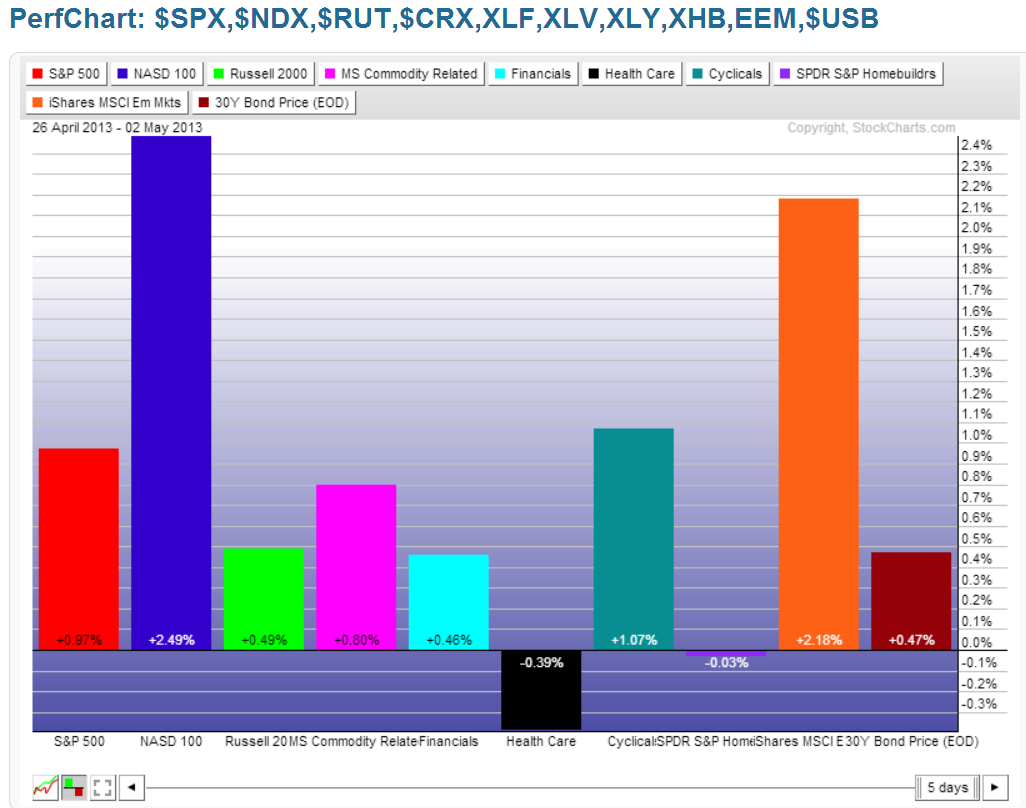

Further to my recent post wherein I introduced a hypothetical portfolio of indices, ETFs, and the 30-Year Bond (in order to broadly track "value" vs. "growth" sentiment), I would offer the following graph which depicts the percentages gained/lost so far this week (as of Thursday's close).

Market participants favoured the Technology sector, followed by Emerging Markets, Cyclicals, Large-caps, Commodities, Small-caps, and Financials. Homebuilders has been flat and some profits have been taken in the Health Care Sector. Some money was then allocated into 30-Year Bonds.

While there was a blip in volatility on Wednesday, the VIX dropped back below 14.00 on Thursday.

We can see that markets have been willing to add a fair bit of "risk." While volatility remains low, I'd suggest that we'll see the markets continue to buy into the "growth" sectors, along with "value" until this sentiment changes.

This weekend's market update will look at a broader flow of money for the entire week, so be sure to check back for that post.

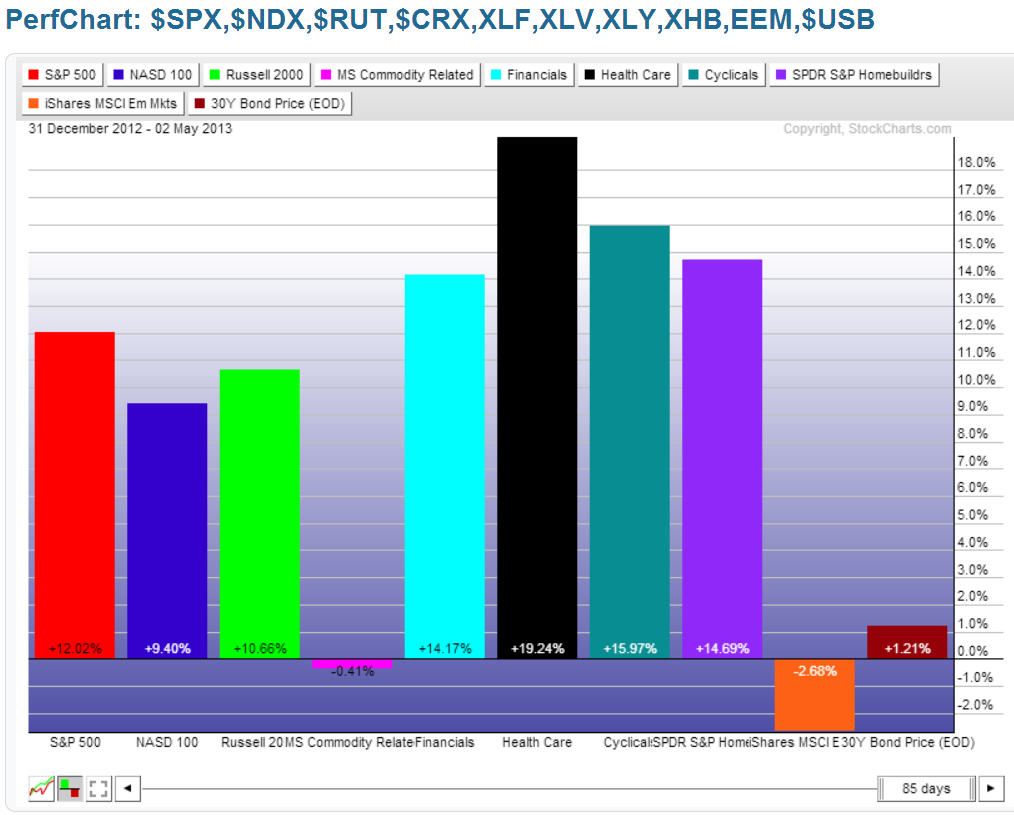

The following Year-to-date graph shows that, up until now, markets have favoured a fairly "value-oriented" approach (sprinkled with some "growth" segments). Commodities and Emerging Markets are in negative territory. We'll see if the buying (as has begun this week) picks up in those areas any time soon. If so, we may also see more money flowing into Bonds as a safety net...in that case, we may see a slow, choppy advance in the general markets as participants rotate into and out of various segments in order to fund further purchases. Otherwise, if we see large-scale draw-downs in Bonds, we may see a much more rapid advance in Commodities and Equities.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Performance Of Hypothetical Portfolio: Value Vs. Growth

Published 05/03/2013, 01:06 AM

Updated 07/09/2023, 06:31 AM

Performance Of Hypothetical Portfolio: Value Vs. Growth

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.