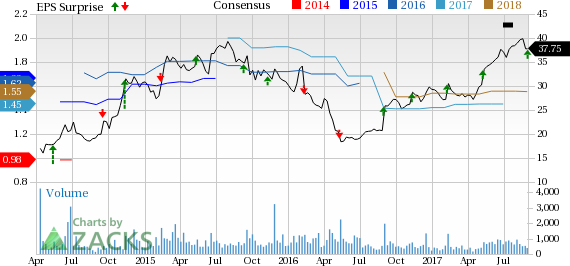

Phibro Animal Health Corporation (NASDAQ:PAHC) reported adjusted earnings per share (EPS) of 39 cents in the fourth quarter of fiscal 2017, up 21.9% year over year. Adjusted EPS also surpassed the Zacks Consensus Estimate of 35 cents. According to the company, the year-over-year improvement was primarily driven by a higher gross profit ratio, reduced interest expense and a lower effective income tax rate.

Including one-time items, the company reported EPS of 38 cents, in line with the year-ago quarter.

Full-year adjusted earnings came in at $1.51, an increase of 5.6% from year-ago period. Also, the figure surpassed the Zacks Consensus Estimate of $1.45.

Net Sales

In the reported quarter, Phibro’s net sales were $194.8 million, up 2.9% year over year. The improvement was driven by sales growth in the Animal Health, Mineral Nutrition segment and Performance Products.

Fiscal 2017 registered net sales of $764.3 million, up 12.8% from a year ago. Also, revenues beat the Zacks Consensus Estimate of $761.52 million.

Sales by Segments

Net sales at the Animal Health segment increased 2% to $128.6 million in the reported quarter on the back of volume increases in the nutritional specialty and vaccine product groups within the segment. While nutritional specialty products grew 14%, sales from vaccines increased 8%, principally on volume growth of products for poultry and swine industries.

However, sales at Medicated feed additives (MFAs) and Other fell 3% primarily due to volume declines.

Domestic net sales of MFAs and Other declined $7.4 million due to reduced volumes of medically important antimicrobials. International net sales increased by $5.2 million, driven by growth in the Asia-Pacific region, which is partially offset by declines in Brazil due to economic conditions.

Net sales at the Mineral Nutrition segment increased 5% to $52.8 million on increased volumes and higher average selling prices resulting from underlying raw material commodity price increase.

Net sales at the Performance Products segment increased 6% to $13.4 million. This was driven by higher volumes of copper-based products and personal care ingredients and increased average selling prices of copper-based products. However, the increase was partially offset by lower average selling prices of personal care ingredients.

Operational Update

Phibro’s fiscal fourth-quarter gross profit increased 5.9% year over year to $63.1 million. The gross margin expanded 89 basis points (bps) to 32.4%.

Selling, general and administrative expenses rose 0.3% to $39.6 million. Operating margin expanded 144 bps year over year to 12.1% in the quarter.

Financial Update

Year to date, Phibro generated $98.4 million in cash flow from operations compared with $37.2 million in the year-ago period. Capital expenditure amounted to $20.9 million in this period, reflecting a reduction from $36.4 million in fiscal 2016.

FY18 Outlook

Phibro provided its fiscal 2018 guidance. The company currently expects to generate net sales of $765-$790 million. The current Zacks Consensus Estimate of $777.1 million falls within the guided range.

Phibro provided its adjusted EPS guidance in the range of $1.55–$1.61. The current Zacks Consensus Estimate of $1.55 is at the lower end of the company's guided range.

Our Take

Phibro ended the fiscal fourth quarter on a solid note with both net sales and adjusted earnings beating the Zacks Consensus Estimate. Also, the year-over-year increase on both the fronts is encouraging. Further, the company witnessed year-over-year improvement across all segments. We are also encouraged by the expansion in the gross and operating margin in the reported quarter.

Moreover, on a full-year basis, adjusted earnings and net sales have surpassed the Zacks Consensus Estimate as well with year-over-year increases in both.

The company has provided its fiscal 2018 guidance for both net sales and adjusted earnings.

Zacks Rank & Peer Performance

Phibro currently has a Zacks Rank #3 (Hold). A few better-ranked medical stocks are Edwards Lifesciences Corp. (NYSE:EW) , PetMed Express, Inc. (NASDAQ:PETS) and IDEXX Laboratories, Inc. (NASDAQ:IDXX) . Edwards Lifesciences sports a Zacks Rank #1 (Strong Buy), while PetMed and IDEXX carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences’ second-quarter 2017 adjusted earnings improved 42.1% year over year, primarily driven by strong sales growth at the company’s transcatheter heart valves business. The stock has gained around 3.5% over the last three months.

IDEXX Laboratories recorded second-quarter 2017 EPS of 95 cents, up 28% (up 30% at CER year over year on a reported basis. Moreover, revenues rose 9% year over year (10% on organic basis) to $509 million.

PetMed reported earnings per share of 45 cents for the first quarter of fiscal 2018, up 40.6% from the year-ago quarter’s 32 cents. Moreover, net sales in the reported quarter rose 9.9% year over year to $79.7 million.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Phibro Animal Health Corporation (PAHC): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Original post

Zacks Investment Research