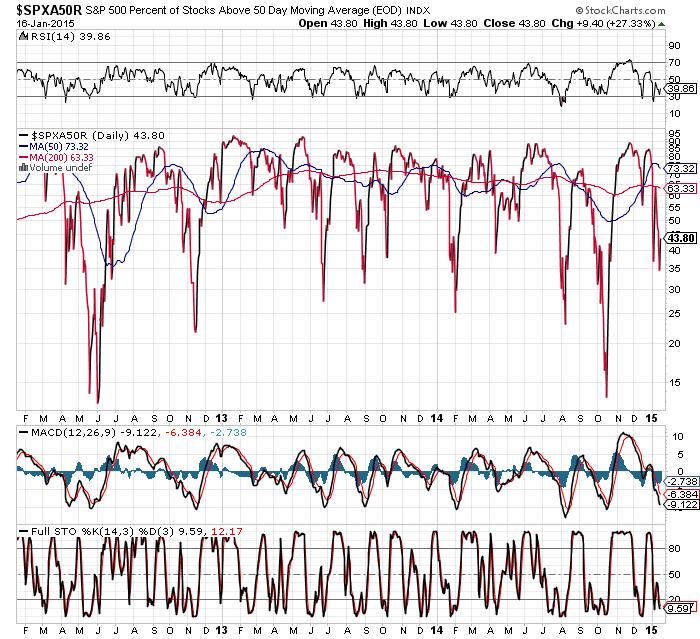

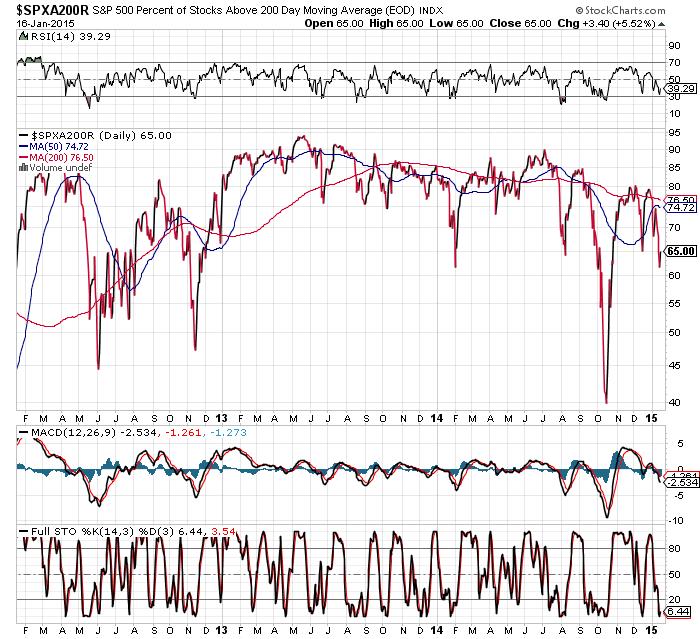

The two charts below of the S&P 500 percentage of stocks above their 50 and 200 day moving averages, respectively, show that they are flirting with major support (at the 35 level and the 60 level, respectively). A drop and hold below those levels could see these percentages free-fall for a while down to their 3-year lows, or lower.

Note the downward-sloping highs on the second chart from last July...indicating that, longer term, the percentage of stocks above the 200 MA has been waning and making successive lower highs, and warning of a weakening market, in general.

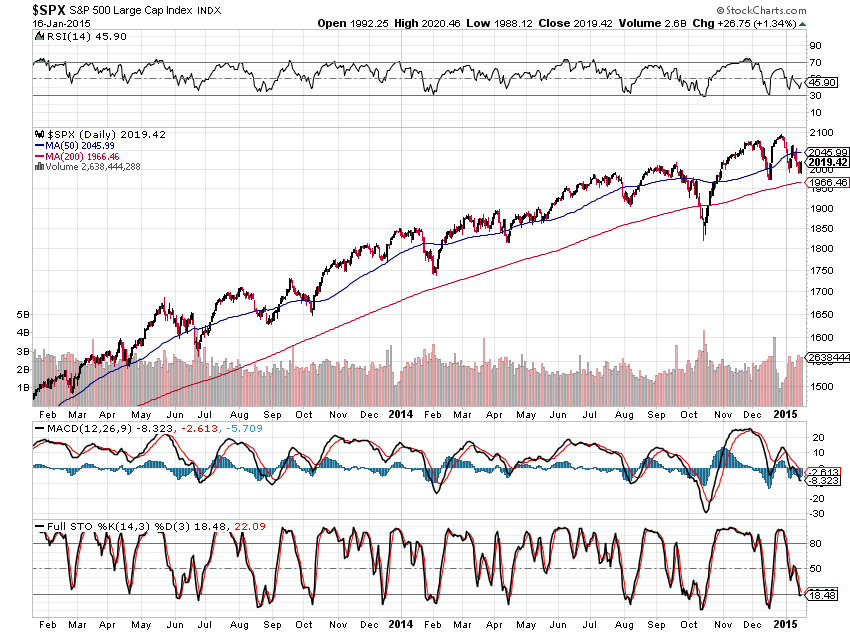

Correlated with a break and hold below those would be a break and hold below, firstly, 2000 on the SPX, then, 1966 (200 MA)...we could, then, very well see a re-test of 1850 or 1800 (or lower) in short order.

No wonder we've seen some very volatile overnight and intraday swings since last July. I expect to see that volatility continue until we see a clear break and hold above 2100 on the SPX, along with a bullish cross-over (and hold) of the 50 MA above the 200 MA on the second chart (above).