Just for fun, I thought I'd look at a few instruments to see their comparative growth during a one-year period as a broad measure of where "value" vs. "growth" sentiment currently is in a so-called "balanced portfolio." There are 10 in total, since that's the number I'm limited to showing on one graph.

Then, if one were so inclined, one could track the performance of this group for the rest of 2013 year to get an idea of general market trend, risk appetite, and the momentum of both.

The selections are based on the "low-growth macro-economic environment" and on the assumptions (made in my post of April 25th) that the "BUZZ WORDS" will be with us and will continue to define World Central Bank and global market activity for the rest of the year.

I, therefore, dub this a "hypothetical canary portfolio."

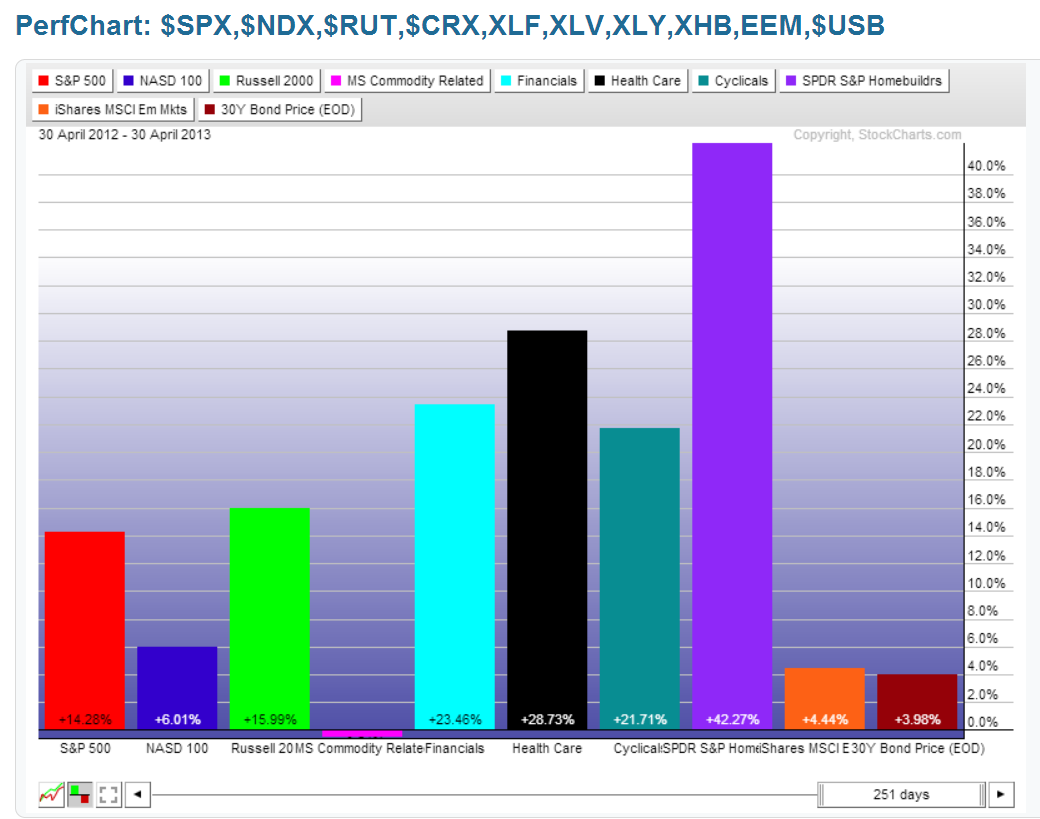

As shown on the 1-year percentage gained/lost graph below, I've selected three of the Major Indices, the Commodities Index, the Financial, Health Care, and Cyclical Sectors, the Home Builder and Emerging Markets ETFs, and 30-Year Bonds. I thought such a basket could represent a good cross-section of "value vs. growth segments" and be worth monitoring. No doubt there are many other portfolio combinations, but this is the mix that I've chosen.

You can see that the Homebuilders ETF has gained the most, followed by Health Care, Financials, Cyclicals, Small-Caps, and Large-Caps. During the past year, Technology, Emerging Markets, 30-Year Bonds, and Commodities have lagged. We'll see whether traders step in any time soon to add these laggards (except Bonds) into their portfolios, thereby increasing "risk" in this projected "low-growth macro-economic environment." Whether they rotate out of the "leading value instruments" and/or Bonds in order to fund such acquisitions remains to be seen.

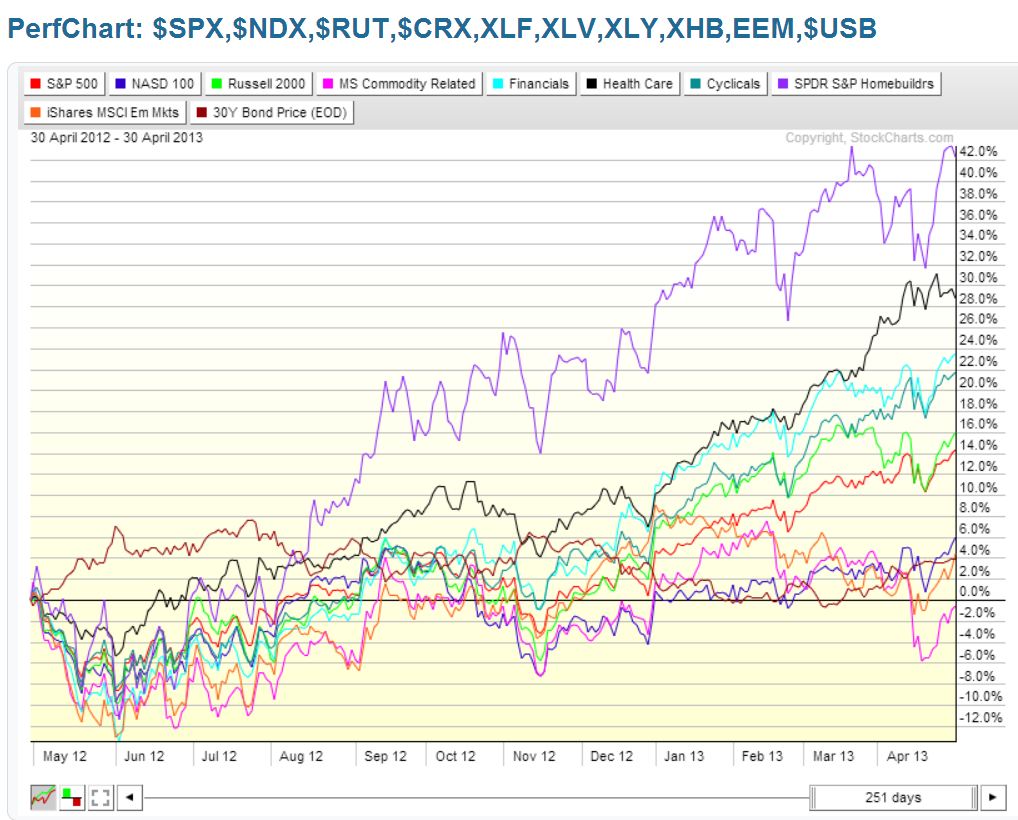

This portfolio is shown next in chart form, from which you get an idea of their respective trend and momentum, along with support/resistance levels.

What I notice first is that the leader, Homebuilders, has run into resistance, while the laggard, the Commodity Index, has fallen to a level of support and bounced, but has yet to make a higher (closing) high and is still in negative territory for the year. I would suggest that if both of these make a higher (closing) high in the short term, and are able to stay above these levels, we may see the others continue upwards for a period of time in a "risk-on growth-oriented" play. This would then tie in with the scenario that I've outlined recently in these three posts here, here, here. However, I would suggest that if Homebuilders and Commodities weaken and fall (and hold) below their last swing (closing) low, we may see some weakness enter in the rest of these markets, and see "risk and value" come off, and money flow into Bonds.

Time will tell which scenario we see first.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Hypothetical Canary Portfolio: Value Vs. Growth

Published 05/01/2013, 01:31 AM

Updated 07/09/2023, 06:31 AM

A Hypothetical Canary Portfolio: Value Vs. Growth

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.