PetroChina Company Limited (NYSE:PTR) suffered a setback recently as a fire broke out at Dalian refinery owned by the state-run integrated oil major. However, there were no casualties.

The fire started due to a broken seal in a feed pump. Consequently, the refinery plant's 1.4 million tonnes per annum catalytic cracker, used for producing gasoline, caught fire. The feedstock equipment, attached to the catalytic cracker was separated, which saved the other units from being affected. Although crude processing operations in the Dalian refinery were not impacted by the fire, production from the gas separation unit might witness a decline.

The environmental inspection was carried out in the facility after the fire was extinguished. It revealed that the containment pools installed at the facility arrested pollutants from entering the coastal waters. Air quality monitoring stations in the locality found no unusual emissions in the area following the fire.

We note that the Dalian refinery had suffered a setback in 2013 when an explosion injured two people.

Dalian Refinery in Focus

Dalian refinery, located in northeast China's Liaoning Province is one of the largest refineries in the country. The plant has three crude distillation units and a processing capacity of 410,000 barrels of crude oil per day. It has been only two months since the last major maintenance in the facility.

Part of the crude oil processed at the facility comes from PetroChina’s own production in the Daqing oil region. Another major supplier of the refinery is Saudi Arabia. Dalian refinery produces gasoline, diesel and liquid petroleum gas.

About PetroChina

PetroChina is the largest integrated oil company in China. It was established in Nov 1999 as part of the restructuring of China National Petroleum Corporation (“CNPC”), a state-owned entity, which currently holds a stake of 86.35% in PetroChina. The company operates in four segments: Exploration & Production, Natural Gas & Pipelines, Refining & Chemicals, and Marketing.

Crude downturn and cuts in domestic natural gas supply prices to industrial customers have wiped out earnings and hit PetroChina hard. China's weakened industrial activity has dampened demand for the company's products like diesel.

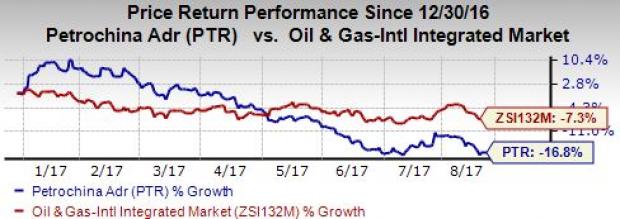

Price Performance

PetroChina has lost 16.8% of its value year to date compared with 7.3% fall of its industry.

Zacks Rank and Stocks to Consider

PetroChina has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks from the oil and energy sector includes Range Resources Corporation (NYSE:RRC) , Canadian Solar Inc. (NASDAQ:CSIQ) and Subsea 7 SA (OTC:SUBCY) . It sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Range Resources’ sales for 2017 are expected to increase 124.2% year over year. The company has a four-quarter average positive earnings surprise of 51.8%.

Canadian Solar’s sales for the third quarter of 2017 are expected to increase 24.7% year over year. The partnership delivered a positive earnings surprise of 6.25% in the second quarter of 2017.

Subsea’s sales for 2017 are expected to increase 11.6% year over year. The company delivered a positive average earnings surprise of 83.8% in the last four quarters.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Subsea 7 SA (SUBCY): Free Stock Analysis Report

PetroChina Company Limited (PTR): Free Stock Analysis Report

Range Resources Corporation (RRC): Free Stock Analysis Report

Canadian Solar Inc. (CSIQ): Free Stock Analysis Report

Original post

Zacks Investment Research