Forex market volumes mildly ticked over last night, with the yen and euro catching a bid while the commodity currencies continued to see decent selling.

US stocks continued to buck the US dollar correlation, tumbling toward Black Monday swing lows. This drop saw the S&P 500 Index close at a 1 month low, Bloomberg blaming the rout on commodity prices and biotech sector woes.

“The Standard & Poor’s 500 Index fell 2.6 percent to 1,881.77 at 4 p.m. in New York, down for a fifth consecutive session to the lowest since Aug. 25.”

Focusing on the lower trending US Dollar, testing the fortitude of bulls amid the suddenly hawkish Fed environment that we seem to have stumbled into.

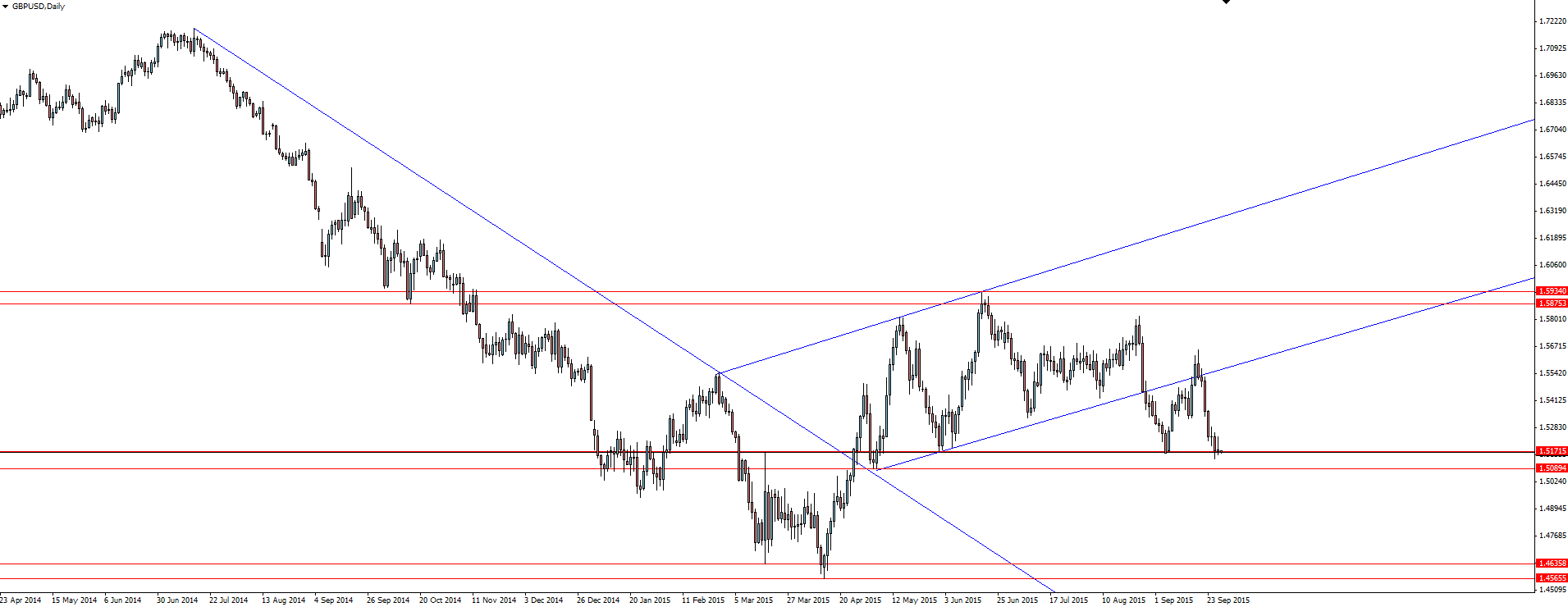

GBP/USD Daily:

The above Cable chart stands out for having clear ranges that we can trade around. But with price clearly at the bottom of one such range, selling here probably isn’t the smartest play. The point is, don’t just look to long USD at the first hint of a hawkish Fed headline, try to hit the edge of ranges in the majors and play from there.

Overnight we did see headlines from Tarullo, Dudley and Evans. All 3 are known doves which adds to the temptation to close your eyes and click buy.

On the Calendar Tuesday:

USD CB Consumer Confidence

GBP BOE Gov Carney Speaks

Chart of the Day:

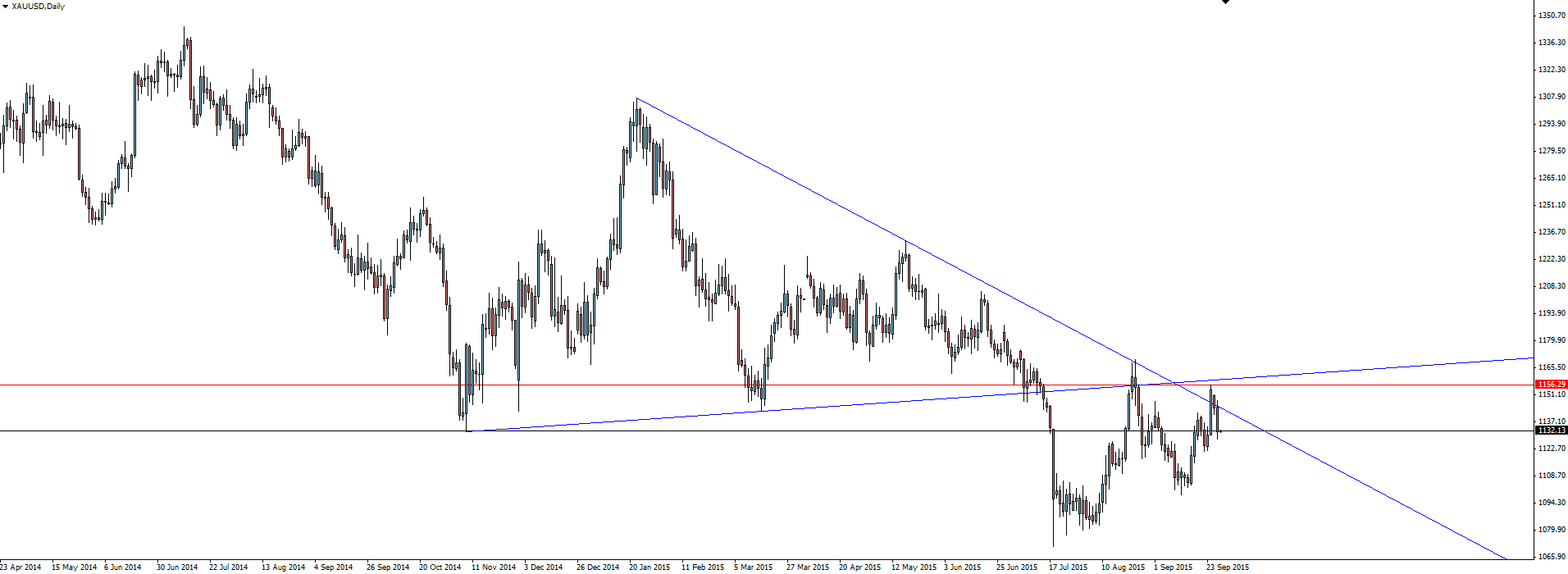

We’ve dug up an old Technical Analysis blog post from August where we went through some Gold shorting scenarios. Scroll down to the final chart on that post and compare it to where price now sits.

XAU/USD Daily:

As you can see, price has come back up to re-test the horizontal SR zone that we had marked as a point of interest in the previous post. With some short term trend line confluence also playing a role, price hasn’t been able to make a new high.

This area offers a clear level to manage your risk around for a trend continuation play.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex Broker Vantage FX Pty Ltd, does not contain a record of our MT4 prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, Forex analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a Forex trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.