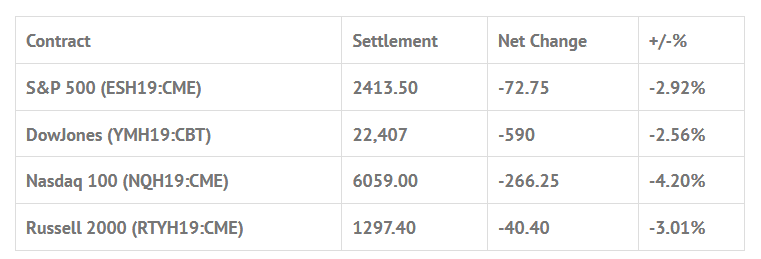

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +0.43%, Hang Seng -0.40%, Nikkei -1.11%

- In Europe 11 out of 13 markets are trading lower: CAC -1.14%, DAX +0.21%, FTSE -0.52%

- Fair Value: S&P +1.50, NASDAQ +17.40, Dow -6.13

- Total Volume: 3.00mil ESH & 1,311 SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Chicago Fed National Activity Index 8:30 AM ET, NYSE Early Close, and SIFMA Rec. Early Close 2:00 ET.

S&P 500 Futures: These are not our fathers markets

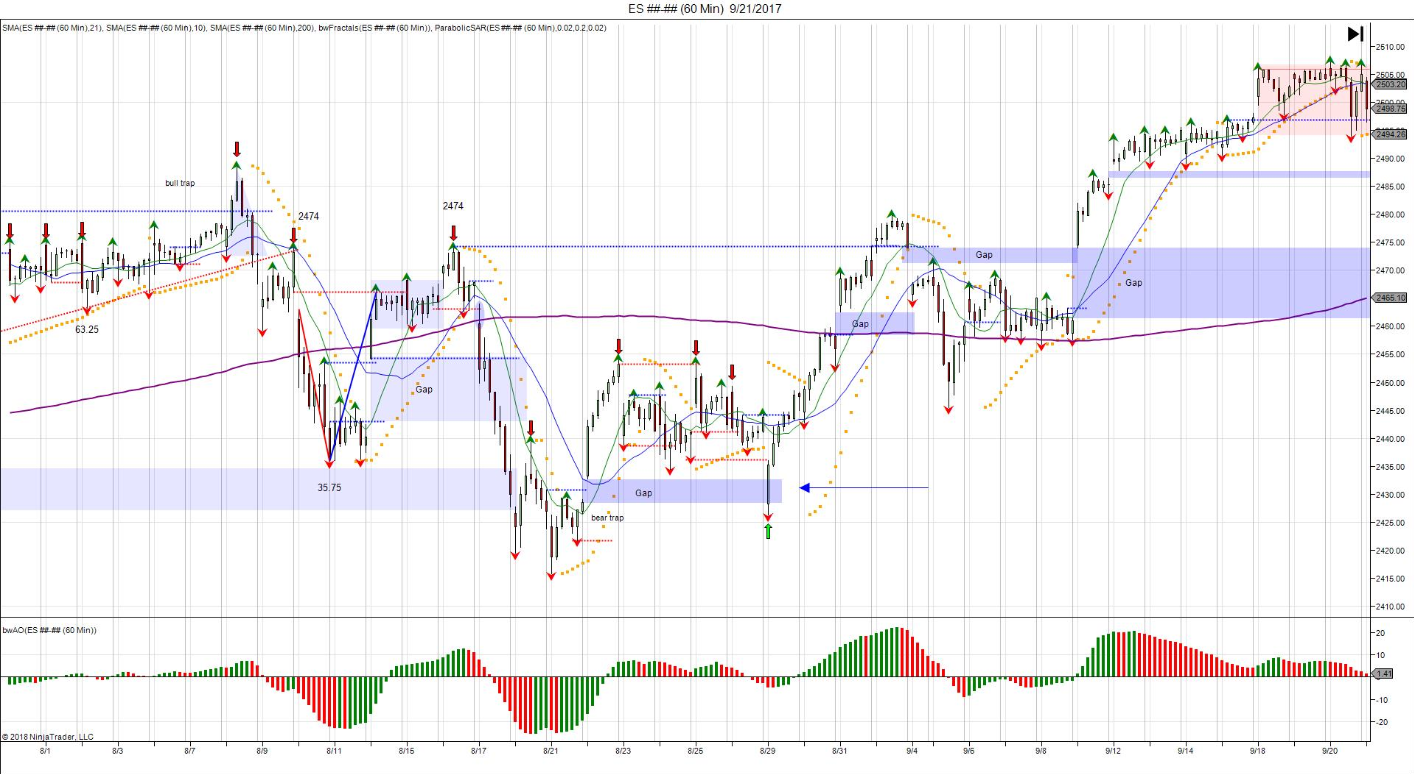

On Friday, the S&P 500 futures opened the cash session at 2476.50, and traded down to an early morning low at 2470.00 in the first hour. Then, as the feds Williams (NYSE:WMB) hit the wire making dovish statements, the futures rallied sharply up to what would be the high of day at 2508.00. When Williams finished his comments, the futures reversed and never looked back, as they tanked down to a morning low of 2435.25.

After a 23.75 handle rally, the afternoon again saw weakness, as the ES pulled back down to a new low, eventually trading down to 2409.25 in the final hour, and then rallied to print 2417.50 at 3:00, before settling the day at 2412.25, down -74.75 handles or, -2.85%.

It was an astonishing day, and it’s been an astonishing last few months. The ES is down 20% from its contract highs, and despite the Christmas holiday as being one of the most cheerful times of the year, the investing community is in a state of shock. The headlines read that the Nasdaq has fallen into bear market territory, and give or take a percentage point or two, so has the ES.

Lets just say it like it is, the overall price action of the ES is some of the worst on record. I know people want to compare the current selloff to something like 1987 or 2000, but it ain’t happening. After all the S&P index arb I did for UBS in the S&P’s, and all the big orders I executed, all the big ups, all the big downs, the current sustained jump in volatility and the size of the ranges is not something we have ever seen. The funny thing is, the Dow being down 800 is the new normal.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.