I wish all my readers around the world a very happy New Year and it’s good to see the markets back in full swing after the holiday season with volumes now returning to normal levels. And to start 2020, I am revisiting some of my late posts in 2019 about commodities, with two much in focus, namely gold and oil as uncertainty and safe-haven flows dominate the new year.

While precious metals have risen strongly, silver has benefited from the backdraft of safe-haven flows into gold, which has surged higher, taking the industrial metal with it and through the various levels I outlined in my post of last year entitled ‘Will silver shine in 2020‘. The target level mentioned in that post was $18.50 per ounce, which is now being tested in early trading as the metal currently trades at $18.44 per ounce. This is what I wrote as a closing summary:

……….and assuming we see good volume in the new year, and coupled with a falling US dollar, this may help to propel the metal higher on towards $18.50 per ounce, with the potential to move to the highs of this year of $19.89 per ounce given the light volume awaiting on the volume point of control histogram.

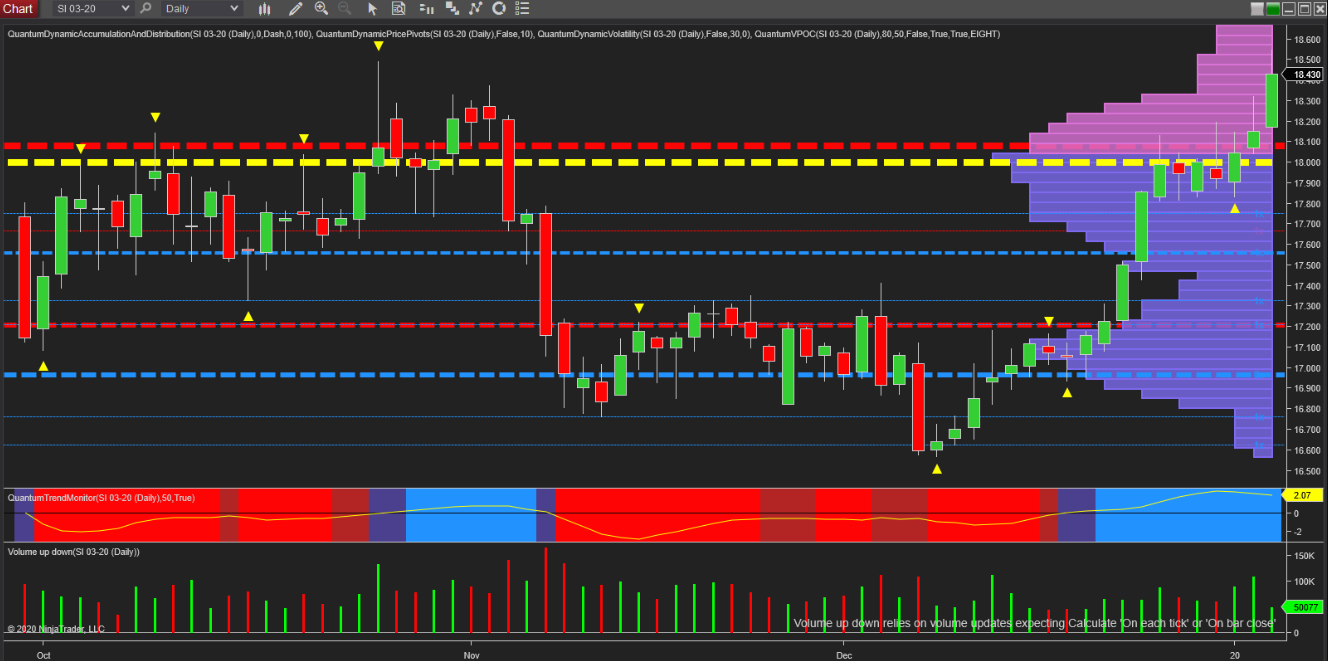

More importantly, the move higher has breached the strong resistance area which had built in the $18.10 per ounce area and denoted with the red dashed line on the accumulation and distribution indicator, and which is now acting as a strong platform of support. In addition, today’s daily candle is moving into an area of low volume on the volume point of control histogram which is declining further through $18.60 per ounce and beyond on the daily chart. Note the trend monitor indicator, which is supporting the bullish tone.

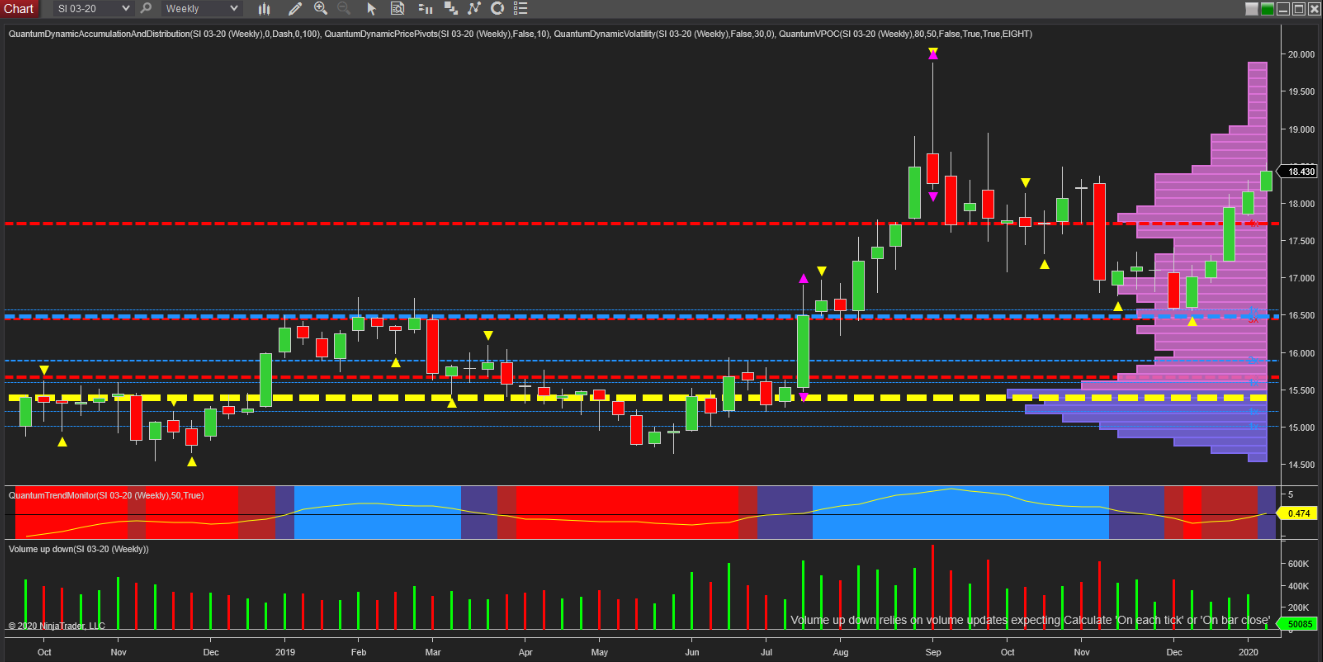

Moving to the weekly chart, this too is confirming the positive picture for silver with the metal rising off the platform of support with the cluster of blue and red dashed lines of the accumulation and distribution indicator denoting these levels. The resistance at $17.70 per ounce has also been breached and with gently rising volume and rising price action, this too is sending out a positive signal for the metal, and with volumes on the volume point of control histogram falling away as we move through $19.00 per ounce and beyond, we may see a run on to $20 per ounce should this level be taken out in due course. So plenty for silver and gold bulls to cheer about as the year gets underway.