Pfizer Inc (NYSE:PFE) and partner Bristol-Myers Squibb Company (NYSE:BMY) presented findings from a phase IV study on Eliquis, which demonstrated the oral anticoagulation’s potential in achieving and maintaining normal heart rhythm (cardioversion).

The study, EMANATE, compared Eliquis with standard-of-care, Heparin, for reducing the occurrence of acute stroke, systemic embolism, major bleeding, clinically relevant non-major bleeding and all-cause death in non-valvular atrial fibrillation (NVAF) patients undergoing cardioversion.

We remind investors that Eliquis is already approved for the reduction of the risk of stroke and systemic embolism in patients with NVAF, treatment of deep vein thrombosis (DVT) and pulmonary embolism (PE) and reduction in the risk of recurrent DVT and PE following initial therapy, and prophylaxis of DVT, which may lead to PE, in patients who have undergone hip or knee replacement surgery. However, the drug is not approved for the reduction of stroke in NVAF patients undergoing cardioversion.

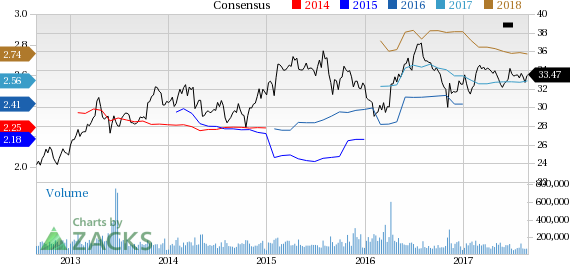

Pfizer has underperformed the industry so far this year. The stock has gained 3% during this period, while the industry gained 11.3%.

Coming back to the latest news, cardioversion procedure is associated with a concern for clotting of blood in the heart while travelling to brain (stroke) or other body parts (systemic embolism). The EMANATE study showed that there was no stroke in Eliquis group compared to six strokes in the Heparin arm. However, no systemic embolism was observed for both the drug groups. Eliquis also reduced the number of major bleeding events and clinically relevant non-major bleeding events compared to Heparin.

The current standard-of-care – Heparin and Coumadin – requires monitoring and potential dose adjustment while administered for reducing the risk of stroke. However, Eliquis can be administered at a fixed dose of 5mg twice daily.

We note that Eliquis, being an anticoagulant, increases the risk of bleeding, which can become serious and potentially fatal.

The company also announced data from a real-world analysis of Eliquis in NVAF patients in a separate press release. Per the analysis, Eliquis showed lower risk of stroke/SE and lower rates of major bleeding compared to Coumadin in NVAF patients as well as for each of the selected high-risk patient sub-populations.

Eliquis faces competition in the anticoagulant segment from Johnson & Johnson’s (NYSE:JNJ) Xarelto and Boehringer Ingelheim’s Pradaxa. With the approval of Portola Pharmaceuticals, Inc.’s (NASDAQ:PTLA) Bevyxxa in June 2017competition is expected to intensify.

Stroke events are a major concern for NVAF patient. The above findings show that Eliquis may become a preferred treatment for the same which may boost the potential of the drug. If Pfizer and Bristol-Myers try to get the label of Eliquis expanded to include the findings, it will give the drug an edge over other marketed blood thinners.

Currently, Pfizer carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Pfizer, Inc. (PFE): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Portola Pharmaceuticals, Inc. (PTLA): Free Stock Analysis Report

Original post

Zacks Investment Research