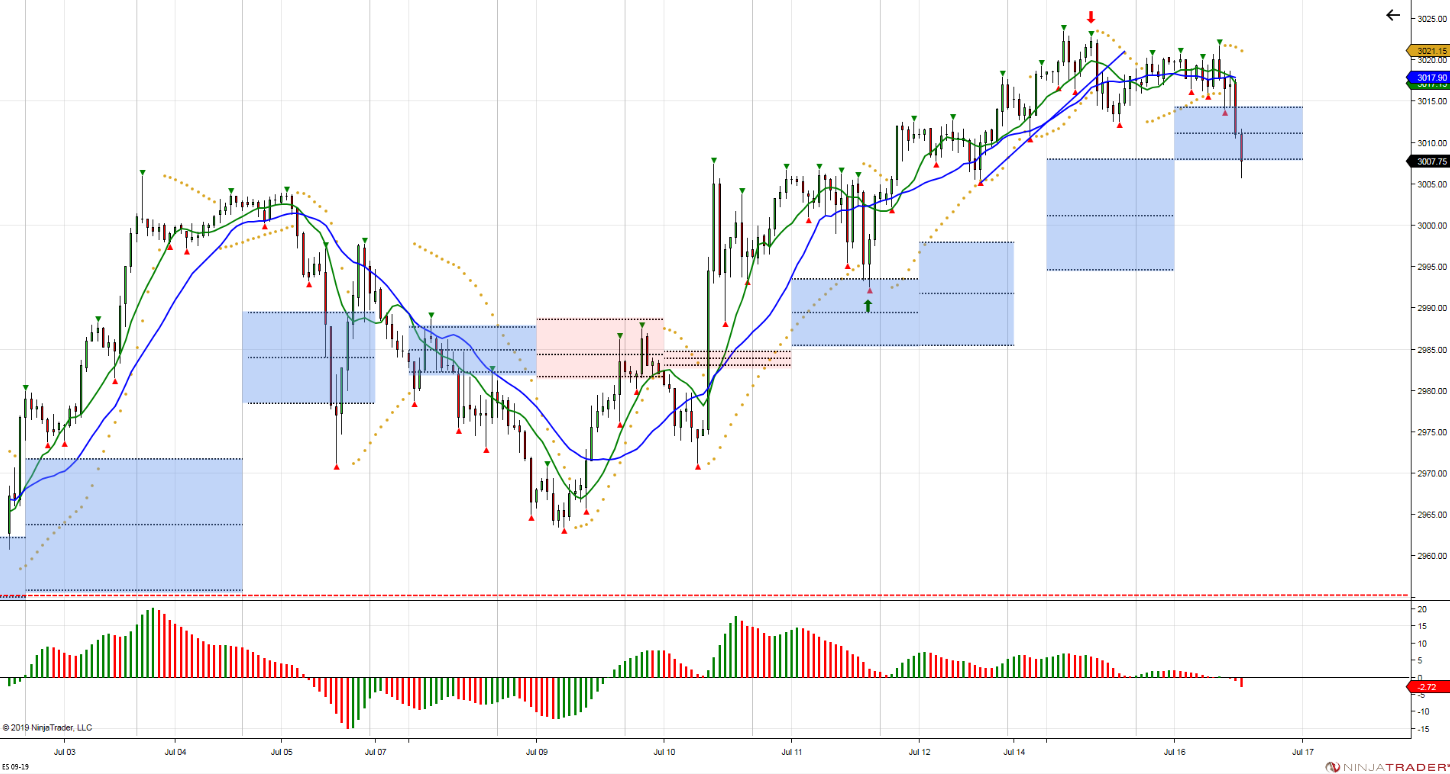

S&P 500 Futures: The Chop Is Real

During Monday nights Globex session, the S&P 500 futures (ESU19:CME) printed a high of 3021.75, a low of 3016.00, and opened Tuesday’s regular trading hours (RTH) at 3016.75.

During Monday nights Globex session, the S&P 500 futures (ESU19:CME) printed a high of 3021.75, a low of 3016.00, and opened Tuesday’s regular trading hours (RTH) at 3016.75.

Out of the gate, the ESU traded sideways in a 4 handle range for the first hour after the 8:30 CT bell. Just before a 10:45, a sell program activated, taking the futures down through the Globex low, to a new low at 3004.50.

From there, the ES traded sideways for the rest of the day, first back-and-filling up to 3013.50, then breaking back down to double bottom at 3004.50.

When the MiM reveal came out showing $520 million to buy MOC, the futures had traded back up to 3011.75, but would go on to close a little weaker, printing 3007.25 on the 3:00 cash close, and 3006.75 on the 3:15 futures close.

In the end, the overall tone of the ES was weak. In terms of the days overall trade, total volume was low, with 935k futures contracts traded.