Brazilian state-run integrated energy company Petróleo Brasileiro S.A. or Petrobras (NYSE:PBR) recently decided to sell 90% of its stake in its wholly owned subsidiary, Transportadora Associada de Gás ("TAG").

About TAG

The subsidiary transports natural gas. Its gas pipeline system spanning 4,500 kilometers is primarily located in the north and northeast of Brazil. The company can transport up to 74.7 million cubic feet per day, which is fully contracted through long-term agreements with ship-or-pay clauses.

Currently, TAG has about 13 years of gas transportation agreements left. The company's earnings before interest, tax, depreciation and amortization (EBITDA) as of 2016 were $1.2 billion.

At present, TAG's operation and maintenance services are performed by Petrobras' wholly owned subsidiary, Petrobras Transporte S.A. or Transpetro.

Divestment Details

Petrobras intends to carry out the selloff in phases. The phases include initiation of non-binding phase, commencement of binding phase, granting exclusive negotiation, receiving approval from senior management and contracts signature, and closing.

The financial terms of the transaction have yet to be disclosed.

Divestment Rationale

Petrobras is presently trying to come out of the money-laundering scandal that has led to a huge debt burden and scarred its credit metrics. At the end of June 2017, the company had net debt of $89,263 million. With the sale of TAG, Petrobras is following its strategy of improving its financial health through the divestment program of 2015-2018.

Last month, Petrobras announced plans to divest around 30 assets by the end of 2017. These divestment plans are in sync with the company’s strategy to reinstate the faith of investors in the stock. Further, it will also help the company gain additional liquidity as it intends to increase investment in ultra deepwater projects.

Also, the company had approved corporate restructuring of its petroleum derivatives distribution and marketing subsidiary Petrobras Distribuidora in August 2017 that requires a capital grant of $2.02 billion. The selloff of 90% stake in TAG may generate capital for the same.

About Petrobras

Headquartered in Rio de Janeiro, Petrobras is the largest integrated energy firm in Brazil and one of the largest in Latin America. The company’s activities include exploration, exploitation and production of oil from reservoir wells, shale and other rocks, as well as refining, processing, trading and transportation of oil and oil products, natural gas and other fluid hydrocarbons, in addition to other energy-related activities.

Petrobras’ cost improvement measures and divestment of non-core assets will likely help financials, thereby supporting earnings growth. However, Petrobras recently cut prices for diesel by 3.5% and gasoline by 5.4% as part of its policy to maintain parity with international markets. This might adversely impact near-term results of its downstream division.

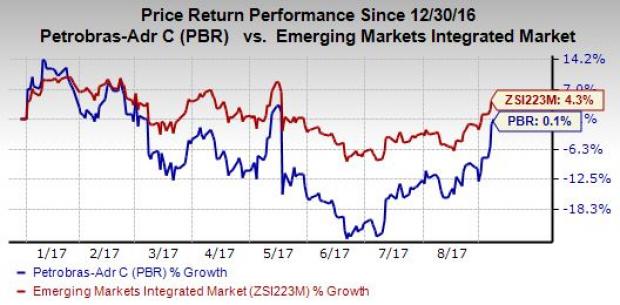

Price Performance

Petrobras has gained 0.1% year to date compared with 4.2% growth of its industry.

Zacks Rank and Stocks to Consider

Petrobras currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the oil and energy sector are Lonestar Resources US Inc. (NASDAQ:LONE) , Range Resources Corp. (NYSE:RRC) and Subsea 7 SA (OTC:SUBCY) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lonestar Resources’ sales for 2017 are expected to surge 60.2% year over year. The company delivered a positive earnings surprise of 62.5% in the second quarter of 2017.

Range Resources’ sales for the third quarter of 2017 are expected to increase 27% year over year. The company delivered an average positive earnings surprise of 51.8% in the last four quarters.

Subsea’s sales for 2017 are expected to increase 11.6% year over year. The company delivered an average positive earnings surprise of 83.8% in the last four quarters.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Petroleo Brasileiro S.A.- Petrobras (PBR): Free Stock Analysis Report

Subsea 7 SA (SUBCY): Free Stock Analysis Report

Range Resources Corporation (RRC): Free Stock Analysis Report

Lonestar Resources US Inc. (LONE): Free Stock Analysis Report

Original post

Zacks Investment Research