Premium e-Commerce solutions provider, Pitney Bowes Inc. (NYSE:PBI) recently announced that it has signed a definitive agreement to purchase Newgistics, Inc. The acquisition will aid Pitney Bowes expand its range of e-Commerce and parcel management solutions for retailers, small & medium businesses, and enterprise clients.

Per the terms of the deal, Pitney Bowes will buy all shares of Newgistics for about $475 million. The deal is anticipated to conclude by late third or early fourth quarter, subject to customary closing conditions.

Newgistics provides a wide range of e-Commerce solutions and is famed for its returns-processing capabilities. The acquisition will augment Pitney Bowes’ digital e-Commerce and parcel service capabilities. It will also add to the company’s physical capabilities including a national network of Presort Services Operating Centers and facilitate enterprise retail cross-border expansion.

The buyout is also in sync with Pitney Bowes’ strategy to offer proven, capable and scalable end-to-end Global e-Commerce solution.

Further, the company announced opened a new Presort Services Operating Center in Huntington Beach, CA to enhance its presence in the U.S. domestic parcels space.

Our Take

During first-quarter 2017, the company’s Digital Commerce Solutions reported 9% year-over-year growth in sales to $166 million, driven by strong Global e-Commerce business (up 17%). The previously concluded buyout of Borderfree has complemented its e-Commerce business and has also contributed toward the overall capacity mix by providing best-in-class capabilities and fortifying portfolio. The company is also working to expand opportunities for the U.S. retailers by accessing consumer markets in China and India. Overall, the Digital Commerce Solutions is anticipated to be a key growth driver in the long haul.

Further, the company anticipates Shipping business to be its next big catalyst. In the past few years, Parcel volume has shot up 48% globally and is expected to grow another 17-28% between by 2021. Newgistics’ parcel service capabilities will serve to strengthen Pitney Bowes’ foothold in the shipping and sending market, while enabling it to capitalize on a burgeoning market.

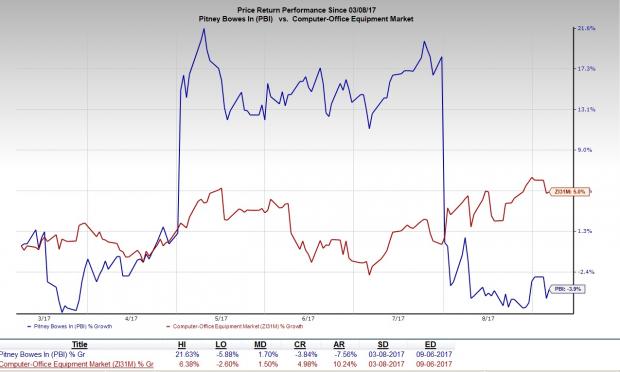

However, the shares of this company have had a disappointing run on the bourse in the last six months. Its shares have declined 3.8%, against the industry’s gain of 4.9%.

Moreover, the company’s softness in the North American mailing business is yet to subside completely. During second-quarter 2017, Small and Medium Business Solutions revenues dipped 3% year over year to $436.4 million. Additionally, decline in recurring revenues and poor equipment sales proved to be a drag on the International Mailing Business. Uncertain global economic environment is expected to impact production mail and software businesses in the near term, consequently limiting growth momentum.

In light of these headwinds, the company currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

Some better-ranked stocks from the same space are Applied Optoelectronics, Inc. (NASDAQ:AAOI) , Arista Networks, Inc. (NYSE:ANET) and Axcelis Technologies, Inc. (NASDAQ:ACLS) . While Applied Optoelectronics and Arista Networks sport a Zacks Rank #1 (Strong Buy), Axcelis Technologies carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Optoelectronics has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 17.9%.

Arista Networks has outpaced estimates in the preceding four quarters, with an average earnings surprise of 22.8%.

Axcelis Technologies has surpassed estimates in three of the trailing four quarters, with an average positive earnings surprise of 35.0%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Axcelis Technologies, Inc. (ACLS): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Pitney Bowes Inc. (PBI): Free Stock Analysis Report

Original post

Zacks Investment Research