Brazilian state-owned energy giant Petróleo Brasileiro S.A. or Petrobras (NYSE:PBR) has been ordered by a local court to provide natural gas to power utility Centrais Elétricas Brasileiras S.A. or Eletrobras despite the latter’s huge debt burden with Petrobras.

In February, Petrobras denied to sell natural gas to Eletrobras as the company and its subsidiaries owe Petrobras its payment worth several billion dollars for natural gas supply. In the first-quarter 2017 earnings report, the energy giant had mentioned that Eletrobras owes it $3 billion.

Eletrobras requires the gas supply to begin testing a 590 megawatt thermal power station named Mauá 3 plant in the Amazon (NASDAQ:AMZN) region. The construction of the thermal power station is nearing completion. The tests are expected to start in June. Eletrobras owes $2.5 billion to Petrobras for this project.

According to Reuters, the court order will compel Petrobras to sell enough natural gas to Eletrobras to start the testing procedure. However, the amount will not be adequate for Eletrobras to start full operation in Mauá 3.

About the Company

Petrobras is an integrated energy company involved in the exploration, production, refining, retailing and transportation of petroleum and its byproducts, both domestically and internationally. The Brazilian multinational corporation is headquartered in Rio de Janeiro.

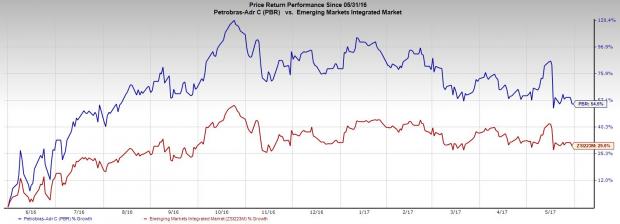

Price Performance

In the last one year, Petrobras’ shares gained 54.53%, outperforming the Zacks categorized Emerging Markets Integrated industry’s increase of 29.57%.

Zacks Rank and Stocks to Consider

Petrobras presently has a Zacks Rank #3 (Hold). Some better-ranked stocks in oil and energy sector are Delek US Holdings, Inc. (NYSE:DK) , Enbridge Energy, L.P. (NYSE:EEP) and Canadian Natural Resources Limited (TO:CNQ) . All of these stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Delek US Holdings’ sales for 2017 are expected to increase 37.46% year over year. The company had a positive average earnings surprise of 60.68% in the last four quarters.

Enbridge Energy’s sales for the second quarter of 2017 are expected to increase 13.17% year over year. The partnership had a positive average earnings surprise of 38.22% in the last four quarters.

Canadian Natural Resources’ sales for the second quarter of 2017 are expected to increase 26.93% year over year. The company had a positive earnings surprise of 30.77% in the first quarter of 2017.

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Petroleo Brasileiro S.A.- Petrobras (PBR): Free Stock Analysis Report

Enbridge Energy, L.P. (EEP): Free Stock Analysis Report

Delek US Holdings, Inc. (DK): Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ): Free Stock Analysis Report

Original post

Zacks Investment Research