Penske Automotive Group, Inc. (NYSE:PAG) reported that it has acquired an extra 5.5% ownership interest in Penske Truck Leasing Co., L.P. (PTL) from the subsidiaries of GE Capital Global Holdings, LLC for roughly $239 million. This additional stake has been funded by using liquidity, available under the company’s U.S. credit agreement.

PTL is a provider of supply chain management and transportation services.

The additional 5.5% ownership in PTL will enable Penske Automotive to realize earnings accretion, additional cash flows through tax savings and an increased amount of annual cash distribution that PTL offers to its partners.

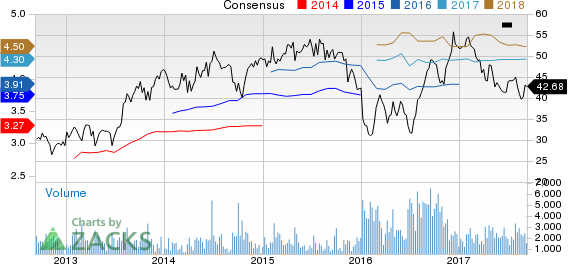

Penske Automotive Group, Inc. Price and Consensus

Apart from Penske Automotive, Mitsui & Co., Ltd. (Mitsui) acquired an additional 10% stake in PTL, at the same valuation. After this acquisition, Penske Corporation, Penske Automotive and Mitsui now own 41.1%, 28.9% and 30% stakes in PTL, respectively.

Penske Automotive will continue to account ownership interest in PTL, using the equity method of accounting. Also, it will record share of PTL’s earnings in its income statement, under the heading, Equity in earnings of affiliates.

Penske Automotive will benefit from recent buyouts as new additions will help the company diversify its business and expand customer base. It will also propel the company to capitalize on the highly fragmented used automotive retail segment.

Price Performance

Penske Automotive’s stock has slumped 17.7% year to date, underperforming the 6% decline of the industry it belongs to.

Zacks Rank & Other Key Picks

Penske Automotive currently holds a Zacks Rank #3 (Hold).

A few better-ranked automobile stocks are Toyota Motor Corporation (NYSE:TM) , Ferrari N.V. (NYSE:RACE) and Bayerische Motoren Werke AG BAMXF, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Toyota has a long-term growth rate of 7%.

Ferrari has an expected long-term earnings growth rate of 14.1%.

Bayerische has a long-term growth rate of 4.2%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Penske Automotive Group, Inc. (PAG): Free Stock Analysis Report

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

Bayerische Motoren Werke AG (BAMXF): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Original post

Zacks Investment Research