Market Brief

Political risk rise in EM

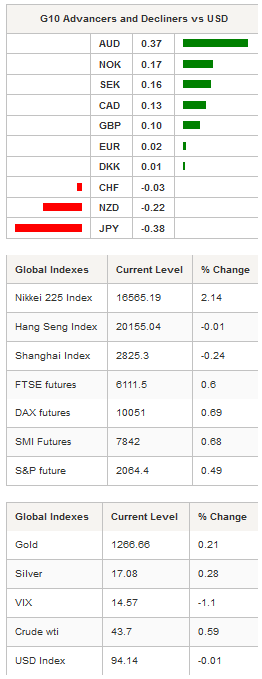

Risk appetite came solidly back in the Asian session after a choppy US equity session. The positive sentiment was supported by Chicago Fed President Evans whose balanced comments indicated that the US economy was healthy yet encouraged a patient approach to further interest rate hikes. Markets shrugged off Fed Dudley's comment (despite status at the Fed) that two rate hikes in 2016 was a “reasonable expectation”. Asia’s regional equity market indices increased, lead by the Nikkei rising 2.00%. Japanese stockers were helped by verbal warnings against excessive JPY volatility. USD/JPY bullish rally continued reaching 108.89 in early Asia trading. Commodity prices are steady after yesterday’s decline following pressure after Chinese trade data indicated soft demand. WTI oil prices were subdued, around $42.25 after declining nearly 5% off the recent highs, as fears stemming from Canadian wildfires disrupting production subsided, and Saudi Aramco Chairman Khalid Al-Falih and the new Saudi oil minister reaffirmed their commitment to current oil production levels. Gold was able to bounce off the $1261.41 lows.

USD was mixed in the G10 (despite slight yield curve steepening) but broadly weaker against Asia FX despite quiet a news cycle. Spillover from recent commodity sell-off lingers pushing commodity linked currencies lower, with NZD and MYR leading the decline. Elsewhere in EM, BRL exhibited extreme volatility, declining 4.5% at one point, on political uncertainty. The news stream is coming in hot and heavy with the Speaker of the House of Representatives stating that he had cancelled the vote to impeach President Rousseff but later said the impeachment proceedings would go ahead on Wednesday. Despite expectations for President Rousseff to step down on Thursday traders will remain vigilant and expect further spikes in BRL volatility.

In the Philippines ex-mayor of Davao City, Rodrigo Duterte is reported to have won the country's presidential election. With 87% of the polling stations Duterte was able to rise above the election day violence and disorder to capture 40% of the ballots (closest rival Mar Roxas claimed 23%). The Philippine Stock Exchange Index increased 0.5%, as the nation’s financial markets restarted trading Tuesday, suggesting that despite Duterte's provocative stance, markets are not overly concerned with the backing of earlier risk premia already priced in.

China’s April CPI inflation held steady at 2.3% y/y for a third month. The read indicates that consumer prices are rising at a decent pace, although below the government official target. PPI deflation continued, yet tightened to -3.4% y/y from -4.3% prior read as input prices surged. We expect inflation pressure to ease heading below 2% by year’s end allowing the PBoC to extend accommodating policies.

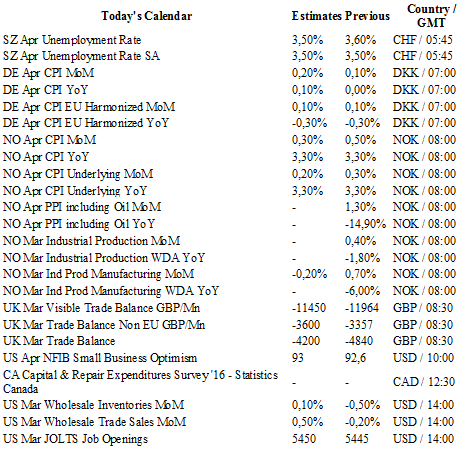

For the European session traders should expect, German, France, Norway and Italy industrial production and UK trade balance. In the US, traders will see Wholesale Inventories and JOLTS Job openings. On the sidelines, Euro area policy markets have increased efforts to unlock aid for Greece by trying to convince the IMP to back the repayment plan. The goal is to get the IMF to agree to stricter austerity measures should Greece miss its budget forecasts.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1396

S 1: 1.1217

S 2: 1.1144

GBP/USD

R 2: 1.4959

R 1: 1.4668

CURRENT: 1.4643

S 1: 1.4300

S 2: 1.4132

USD/JPY

R 2: 112.68

R 1: 111.91

CURRENT: 106.94

S 1: 105.23

S 2: 100.78

USD/CHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9621

S 1: 0.9476

S 2: 0.9259