Investing.com’s stocks of the week

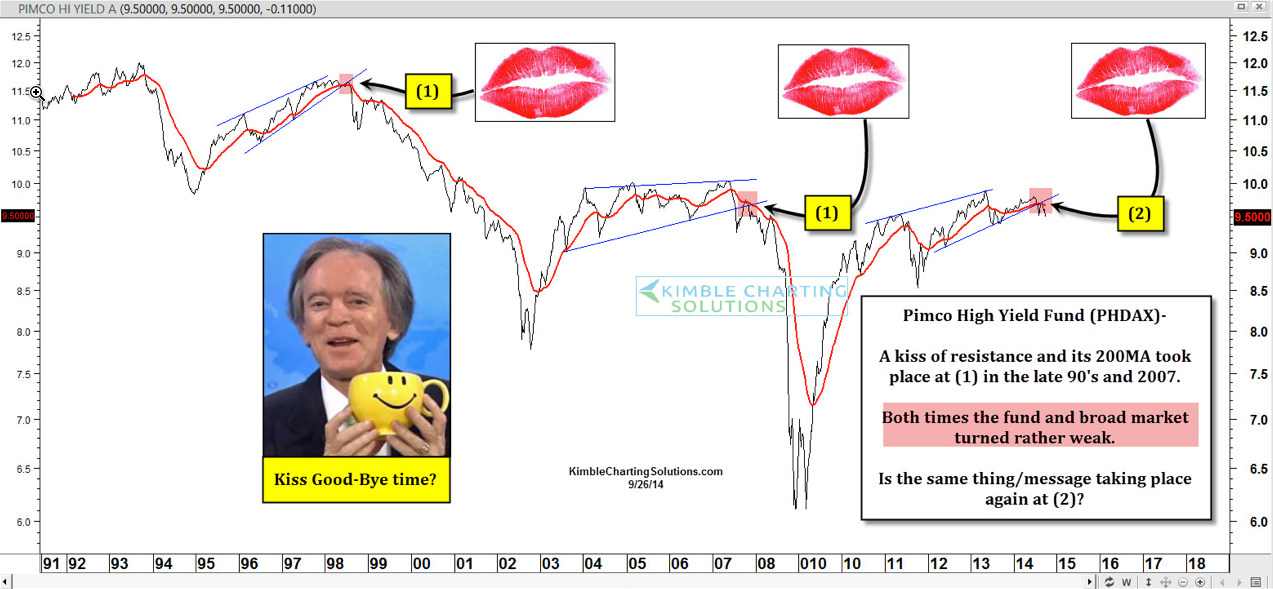

In the late 1990's and 2007 the PIMCO High Yield fund (PHDAX) formed bearish rising wedges. Once support broke, the fund rallied to kiss the underside of the wedge and its 200-MA at each (1), then it proceeded to fall a large percentage in price.

Both times this occurred, the broad market soon followed the fund's price action. Were those important "kiss good-bye" messages being sent from the junk-bond arena? In hindsight it appears they were.

At this time the fund looks to be creating a similar pattern, as it recently kissed the underside of the bearish rising wedge and its 200-MA at (2) above.

Bill Gross announced that he was leaving PIMCO Friday morning. The question? Is the fund suggesting that investors do the same and exit some broad market holdings due recent price action?

In my opinion, the fund's price action has NOT sent an all-out bearish signal to the broad market at this time as the S&P 500 is just 2% off all-time highs. If we see further weakness from this complex, the message would be one I will respect.